Answered step by step

Verified Expert Solution

Question

1 Approved Answer

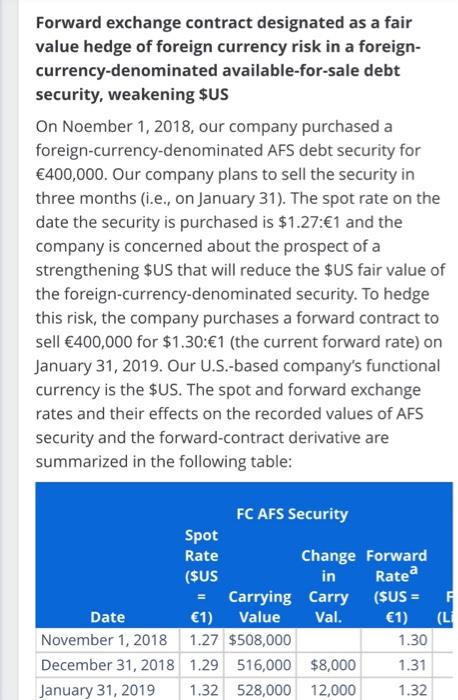

On Noember 1, 2018, our company purchased a foreign-currency-denominated AFS debt security for 400,000. Our company plans to sell the security in three months (i.e.,

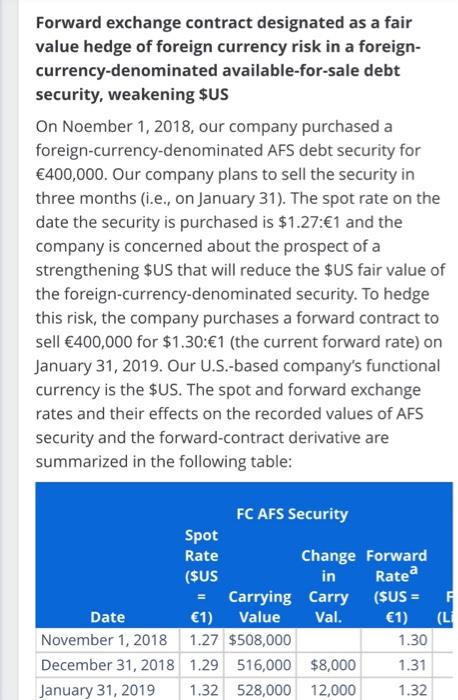

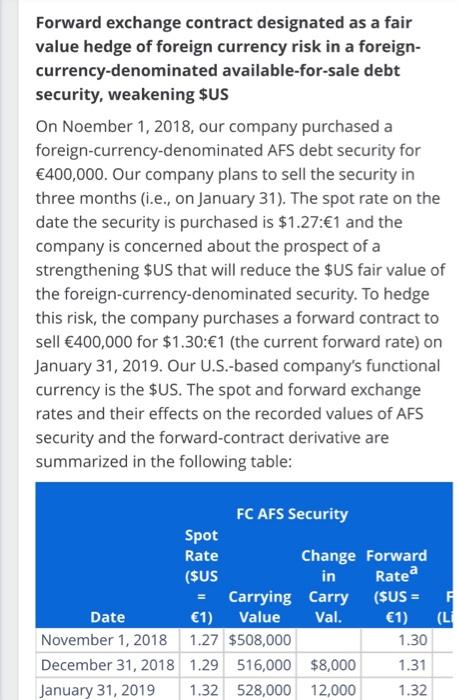

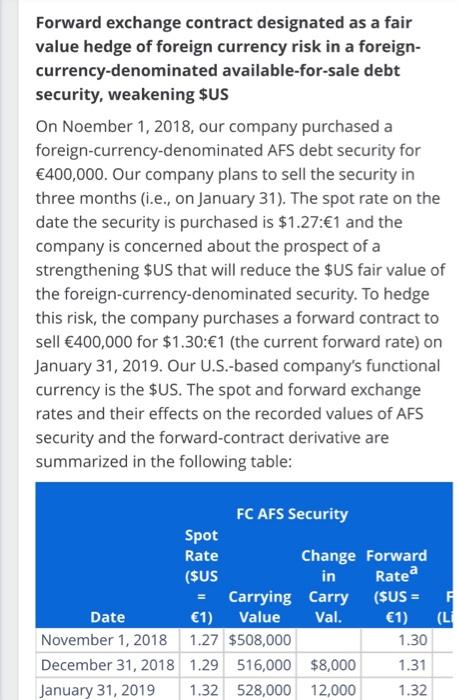

On Noember 1, 2018, our company purchased a foreign-currency-denominated AFS debt security for 400,000. Our company plans to sell the security in three months (i.e., on January 31). The spot rate on the date the security is purchased is $1.27:1 and the company is concerned about the prospect of a strengthening $US that will reduce the $US fair value of the foreign-currency-denominated security. To hedge this risk, the company purchases a forward contract to sell 400,000 for $1.30:1 (the current forward rate) on January 31, 2019. Our U.S.-based companys functional currency is the $US. The spot and forward exchange rates and their effects on the recorded values of AFS security and the forward-contract derivative are summarized in the following table:

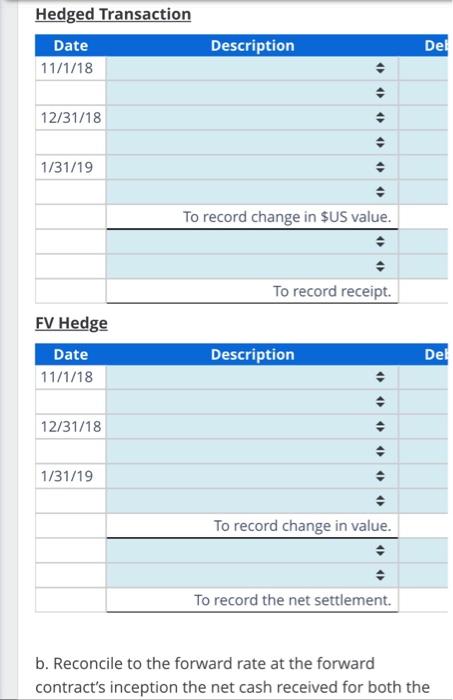

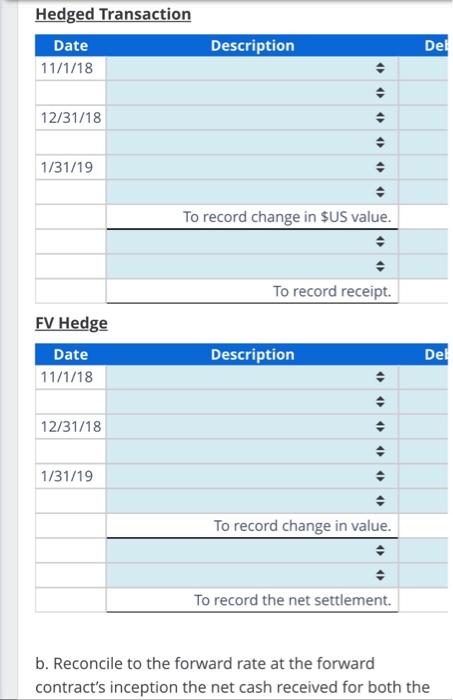

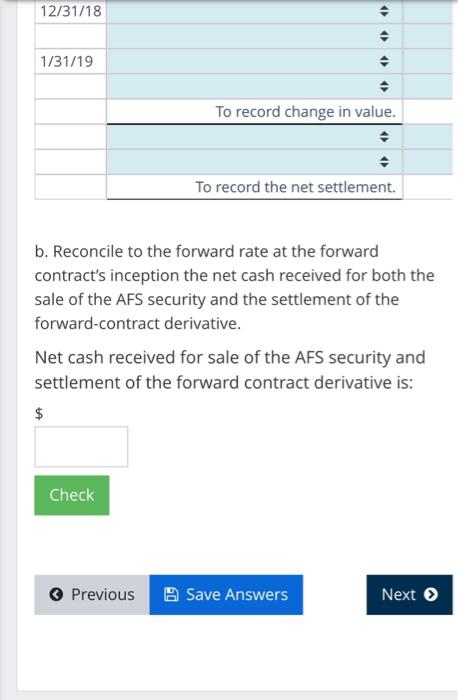

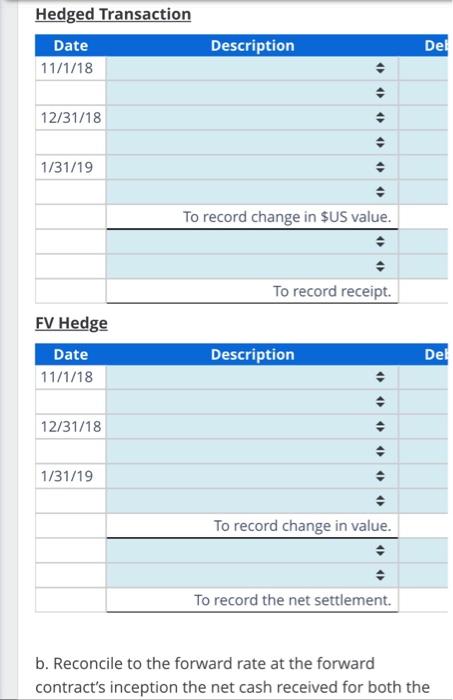

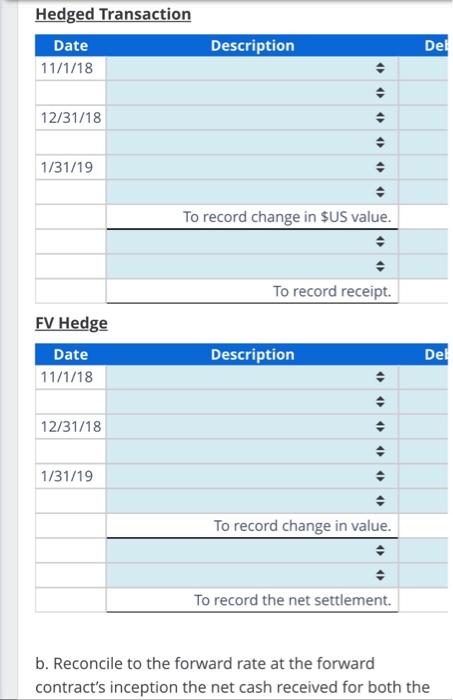

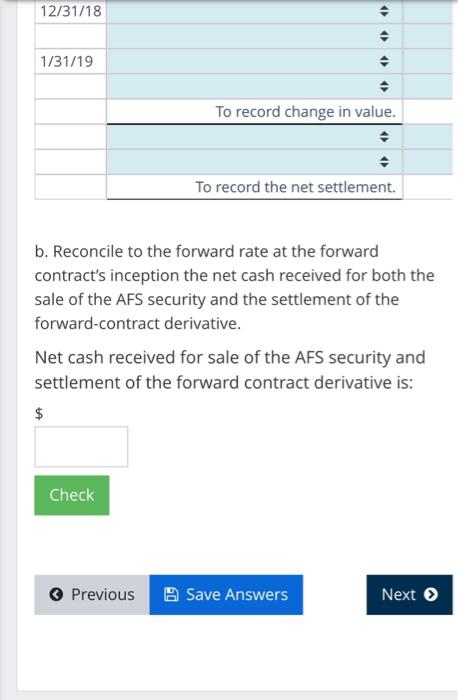

Hedged Transaction FV Hedge b. Reconcile to the forward rate at the forward contract's inception the net cash received for both the Forward exchange contract designated as a fair value hedge of foreign currency risk in a foreigncurrency-denominated available-for-sale debt security, weakening \$US On Noember 1, 2018, our company purchased a foreign-currency-denominated AFS debt security for 400,000. Our company plans to sell the security in three months (i.e., on January 31). The spot rate on the date the security is purchased is $1.27:1 and the company is concerned about the prospect of a strengthening \$US that will reduce the $ US fair value of the foreign-currency-denominated security. To hedge this risk, the company purchases a forward contract to sell 400,000 for $1.30:1 (the current forward rate) on January 31, 2019. Our U.S.-based company's functional currency is the \$US. The spot and forward exchange rates and their effects on the recorded values of AFS security and the forward-contract derivative are summarized in the following table: Hedged Transaction FV Hedge b. Reconcile to the forward rate at the forward contract's inception the net cash received for both the Forward exchange contract designated as a fair value hedge of foreign currency risk in a foreigncurrency-denominated available-for-sale debt security, weakening \$US On Noember 1, 2018, our company purchased a foreign-currency-denominated AFS debt security for 400,000. Our company plans to sell the security in three months (i.e., on January 31). The spot rate on the date the security is purchased is $1.27:1 and the company is concerned about the prospect of a strengthening \$US that will reduce the $ US fair value of the foreign-currency-denominated security. To hedge this risk, the company purchases a forward contract to sell 400,000 for $1.30:1 (the current forward rate) on January 31, 2019. Our U.S.-based company's functional currency is the \$US. The spot and forward exchange rates and their effects on the recorded values of AFS security and the forward-contract derivative are summarized in the following table: b. Reconcile to the forward rate at the forward contract's inception the net cash received for both the sale of the AFS security and the settlement of the forward-contract derivative. Net cash received for sale of the AFS security and settlement of the forward contract derivative is: Hedged Transaction FV Hedge b. Reconcile to the forward rate at the forward contract's inception the net cash received for both the Forward exchange contract designated as a fair value hedge of foreign currency risk in a foreigncurrency-denominated available-for-sale debt security, weakening \$US On Noember 1, 2018, our company purchased a foreign-currency-denominated AFS debt security for 400,000. Our company plans to sell the security in three months (i.e., on January 31). The spot rate on the date the security is purchased is $1.27:1 and the company is concerned about the prospect of a strengthening \$US that will reduce the $ US fair value of the foreign-currency-denominated security. To hedge this risk, the company purchases a forward contract to sell 400,000 for $1.30:1 (the current forward rate) on January 31, 2019. Our U.S.-based company's functional currency is the \$US. The spot and forward exchange rates and their effects on the recorded values of AFS security and the forward-contract derivative are summarized in the following table: Hedged Transaction FV Hedge b. Reconcile to the forward rate at the forward contract's inception the net cash received for both the Forward exchange contract designated as a fair value hedge of foreign currency risk in a foreigncurrency-denominated available-for-sale debt security, weakening \$US On Noember 1, 2018, our company purchased a foreign-currency-denominated AFS debt security for 400,000. Our company plans to sell the security in three months (i.e., on January 31). The spot rate on the date the security is purchased is $1.27:1 and the company is concerned about the prospect of a strengthening \$US that will reduce the $ US fair value of the foreign-currency-denominated security. To hedge this risk, the company purchases a forward contract to sell 400,000 for $1.30:1 (the current forward rate) on January 31, 2019. Our U.S.-based company's functional currency is the \$US. The spot and forward exchange rates and their effects on the recorded values of AFS security and the forward-contract derivative are summarized in the following table: b. Reconcile to the forward rate at the forward contract's inception the net cash received for both the sale of the AFS security and the settlement of the forward-contract derivative. Net cash received for sale of the AFS security and settlement of the forward contract derivative is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started