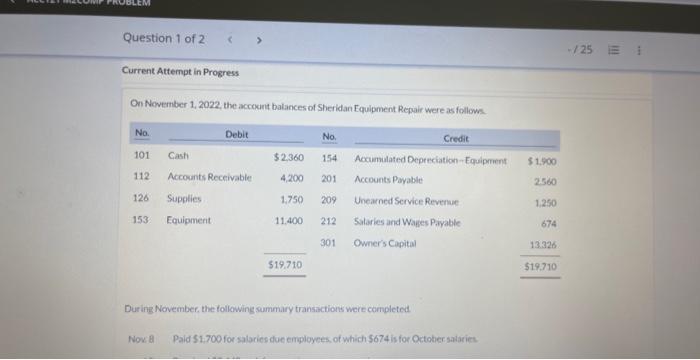

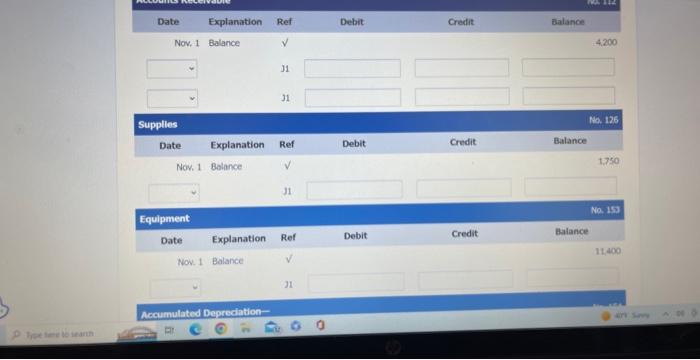

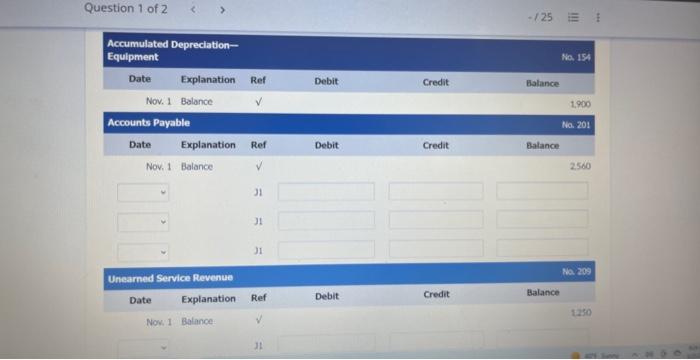

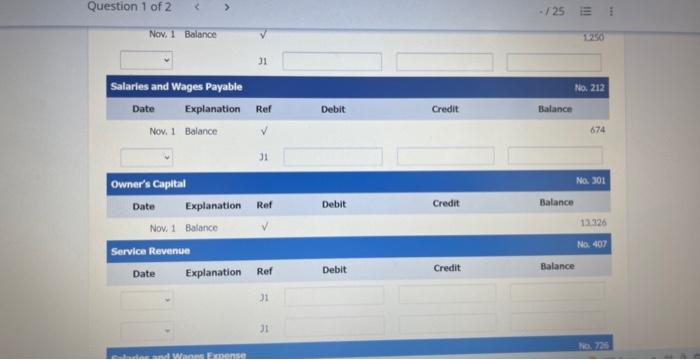

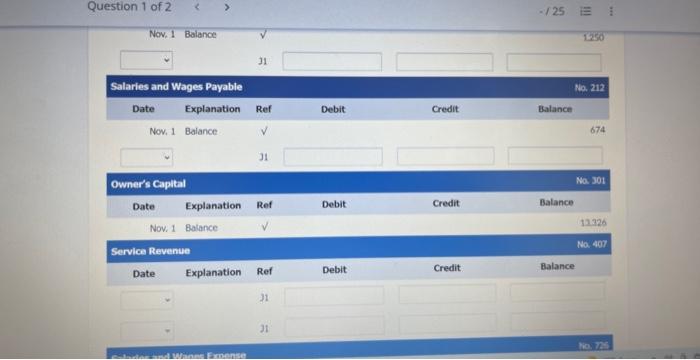

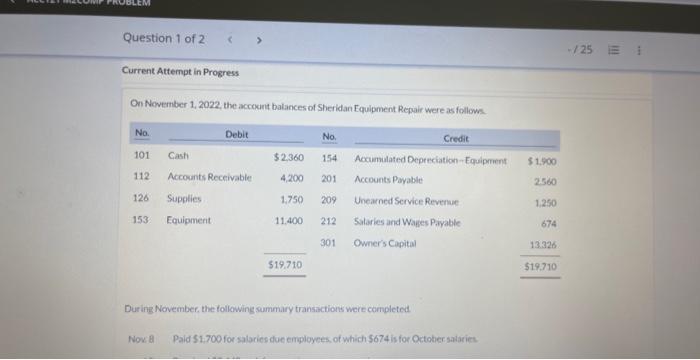

on nov 1, 2022 the account balances of sheridan equipment repair were as follows.

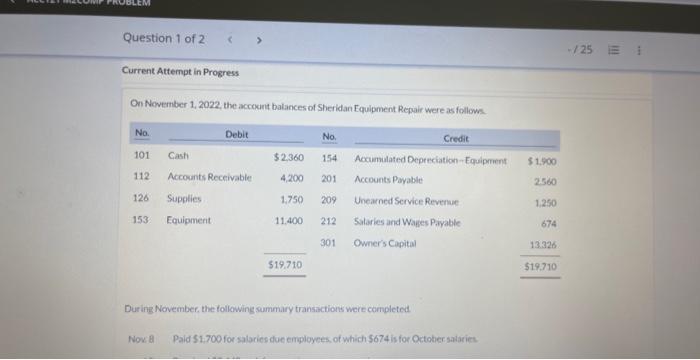

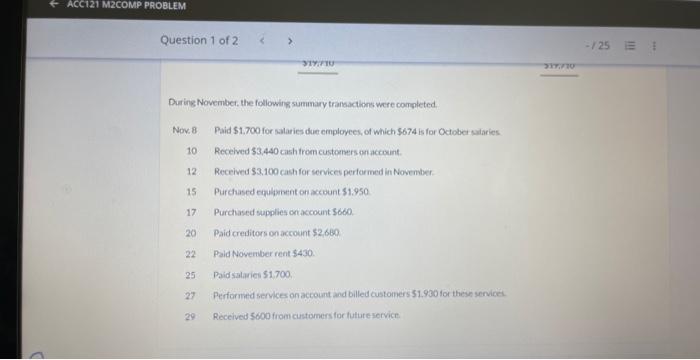

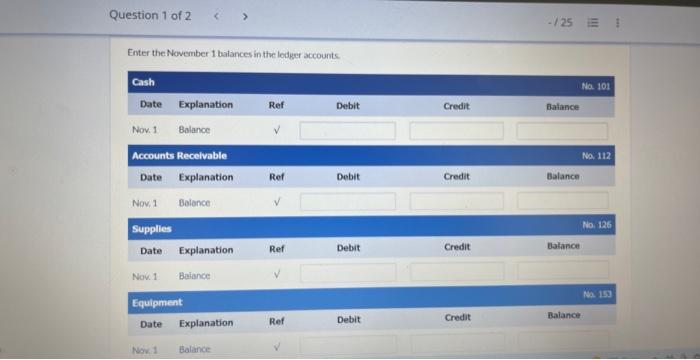

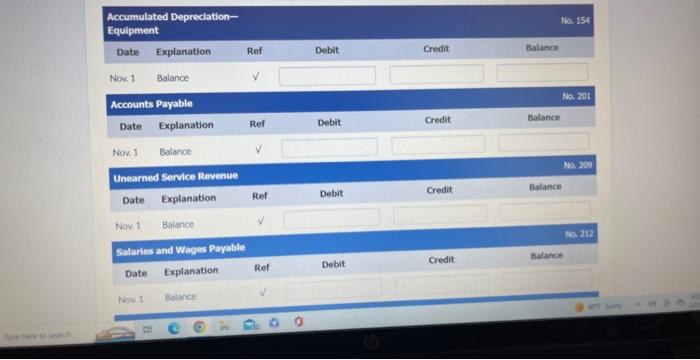

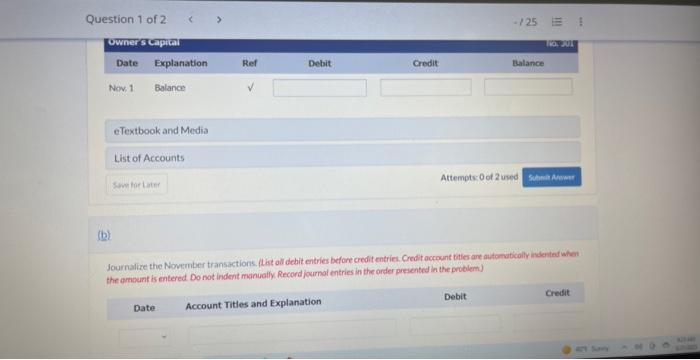

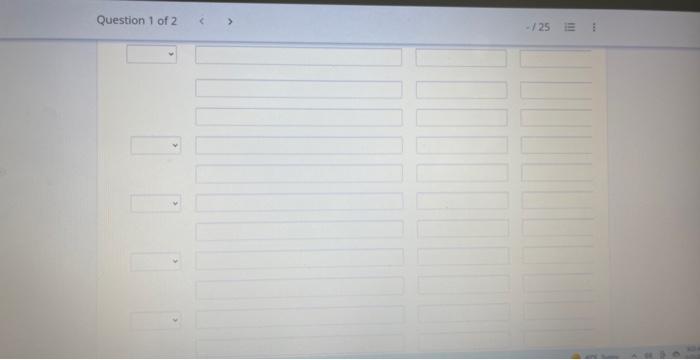

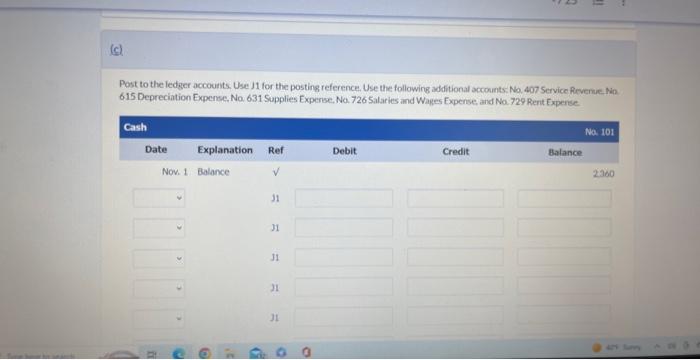

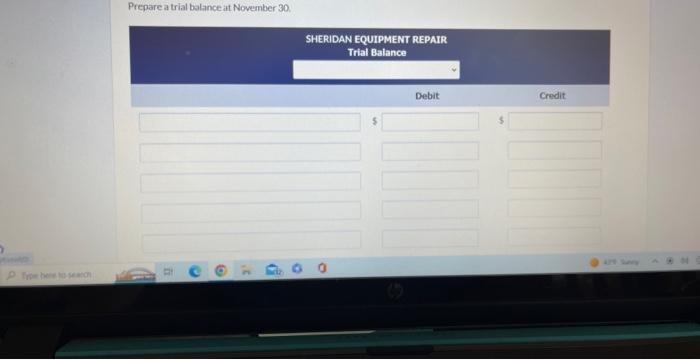

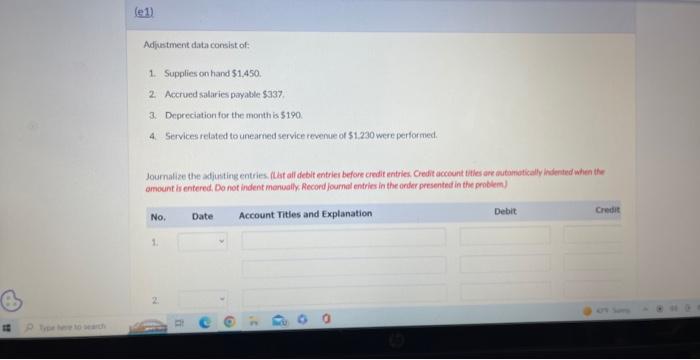

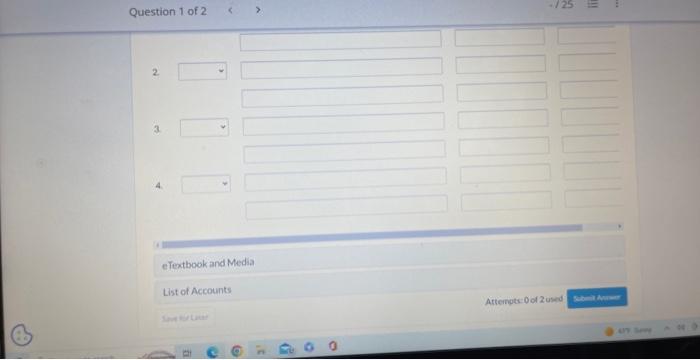

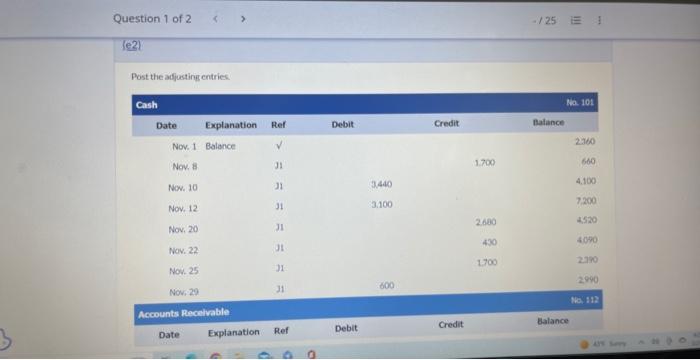

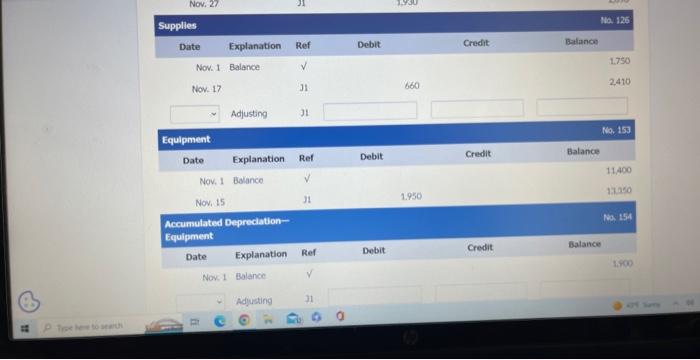

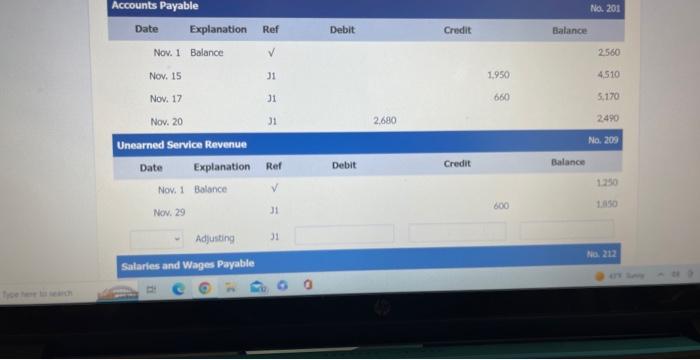

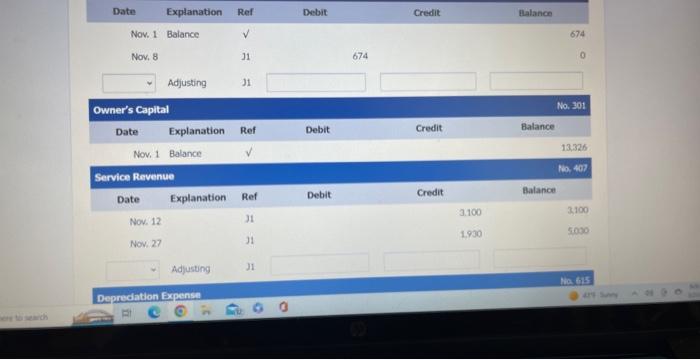

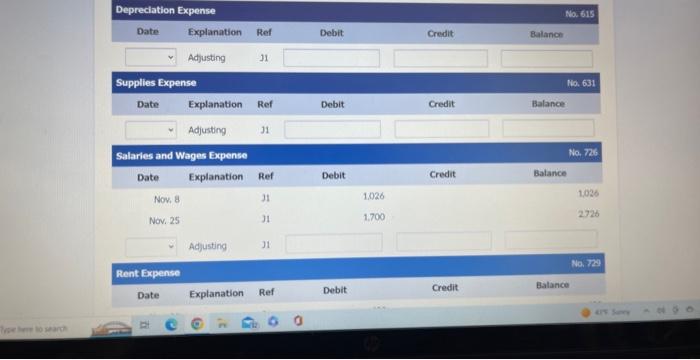

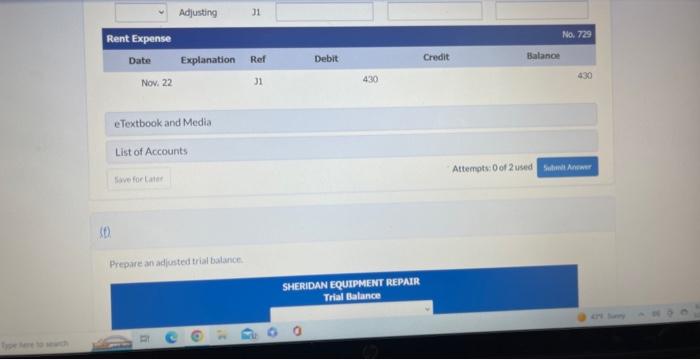

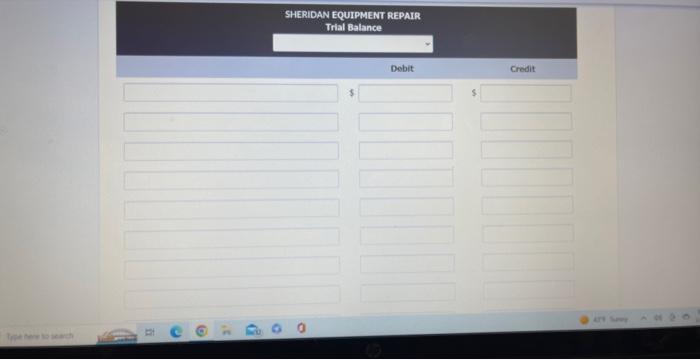

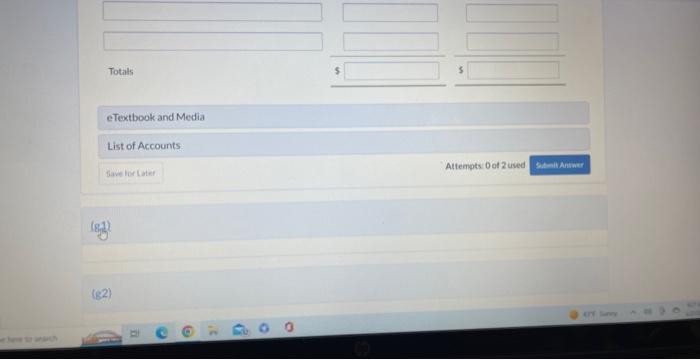

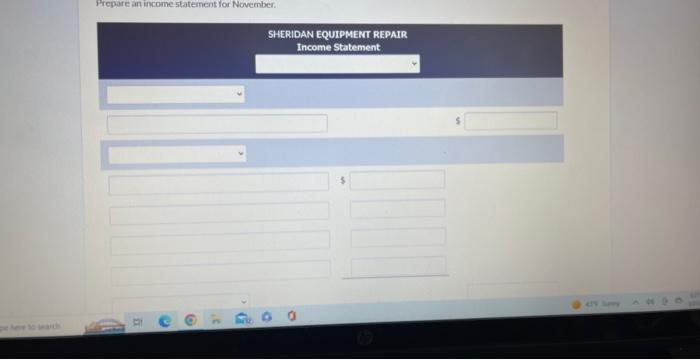

Current Attempt in Progress On November 1, 2022, the accocint balances of Sheridan Equipment Repiair were as follows. During November, the following summary transiactions were completed Now 8 Paid 51.700 for salaries due empioyees, of which 5674 is for October satarien. During Novembet, the followins summary tranaactbons were completed Noy, 8 Paid $1.700 for salaries due employees, of which $674 is for Octobei salaries 10 Received 53,440 cash trom customers on account. 12. Received 33.100 cash for senvices perfor med in November. 15 Purchased equlement on account $1.950 17: Purchased supplies crakcount $660. 20 Paidcreditors onaccount $2,660 22 Paid Novendber rent $430. 25 Paidsalaries 51700 27 Performed servlces on account and billed customers 51.930 for these senviget. 29: Received 5000 from customers for futureservice takau aha Accumulated Depreciation- No. 154 Equipment Nov. 1 Balance Nan 1 Balance: Journalize the Nowember transactions. (tiat all debit entries before credit entries. Credit account bties are autonvbicaliy inderited when. the ambunt is entered Do not indent manuolly. Recond journol entries in the order presented in the problem) Question 1 of 2 Post to the lediger accounts. Use J1 for the posting reference. Use the following additional accounts: No. 407 Service Reverie . 615 Depreciation Experse, No. 631 Supplies Experse. No. 726 Salaries and Wages Expense and No. 729 Rent Experse. Accumulated Degrediation- Question 1 of 2 Question 1 of 2 Prepare a trial balance at November 30 . Adjustment data consist of: 1. Supplies onhand $1.450. 2. Accrued salaries payaltle $337 3. Depreciation for the month is $190 4. Services related to unearned service revenue of $1.230 were performed. Journalize the adjusting entries. Ilist alf deblt entrier before credit entries Credit account thles are autaniotically Wisiented when the amount is entered, Do not indent manually Record journal entries in the order presented in the problem) Question 1 of 2 2. 3 4 eTextbook and Media List of Accounts Attenpts: 0 of 2 used Post the anfuastinit entries supplies Adjusting J1 No. 153 Equipment Date Explanation Ref Debit Credit Balance 11.490 Nov, 15 31 1.950 Accumulated Depreciation- Na. 154 Equipment: Balance Date Explanation Ref Debit Credit Nove 1 Balance in Accounts Payable No. 201 * Adyusting 31 Wa. 212 Salaries and Wages Payable. Depredation Expense Depreciation Expense Acjusting J1 Rent Expense No. 7 ? Date Explanation Ref Debit Credit. Balance Prepare an adfusted trial balance SHERIDAN EQUIPMENT REPAIR Trial Balance Totals eTextbook and Media List of Accounts Atteants 0 ot 2 used theneit Antwer fave for Latef Prepare an income staternent for November. eTextbook and Media List of Accounts Attempts: 0 of 2 used Save for Liter (g2) (gg) (6) n (a) 9 () Prepare an owner's equity statenent for November. Question 1 of 2 5 eTextbook and Media List of Accounts (g) SHERIDAN EQUTPMENT REPATR Balance sheet (C) = E. 00 eTextbook and Media List of Accounts (i) m 0 Current Attempt in Progress On November 1, 2022, the accocint balances of Sheridan Equipment Repiair were as follows. During November, the following summary transiactions were completed Now 8 Paid 51.700 for salaries due empioyees, of which 5674 is for October satarien. During Novembet, the followins summary tranaactbons were completed Noy, 8 Paid $1.700 for salaries due employees, of which $674 is for Octobei salaries 10 Received 53,440 cash trom customers on account. 12. Received 33.100 cash for senvices perfor med in November. 15 Purchased equlement on account $1.950 17: Purchased supplies crakcount $660. 20 Paidcreditors onaccount $2,660 22 Paid Novendber rent $430. 25 Paidsalaries 51700 27 Performed servlces on account and billed customers 51.930 for these senviget. 29: Received 5000 from customers for futureservice takau aha Accumulated Depreciation- No. 154 Equipment Nov. 1 Balance Nan 1 Balance: Journalize the Nowember transactions. (tiat all debit entries before credit entries. Credit account bties are autonvbicaliy inderited when. the ambunt is entered Do not indent manuolly. Recond journol entries in the order presented in the problem) Question 1 of 2 Post to the lediger accounts. Use J1 for the posting reference. Use the following additional accounts: No. 407 Service Reverie . 615 Depreciation Experse, No. 631 Supplies Experse. No. 726 Salaries and Wages Expense and No. 729 Rent Experse. Accumulated Degrediation- Question 1 of 2 Question 1 of 2 Prepare a trial balance at November 30 . Adjustment data consist of: 1. Supplies onhand $1.450. 2. Accrued salaries payaltle $337 3. Depreciation for the month is $190 4. Services related to unearned service revenue of $1.230 were performed. Journalize the adjusting entries. Ilist alf deblt entrier before credit entries Credit account thles are autaniotically Wisiented when the amount is entered, Do not indent manually Record journal entries in the order presented in the problem) Question 1 of 2 2. 3 4 eTextbook and Media List of Accounts Attenpts: 0 of 2 used Post the anfuastinit entries supplies Adjusting J1 No. 153 Equipment Date Explanation Ref Debit Credit Balance 11.490 Nov, 15 31 1.950 Accumulated Depreciation- Na. 154 Equipment: Balance Date Explanation Ref Debit Credit Nove 1 Balance in Accounts Payable No. 201 * Adyusting 31 Wa. 212 Salaries and Wages Payable. Depredation Expense Depreciation Expense Acjusting J1 Rent Expense No. 7 ? Date Explanation Ref Debit Credit. Balance Prepare an adfusted trial balance SHERIDAN EQUIPMENT REPAIR Trial Balance Totals eTextbook and Media List of Accounts Atteants 0 ot 2 used theneit Antwer fave for Latef Prepare an income staternent for November. eTextbook and Media List of Accounts Attempts: 0 of 2 used Save for Liter (g2) (gg) (6) n (a) 9 () Prepare an owner's equity statenent for November. Question 1 of 2 5 eTextbook and Media List of Accounts (g) SHERIDAN EQUTPMENT REPATR Balance sheet (C) = E. 00 eTextbook and Media List of Accounts (i) m 0