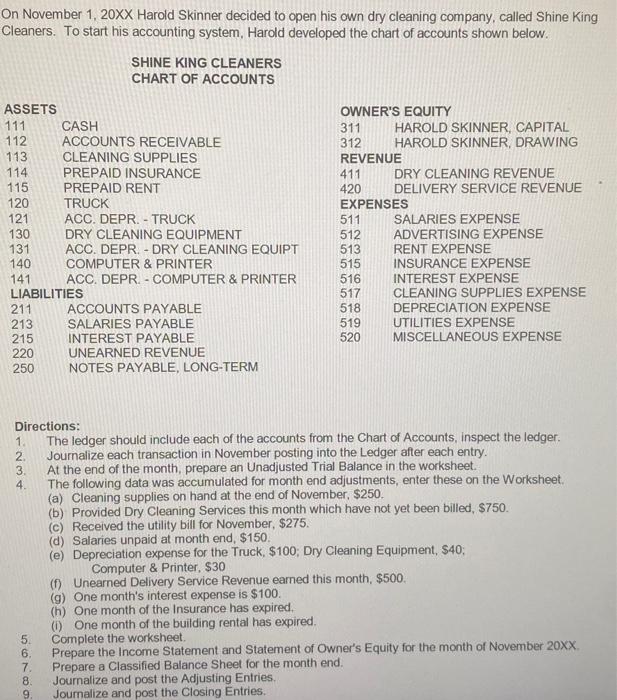

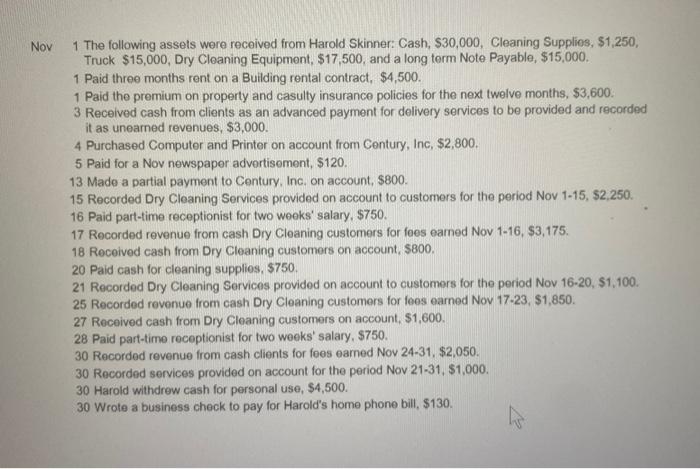

On November 1, 20 Harold Skinner decided to open his own dry cleaning company, called Shine King Cleaners. To start his accounting system. Harold developed the chart of accounts shown below. Directions: 1. The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. 2. Journalize each transaction in November posting into the Ledger after each entry. 3. At the end of the month, prepare an Unadjusted Trial Balance in the worksheet. 4. The following data was accumulated for month end adjustments, enter these on the Worksheet. (a) Cleaning supplies on hand at the end of November, $250. (b) Provided Dry Cleaning Services this month which have not yet been billed, $750. (c) Received the utility bill for November, $275. (d) Salaries unpaid at month end, $150. (e) Depreciation expense for the Truck, $100; Dry Cleaning Equipment, $40 : Computer \& Printer, $30 (f) Unearned Delivery Service Revenue earned this month, $500. (g) One month's interest expense is $100. (h) One month of the Insurance has expired. (i) One month of the building rental has expired. 5. Complete the worksheet. 6. Prepare the Income Statement and Statement of Owner's Equity for the month of November 20XX. 7. Prepare a Classified Balance Sheet for the month end. 8. Journalize and post the Adjusting Entries. Nov 1 The following assets were received from Harold Skinner: Cash, \$30,000, Cleaning Supplios, \$1,250, Truck $15,000, Dry Cleaning Equipment, \$17,500, and a long torm Note Payable, \$15,000. 1 Paid three months rent on a Building rental contract, $4,500. 1 Paid the premium on property and casulty insurance policies for the next twelve months, $3,600. 3 Received cash from clients as an advanced payment for delivery services to be provided and recorded it as unearned revenues, $3,000. 4 Purchased Computer and Printer on account from Century, Inc, $2,800. 5 Paid for a Nov newspaper advortisoment, $120. 13 Made a partial payment to Century. Inc. on account, $800. 15 Recorded Dry Cleaning Services provided on account to customers for the period Nov 1-15, $2,250. 16 Paid part-time receptionist for two weoks' salary, $750. 17 Recorded revenue from cash Dry Cleaning customers for foes earned Nov 1-16, \$3,175. 18 Recoived cash from Dry Cleaning customers on account, $800. 20 Paid cash for cleaning supplios, $750. 21 Recorded Dry Cleaning Services provided on account to customers for the period Nov 16-20, $1,100. 25 Recorded revenue from cash Dry Cleaning customers for fees earned Nov 17.23, \$1,850. 27 Received cash from Dry Cleaning customers on account, \$1,600. 28 Paid part-time receptionist for two weeks' salary, $750. 30 Recorded revenue from cash clients for fees eamed Nov 24-31, \$2,050. 30 Recorded services provided on account for the period Nov 21-31, \$1,000. 30 Harold withdrew cash for personal use, $4,500. 30 Wrote a business check to pay for Harold's home phone bill, $130. On November 1, 20 Harold Skinner decided to open his own dry cleaning company, called Shine King Cleaners. To start his accounting system. Harold developed the chart of accounts shown below. Directions: 1. The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. 2. Journalize each transaction in November posting into the Ledger after each entry. 3. At the end of the month, prepare an Unadjusted Trial Balance in the worksheet. 4. The following data was accumulated for month end adjustments, enter these on the Worksheet. (a) Cleaning supplies on hand at the end of November, $250. (b) Provided Dry Cleaning Services this month which have not yet been billed, $750. (c) Received the utility bill for November, $275. (d) Salaries unpaid at month end, $150. (e) Depreciation expense for the Truck, $100; Dry Cleaning Equipment, $40 : Computer \& Printer, $30 (f) Unearned Delivery Service Revenue earned this month, $500. (g) One month's interest expense is $100. (h) One month of the Insurance has expired. (i) One month of the building rental has expired. 5. Complete the worksheet. 6. Prepare the Income Statement and Statement of Owner's Equity for the month of November 20XX. 7. Prepare a Classified Balance Sheet for the month end. 8. Journalize and post the Adjusting Entries. Nov 1 The following assets were received from Harold Skinner: Cash, \$30,000, Cleaning Supplios, \$1,250, Truck $15,000, Dry Cleaning Equipment, \$17,500, and a long torm Note Payable, \$15,000. 1 Paid three months rent on a Building rental contract, $4,500. 1 Paid the premium on property and casulty insurance policies for the next twelve months, $3,600. 3 Received cash from clients as an advanced payment for delivery services to be provided and recorded it as unearned revenues, $3,000. 4 Purchased Computer and Printer on account from Century, Inc, $2,800. 5 Paid for a Nov newspaper advortisoment, $120. 13 Made a partial payment to Century. Inc. on account, $800. 15 Recorded Dry Cleaning Services provided on account to customers for the period Nov 1-15, $2,250. 16 Paid part-time receptionist for two weoks' salary, $750. 17 Recorded revenue from cash Dry Cleaning customers for foes earned Nov 1-16, \$3,175. 18 Recoived cash from Dry Cleaning customers on account, $800. 20 Paid cash for cleaning supplios, $750. 21 Recorded Dry Cleaning Services provided on account to customers for the period Nov 16-20, $1,100. 25 Recorded revenue from cash Dry Cleaning customers for fees earned Nov 17.23, \$1,850. 27 Received cash from Dry Cleaning customers on account, \$1,600. 28 Paid part-time receptionist for two weeks' salary, $750. 30 Recorded revenue from cash clients for fees eamed Nov 24-31, \$2,050. 30 Recorded services provided on account for the period Nov 21-31, \$1,000. 30 Harold withdrew cash for personal use, $4,500. 30 Wrote a business check to pay for Harold's home phone bill, $130