Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On November 1, 2010, the shareholders of Cairo Company approved a plan that grants the company's five executives options to purchase 2,000 shares each

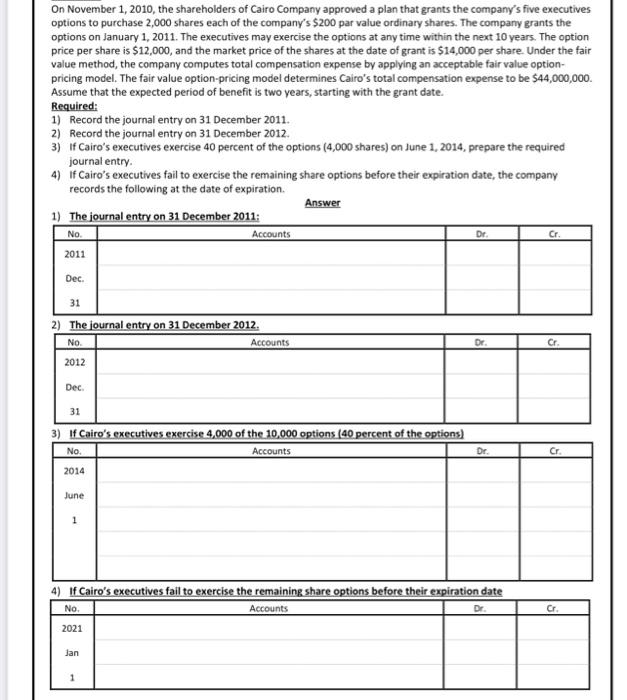

On November 1, 2010, the shareholders of Cairo Company approved a plan that grants the company's five executives options to purchase 2,000 shares each of the company's $200 par value ordinary shares. The company grants the options on January 1, 2011. The executives may exercise the options at any time within the next 10 years. The option price per share is $12,000, and the market price of the shares at the date of grant is $14,000 per share. Under the fair value method, the company computes total compensation expense by applying an acceptable fair value option- pricing model. The fair value option-pricing model determines Cairo's total compensation expense to be $44,000,000. Assume that the expected period of benefit is two years, starting with the grant date. Required: 1) Record the journal entry on 31 December 2011. 2) Record the journal entry on 31 December 2012. 3) If Cairo's executives exercise 40 percent of the options (4,000 shares) on June 1, 2014, prepare the required journal entry. 4) If Cairo's executives fail to exercise the remaining share options before their expiration date, the company records the following at the date of expiration. Answer 1) The journal entry on 31 December 2011: No. 2011 Dec. 31 2) The journal entry on 31 December 2012. No. 2012 Dec. June 31 3) If Cairo's executives exercise 4,000 of the 10,000 options (40 percent of the options) No. Accounts 2014 1 Accounts Jan Accounts 1 Dr. 4) If Cairo's executives fail to exercise the remaining share options before their expiration date No. Accounts Dr. 2021 Dr. Cr. Cr. Cr. Cr.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entry on December 31 2011 Total Compensation Expense 44000000 as provided This is the tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started