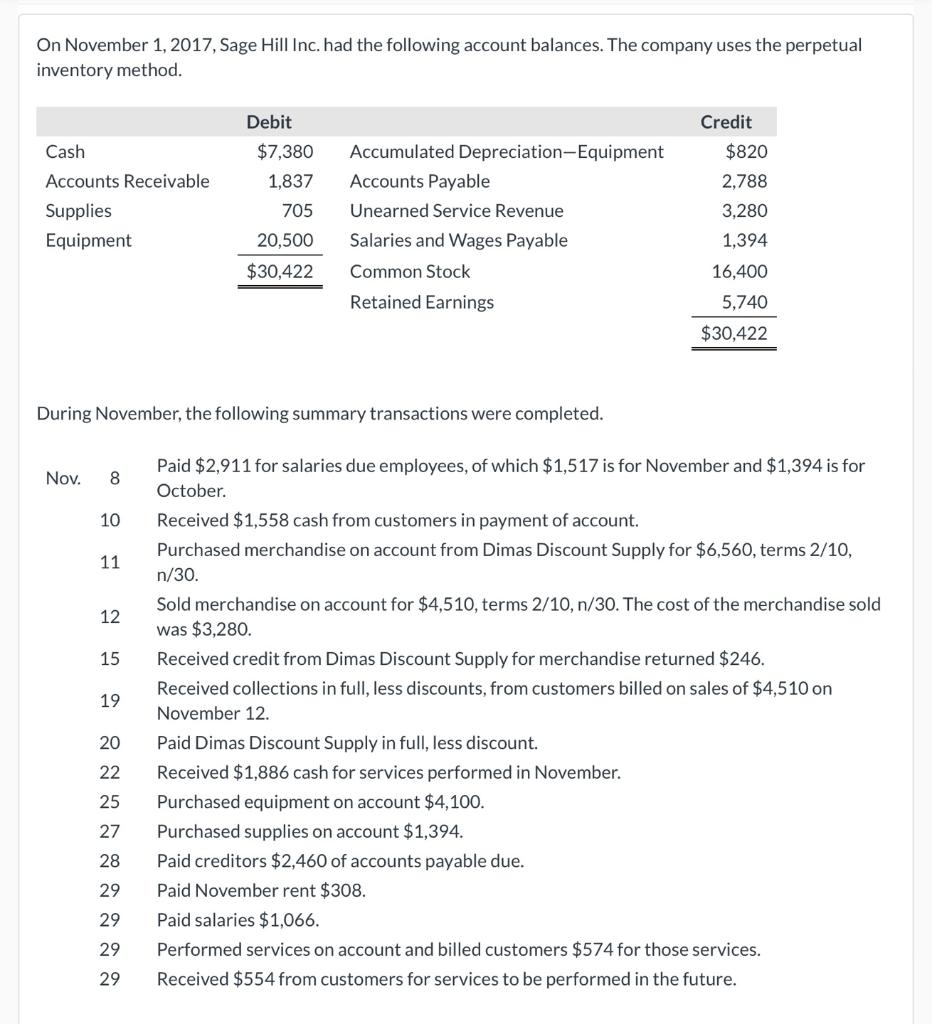

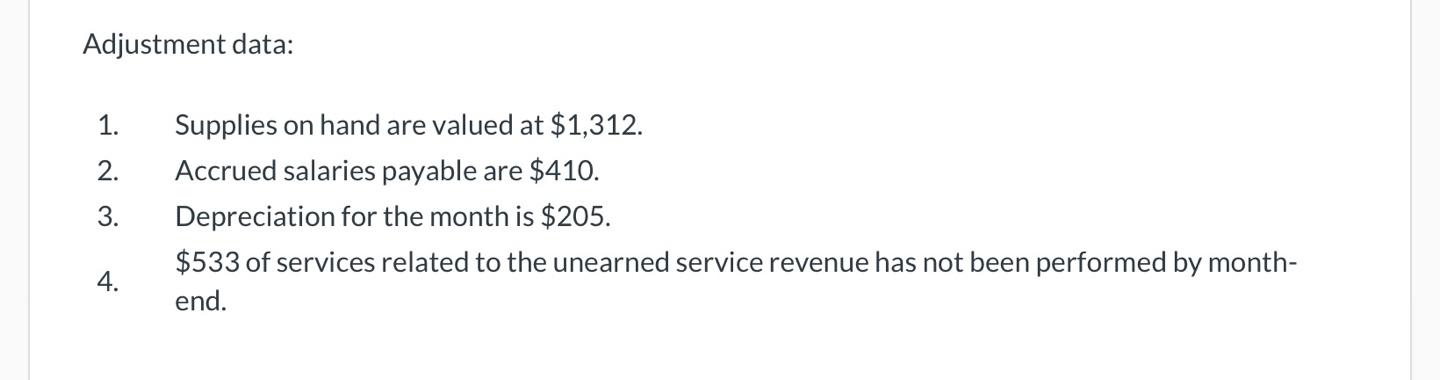

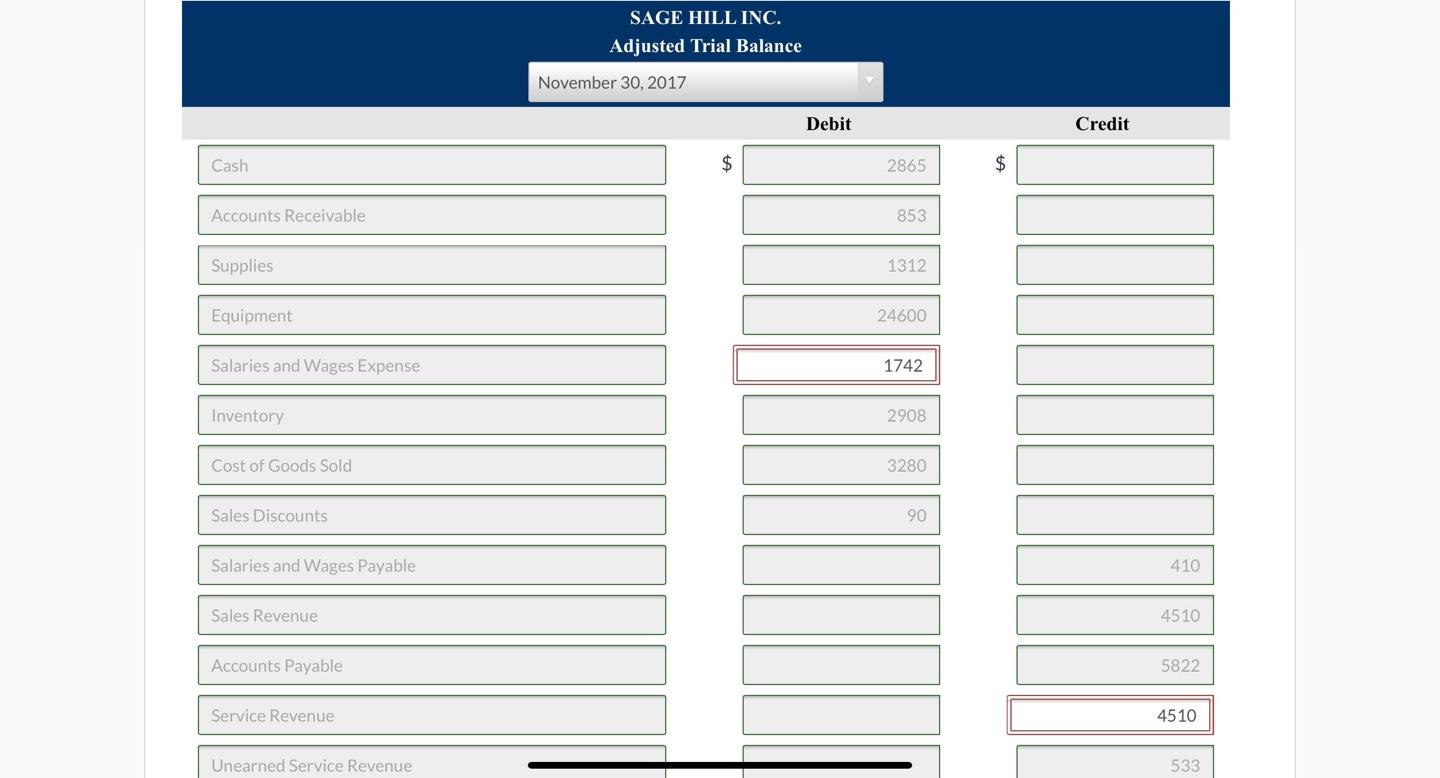

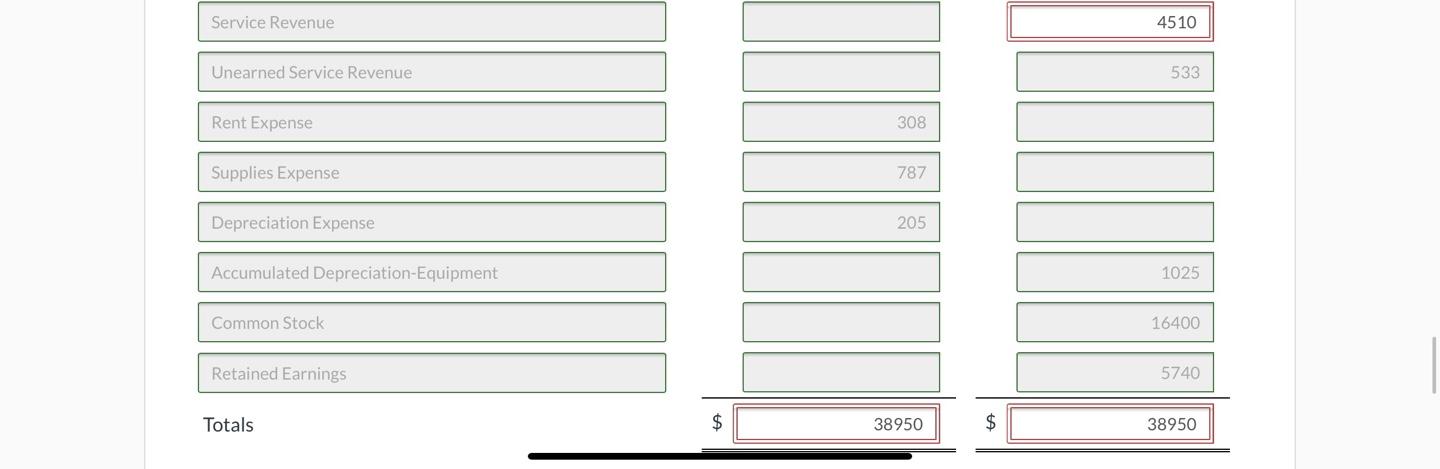

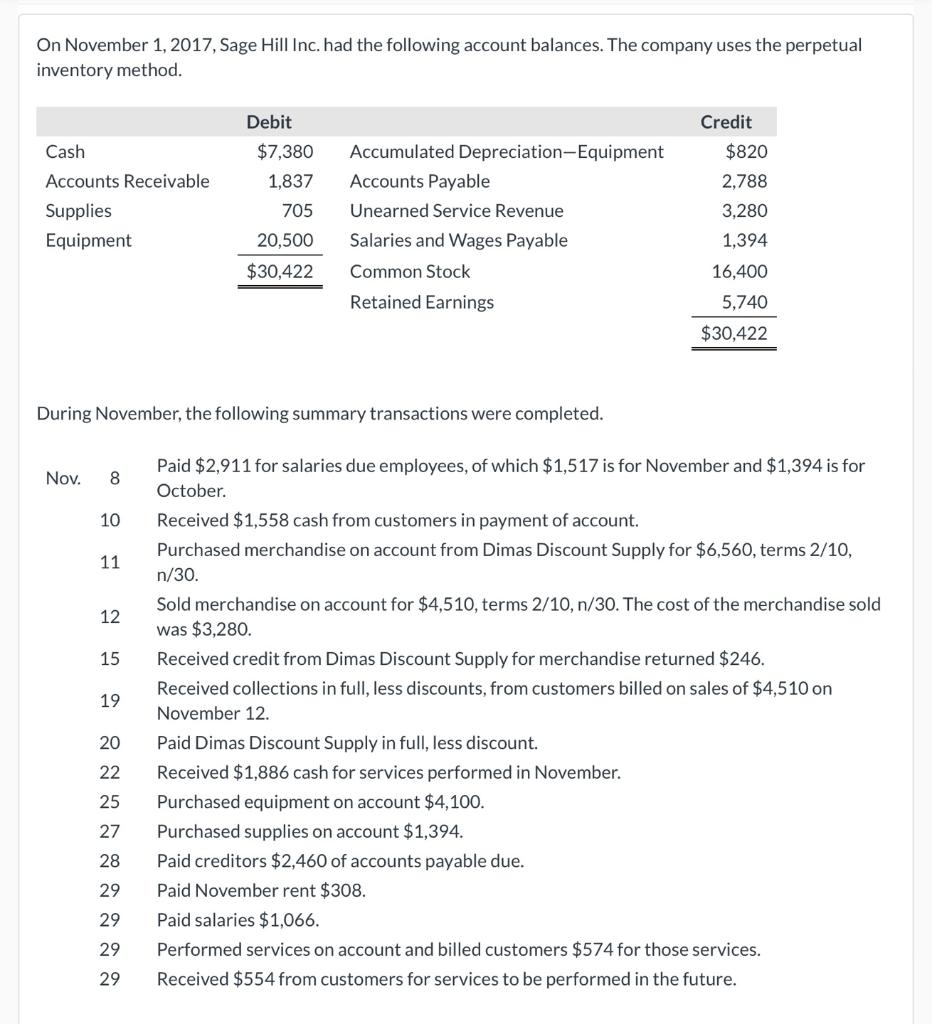

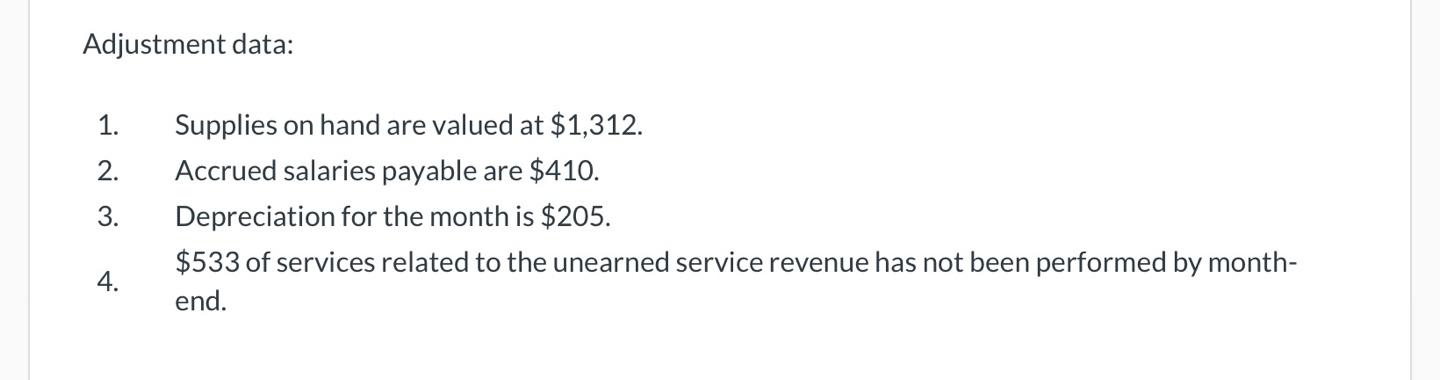

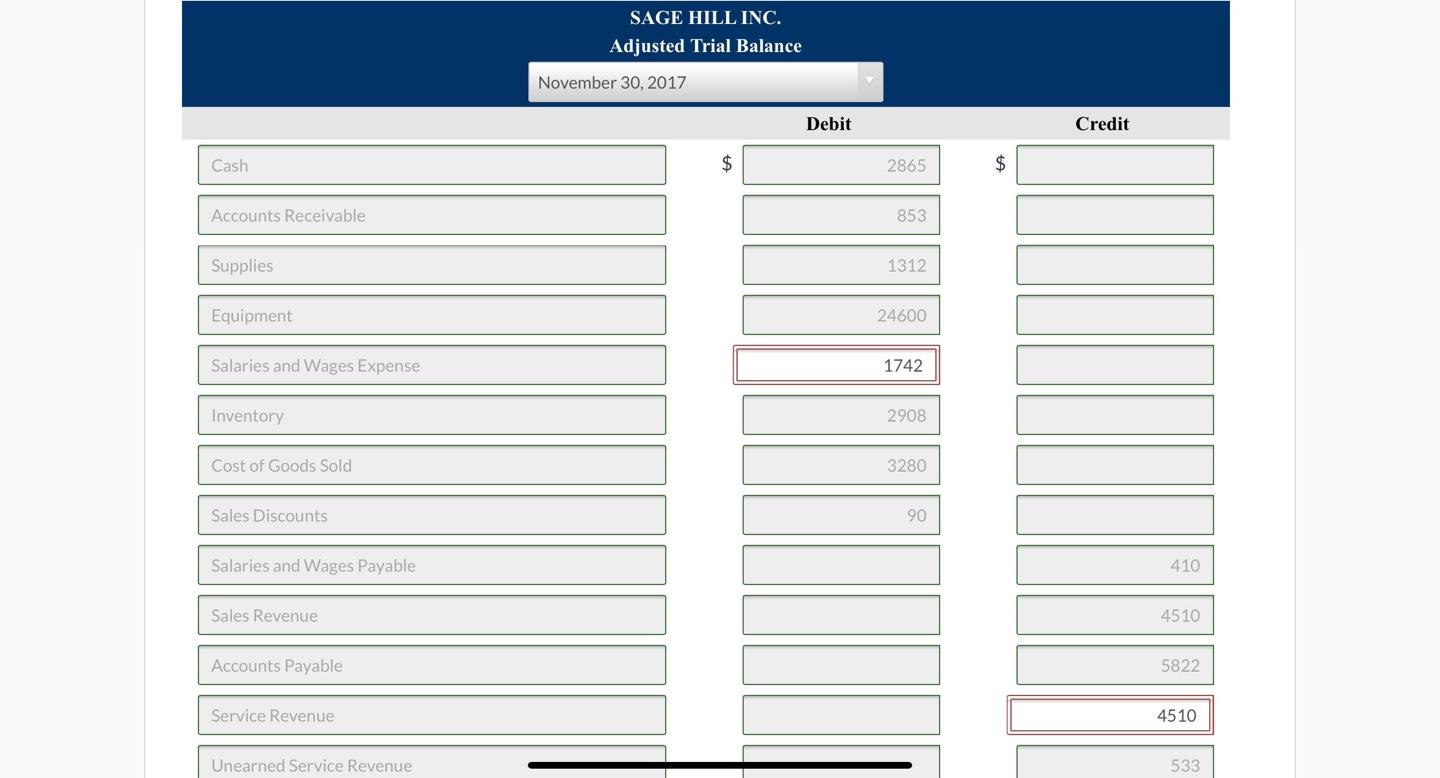

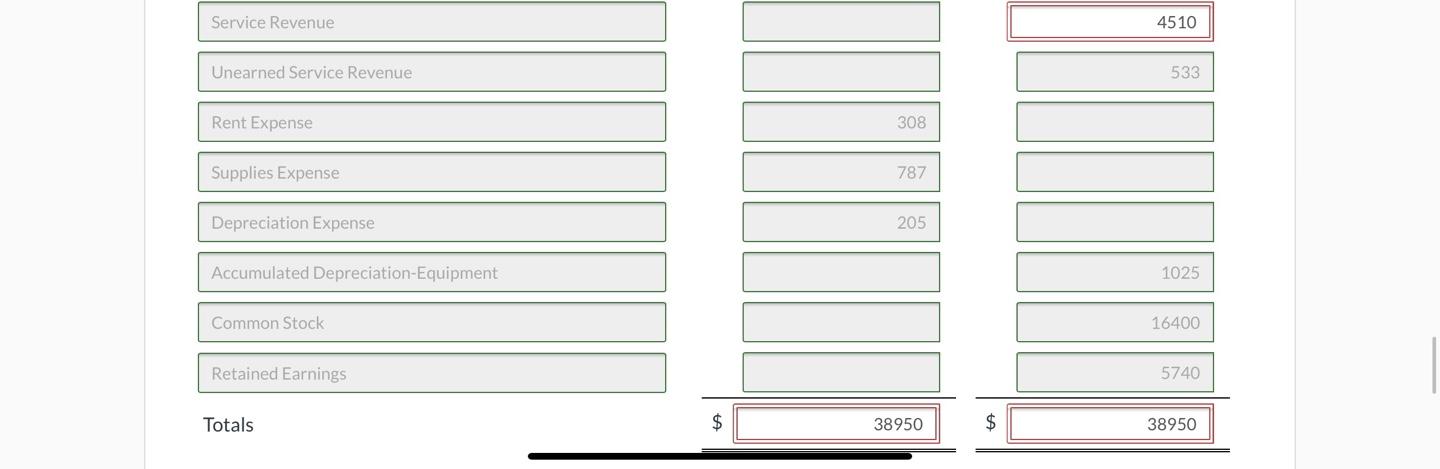

On November 1, 2017, Sage Hill Inc. had the following account balances. The company uses the perpetual inventory method. Debit $7,380 Cash Credit $820 2.788 Accounts Receivable Supplies Equipment 1,837 705 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Common Stock Retained Earnings 3,280 1,394 20,500 $30,422 16,400 5,740 $30,422 During November, the following summary transactions were completed. Nov. 8 10 11 12 15 19 Paid $2,911 for salaries due employees, of which $1,517 is for November and $1,394 is for October Received $1,558 cash from customers in payment of account. Purchased merchandise on account from Dimas Discount Supply for $6,560, terms 2/10, n/30. Sold merchandise on account for $4,510, terms 2/10, n/30. The cost of the merchandise sold was $3,280. Received credit from Dimas Discount Supply for merchandise returned $246. Received collections in full, less discounts, from customers billed on sales of $4,510 on November 12. Paid Dimas Discount Supply in full, less discount. Received $1,886 cash for services performed in November. Purchased equipment on account $4,100. Purchased supplies on account $1,394. Paid creditors $2,460 of accounts payable due. Paid November rent $308. Paid salaries $1,066. Performed services on account and billed customers $574 for those services. Received $554 from customers for services to be performed in the future. 20 22 25 27 28 29 29 29 29 Adjustment data: 1. 2. 3. Supplies on hand are valued at $1,312. Accrued salaries payable are $410. Depreciation for the month is $205. $533 of services related to the unearned service revenue has not been performed by month- end. 4. SAGE HILL INC. Adjusted Trial Balance November 30, 2017 Debit Credit Cash $ 2865 ta Accounts Receivable 853 Supplies 1312 Equipment 24600 Salaries and Wages Expense 1742 Inventory 2908 Cost of Goods Sold 3280 Sales Discounts 90 Salaries and Wages Payable 410 Sales Revenue 4510 Accounts Payable 5822 Service Revenue 4510 Unearned Service Revenue 533 Service Revenue 4510 Unearned Service Revenue 533 Rent Expense 308 Supplies Expense 787 Depreciation Expense 205 Accumulated Depreciation Equipment 1025 Common Stock 16400 Retained Earnings 5740 Totals $ 38950 $ 38950