Answered step by step

Verified Expert Solution

Question

1 Approved Answer

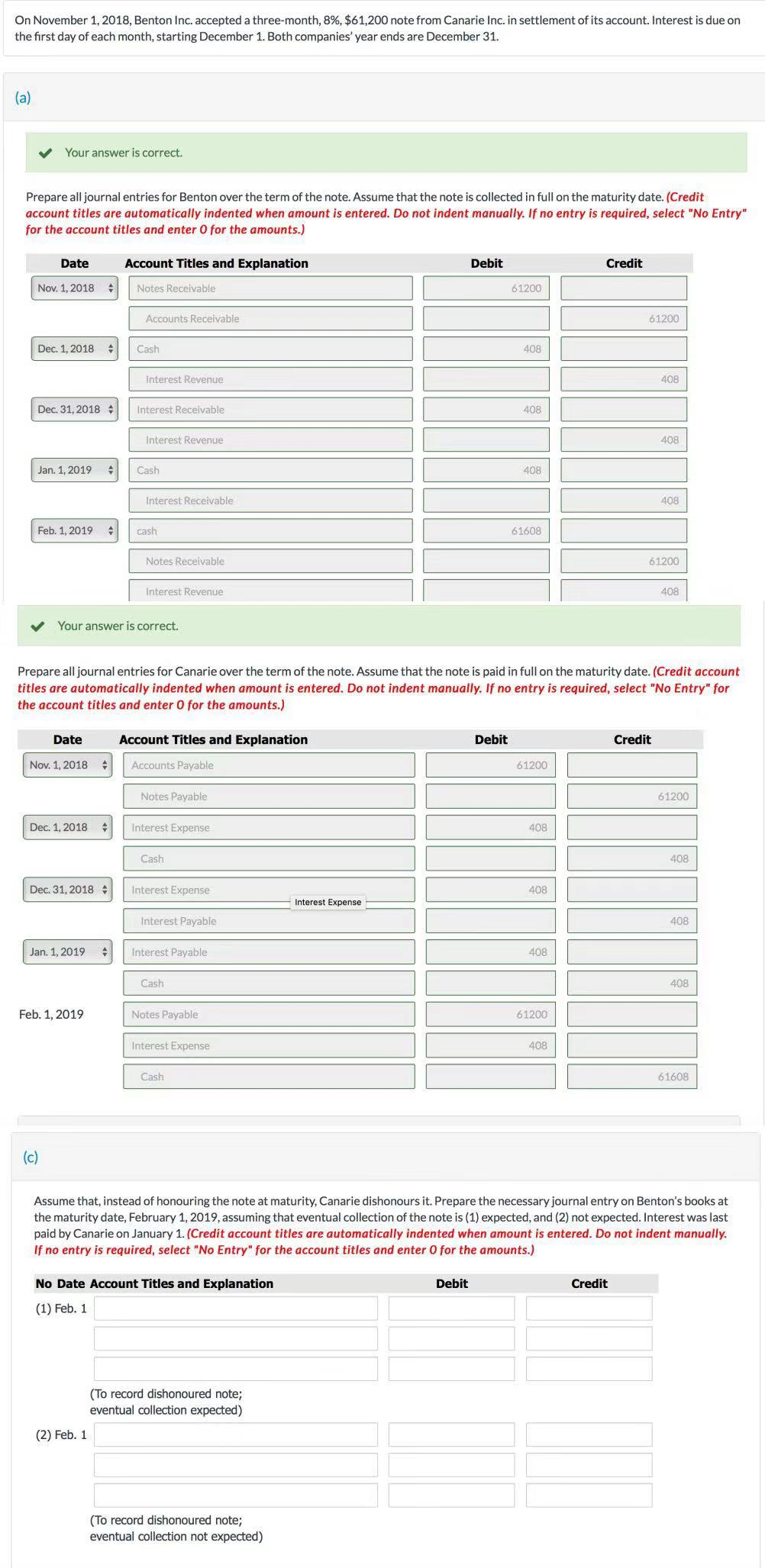

On November 1, 2018, Benton Inc. accepted a three-month, 8%, $61,200 note from Canarie Inc. in settlement of its account. Interest is due on

On November 1, 2018, Benton Inc. accepted a three-month, 8%, $61,200 note from Canarie Inc. in settlement of its account. Interest is due on the first day of each month, starting December 1. Both companies' year ends are December 31. (a) Your answer is correct. Prepare all journal entries for Benton over the term of the note. Assume that the note is collected in full on the maturity date. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Nov. 1, 2018 Dec. 1, 2018 Dec. 31, 2018 Jan. 1, 2019 Feb. 1, 2019 Date Nov. 1, 2018 # Dec. 1, 2018 + Dec. 31, 2018 Jan. 1, 2019 + (c) Feb. 1, 2019 Account Titles and Explanation Notes Receivable Accounts Receivable Cash Interest Revenue (2) Feb. 1 Interest Receivable. Interest Revenue Your answer is correct. Cash Interest Receivable cash Notes Receivable Interest Revenue Account Titles and Explanation Accounts Payable Notes Payable Interest Expense Cash Interest Expense Prepare all journal entries for Canarie over the term of the note. Assume that the note is paid in full on the maturity date. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Interest Payable Interest Payable Cash Notes Payable Interest Expense Cash No Date Account Titles and Explanation (1) Feb. 1 (To record dishonoured note; eventual collection expected) Interest Expense (To record dishonoured note; eventual collection not expected) Debit Debit 61200 Debit 408 408 408 61608 61200 408 408 408 61200 Credit 408 61200 Credit 408 408 Credit 408 61200 408 Assume that, instead of honouring the note at maturity, Canarie dishonours it. Prepare the necessary journal entry on Benton's books at the maturity date, February 1, 2019, assuming that eventual collection of the note is (1) expected, and (2) not expected. Interest was last paid by Canarie on January 1. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) 61200 408 408 408 61608

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started