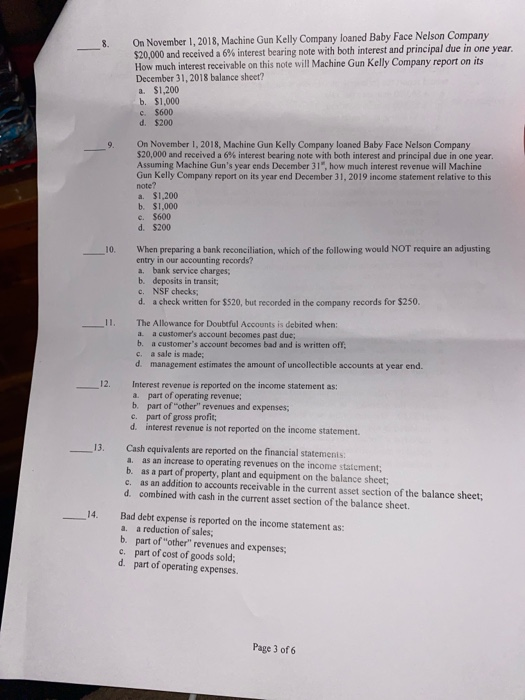

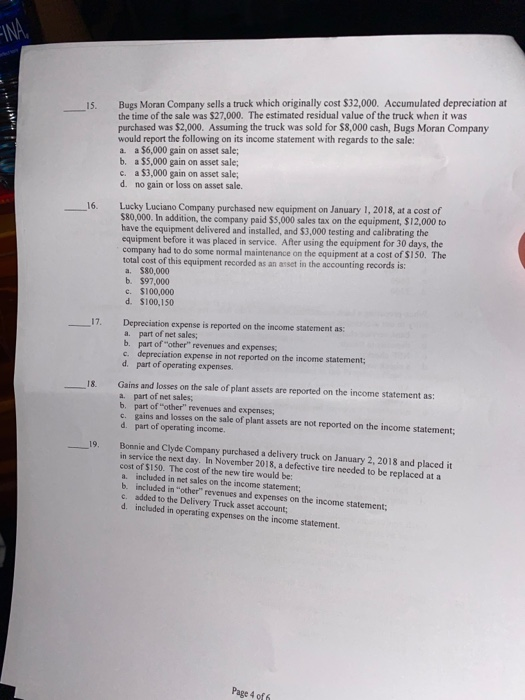

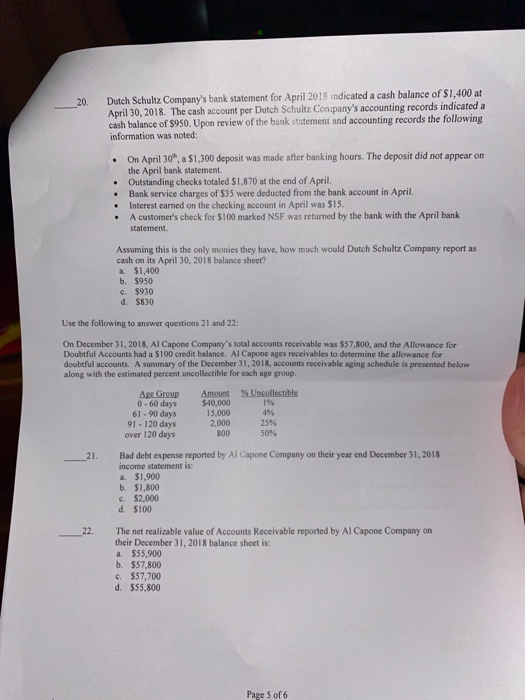

On November 1, 2018, Machine Gun Kelly Company loaned Baby Face Nelson Company $20,000 and received a 6% interest bearing note with both interest and principal due in one year. How much interest receivable on this note will Machine Gun Kelly Company report on its December 31, 2018 balance sheet? a. $1,200 b. $1,000 c. $600 d. $200 On November 1, 2018, Machine Gun Kelly Company loaned Baby Face Nelson Company $20,000 and received a 6% interest bearing note with both interest and principal due in one year. Assuming Machine Gun's year ends December 31", how much interest revenue will Machine Gun Kelly Company report on its year end December 31, 2019 income statement relative to this note? a $1,200 b. $1,000 c. $600 d. $200 When preparing a bank reconciliation, which of the following would NOT require an adjusting entry in our accounting records? a. bank service charges; b. deposits in transit; c. NSF checks; d. a check written for $520, but recorded in the company records for $250. The Allowance for Doubtful Accounts is debited when: a. a customer's account becomes past due; b. a customer's account becomes bad and is written off: ca sale is made; d. management estimates the amount of uncollectible accounts at year end. Interest revenue is reported on the income statement as: a part of operating revenue b. part of other" revenues and expenses c. part of gross profit; d. interest revenue is not reported on the income statement Cash equivalents are reported on the financial statements: a. as an increase to operating revenues on the income statement; b. as a part of property, plant and equipment on the balance sheet; c. as an addition to accounts receivable in the current asset section of the balance sheet: d. combined with cash in the current asset section of the balance sheet. Bad debt expense is reported on the income statement as: a a reduction of sales; b. part of "other" revenues and expenses, c. part of cost of goods sold; d. part of operating expenses. Page 3 of 6 Bugs Moran Company sells a truck which originally cost $32,000. Accumulated depreciation at the time of the sale was $27,000. The estimated residual value of the truck when it was purchased was $2,000. Assuming the truck was sold for $8,000 cash, Bugs Moran Company would report the following on its income statement with regards to the sale: a. a $6,000 gain on asset sale; b. a $5,000 gain on asset sale; c. a $3,000 gain on asset sale; d. no gain or loss on asset sale. Lucky Luciano Company purchased new equipment on January 1, 2018, at a cost of $80,000. In addition, the company paid $5,000 sales tax on the equipment, $12,000 to have the equipment delivered and installed, and $3,000 testing and calibrating the equipment before it was placed in service. After using the equipment for 30 days, the company had to do some normal maintenance on the equipment at a cost of $150. The total cost of this equipment recorded as an asset in the accounting records is: a $80,000 b. $97.000 c. $100,000 d. S100,150 Depreciation expense is reported on the income statement as: a. part of net sales; b. part of "other" revenues and expenses c. depreciation expense in not reported on the income statement; d. part of operating expenses. Gains and losses on the sale of plant assets are reported on the income statement as: a. part of net sales: b. part of "other" revenues and expenses: c. gains and losses on the sale of plant assets are not reported on the income statement; d. part of operating income. Bonnie and Clyde Company purchased a delivery truck on January 2, 2018 and placed it in service the next day. In November 2018, a defective tire needed to be replaced at a cost of $150. The cost of the new tire would be: included in net sales on the income statement; b. included in other revenues and expenses on the income statement: c added to the Delivery Truck asset account; d. included in operating expenses on the income statement. Page 4 of 6 20 Dutch Schultz Company's bank statement for April 2018 indicated a cash balance of $1,400 at April 30, 2018. The cash account per Dutch Schultz Company's accounting records indicated a cash balance of $950. Upon review of the bank statement and accounting records the following information was noted: On April 30", a $1,300 deposit was made after banking hours. The deposit did not appear on the April bank statement. Outstanding checks totaled $1,870 at the end of April. Bank service charges of $35 were deducted from the bank account in April. Interest eared on the checking account in April was $15. A customer's check for $100 marked NSF was returned by the bank with the April bank statement Assuming this is the only monies they have, how much would Dutch Schultz Company report as cash on its April 30, 2018 balance sheet? a $1,400 b. $950 C. $930 d. S830 Use the following to answer questions 21 and 22: On December 31, 2018, Al Capone Company's total accounts receivable was $57,800, and the Allowance for Doubtful Accounts had a $100 credit balance. Al Capone ages receivables to determine the allowance for doubtful accounts. A summary of the December 31, 2018, accounts receivable aging schedule is presented below along with the estimated percent uncollectible for each age group. %Uncollectible Age Group 0 - 60 days 61 - 90 days 91 - 120 days over 120 days Amount 540,000 15.000 2.000 800 50% Bad debt expense reported by Al Capone Company on their year end December 31, 2018 income statement is a $1.900 b. $1,800 c. $2,000 d $100 The net realizable value of Accounts Receivable reported by Al Capone Company on their December 31, 2018 balance sheet is: a $55.900 b. $57,800 c. $57,700 d. $55,800 Page 5 of 6