Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On November 1, 2019 Husky owned 1,000,000 barrels of oil that it wants to sell in March 2020 for $45 per barrel. Husky acquired

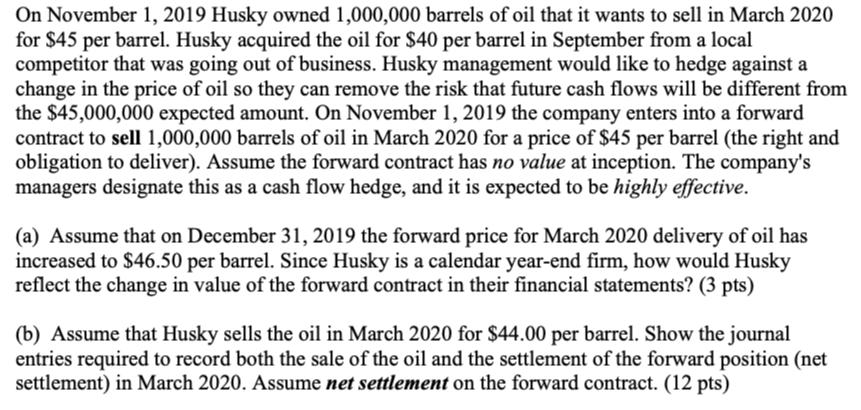

On November 1, 2019 Husky owned 1,000,000 barrels of oil that it wants to sell in March 2020 for $45 per barrel. Husky acquired the oil for $40 per barrel in September from a local competitor that was going out of business. Husky management would like to hedge against a change in the price of oil so they can remove the risk that future cash flows will be different from the $45,000,000 expected amount. On November 1, 2019 the company enters into a forward contract to sell 1,000,000 barrels of oil in March 2020 for a price of $45 per barrel (the right and obligation to deliver). Assume the forward contract has no value at inception. The company's managers designate this as a cash flow hedge, and it is expected to be highly effective. (a) Assume that on December 31, 2019 the forward price for March 2020 delivery of oil has increased to $46.50 per barrel. Since Husky is a calendar year-end firm, how would Husky reflect the change in value of the forward contract in their financial statements? (3 pts) (b) Assume that Husky sells the oil in March 2020 for $44.00 per barrel. Show the journal entries required to record both the sale of the oil and the settlement of the forward position (net settlement) in March 2020. Assume net settlement on the forward contract. (12 pts)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution a forward price Derivative assets of oil inventory 404650 100000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started