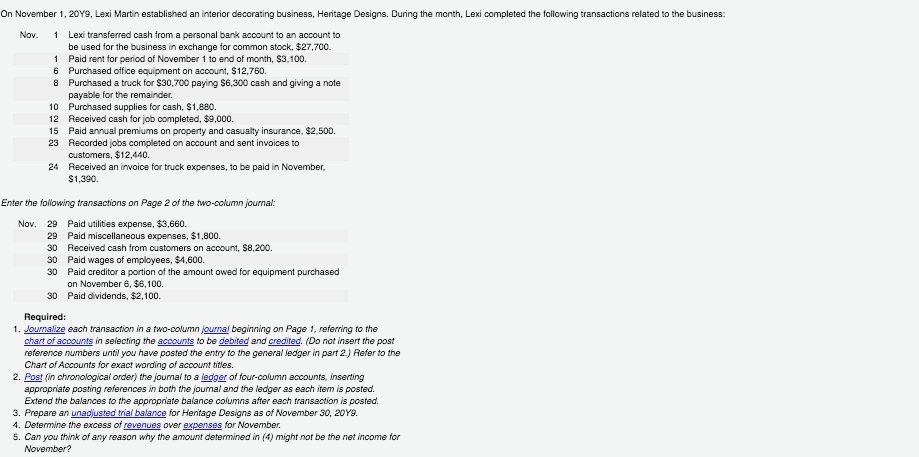

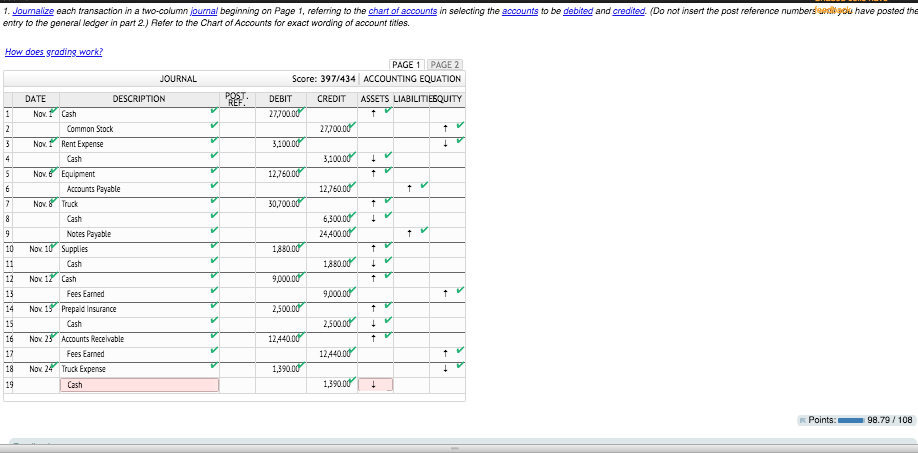

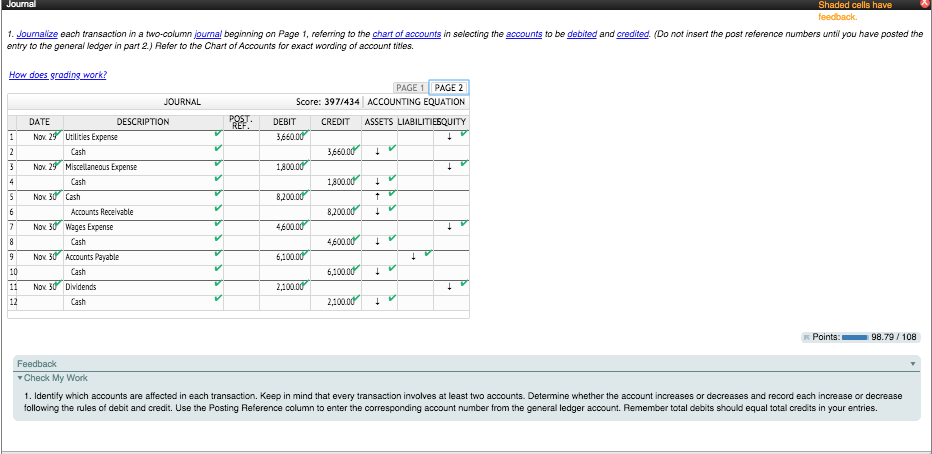

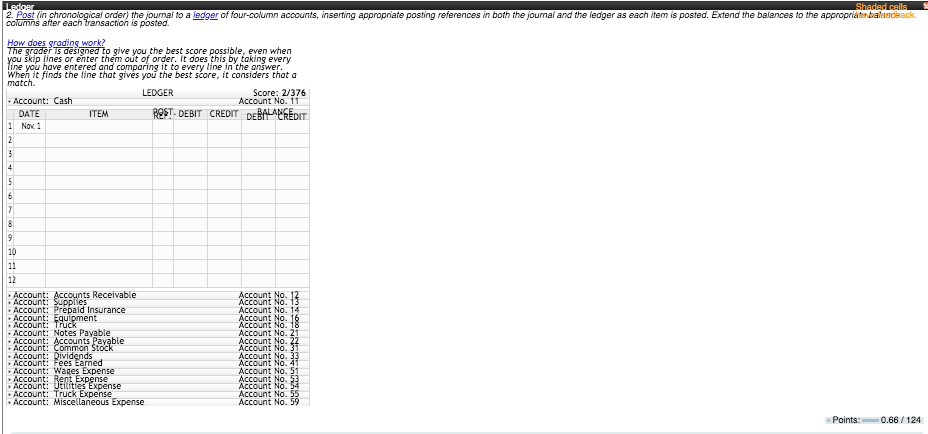

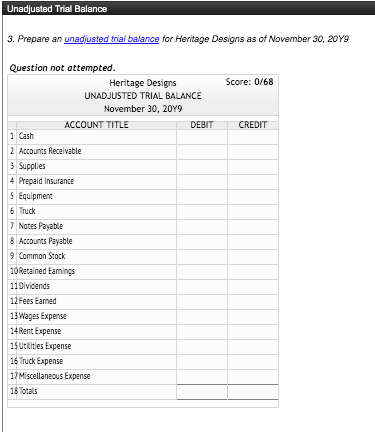

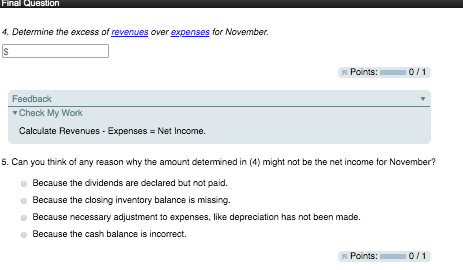

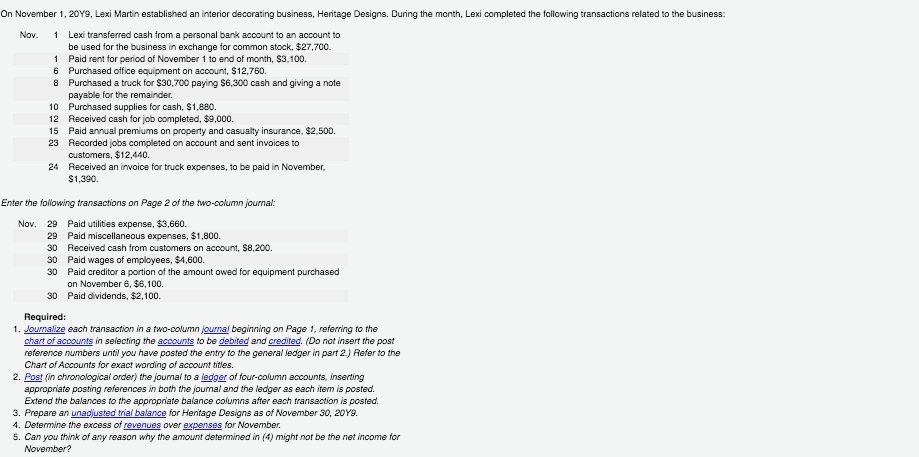

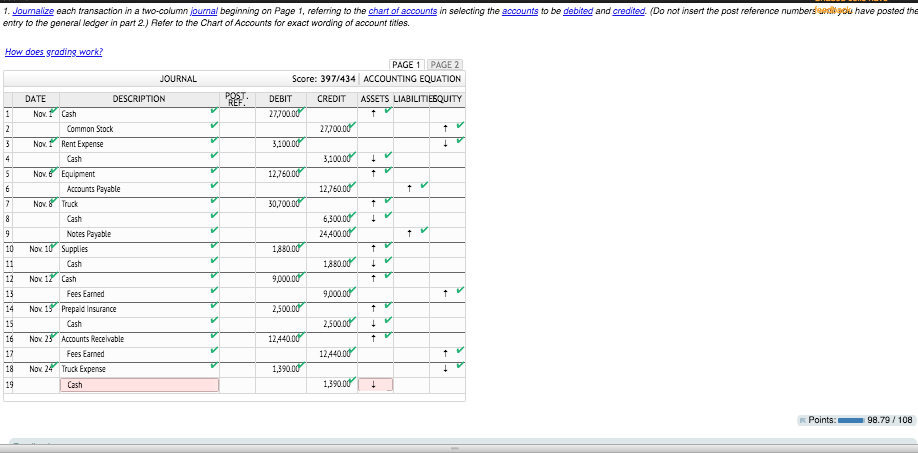

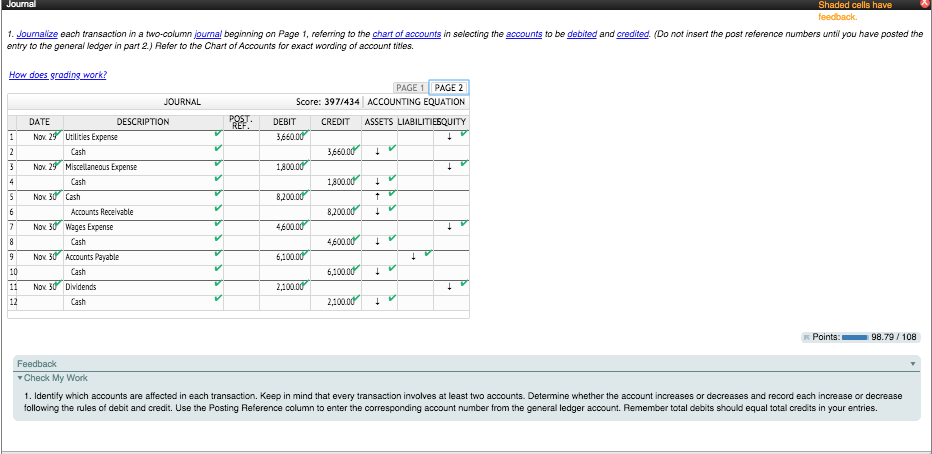

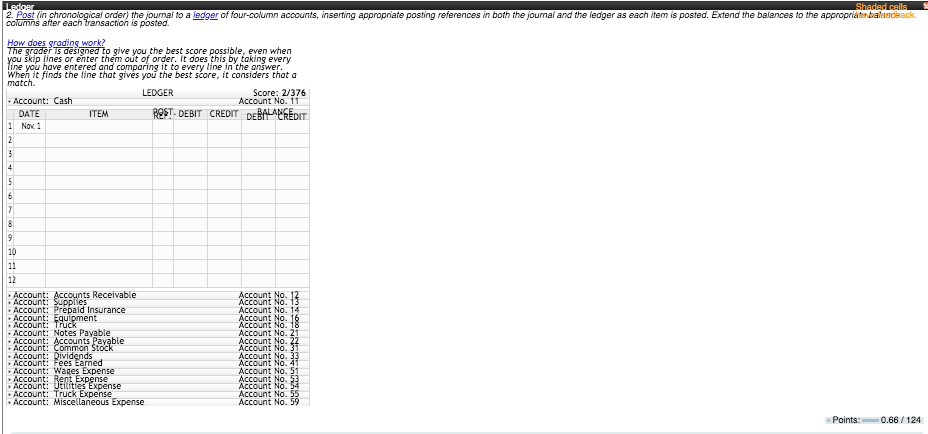

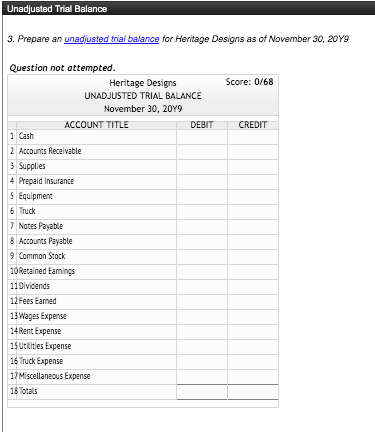

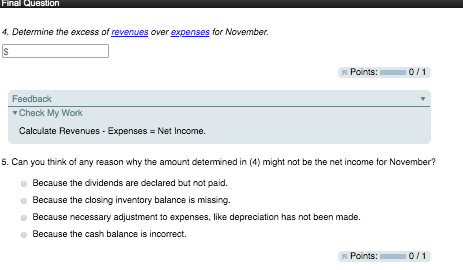

On November 1, 2019, Lexi Martin established an interior decorating business, Heritage Designs. During the month, Lexi completed the following transactions related to the business: Nov. 1 Lexi transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $27.700. 1 Paid rent for period of November 1 to end of month, $3,100. 6 Purchased office equipment on account, $12.760. 8 Purchased a truck for $30,700 paying $6,300 cash and giving a note payable for the remainder. 10 Purchased supplies for cash, S1,880. 12 Received cash for job completed, $9,000. 15 Paid annual premiums on property and casualty insurance, $2,500. 23 Recorded jobs completed on account and sent invoices to customers, $12.440. 24 Received an invoice for truck expenses, to be paid in November, $1,390. Enter the following transactions on Page 2 of the two-column journal: Nov. 29 Paid utilities expense, $3,660. 29 Paid miscellaneous expenses, $1,800. 30 Received cash from customers on account, $8,200. 30 Paid wages of employees, $4,600. 30 Paid creditor a portion of the amount owed for equipment purchased on November 6, $6,100. 30 Paid dividends, $2,100. Required: 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the chart of accounts in selecting the accounts to be debited and credited. (Do not insert the post reference numbers until you have posted the entry to the general ledger in part 2) Refer to the Chart of Accounts for exact wording of account titles. 2. Post (in chronological order) the journal to a ledger of four-column accounts, inserting appropriate posting references in both the journal and the ledger as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Heritage Designs as of November 30, 2049. 4. Determine the excess of revenues over expenses for November. 5. Can you think of any reason why the amount determined in (4) might not be the net income for November? you have posted the 1. Journalize each transaction in a two-column lumal beginning on Page 1, referring to the chart of accounts in selecting the accounts to be debited and credited. (Do not insert the post reference numbers entry to the general ledger in part 2) Refer to the Chart of Accounts for exact wording of account titles. How does greding work? PAGE 1 PAGE 2 Score: 397/434 ACCOUNTING EQUATION Po CREDIT ASSETS LIABILITIESQUITY DATE Nox JOURNAL DESCRIPTION Cash Common Stock Rent Expense DEBIT 27700.00 27,70000 3 Nox 3,100.00 3.100.00 5 12.760.00 12,760.00 30,700.00 6,300.00 24,400.00 10 1,880.00 1.880.00 Nov. Equipment Accounts Payable Nov. 8 Truck Cash Notes Payable Nov 10 Supplies Cash Nov 17 Cash Fees Earned Nox 1 Prepaid Insurance Cash Nov 25 Accounts Receivable Fees Earned Nox 24 Truck Expense Cash 9.000.00 9,000.00 12 13 14 15 16 17 18 2,500.00 2,500.00 12.440.00 12,440.00 1.390.00 1,390.00 Points: 98.79 / 108 Journal Shaded cells have feedback 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the chart of accounts in selecting the accounts to be debited and credited. (Do not insert the post reference numbers until you have posted the entry to the general ledger in part 2.) Refer to the Chart of Accounts for exact wording of account titles. How does grading work? 1 3 JOURNAL DATE DESCRIPTION Nov. 29 Utilities Expense Cash Nov 29 Miscellaneous Expense Cash Nov 30 Cash Accounts Receivable Nov 30 Wages Expense PAGE 1 PAGE 2 Score: 397/434 ACCOUNTING EQUATION DEBIT CREDIT ASSETS LIABILITIESQUITY 3660.00 3.660.00 1,800.00 1.800.00 1 8,200.00 8200.00 4600.00 4.600.00 6,100.00 6,100.00 2.100.00 2,100.00 7 9 Nox 30 Accounts Payable Cash Dividends Cash 11 Nov 30 Points: 98.79 / 108 Feedback Check My Work 1. Identify which accounts are affected in each transaction. Keep in mind that every transaction involves at least two accounts. Determine whether the account increases or decreases and record each increase or decrease following the rules of debit and credit. Use the Posting Reference column to enter the corresponding account number from the general ledger account. Remember total debits should equal total credits in your entries. Ladoor Shaded calls 2 Post (in chronological order) the journal to a ledger of four-column accounts, inserting appropriate posting references in both the journal and the ledger as each item is posted. Extend the balances to the appropriate b columns after each transaction is posted edback. How does grading work? The grader is designed to give you the best score possible, even when you skip fines or enter them out of order. It does this by taking every Tine you have entered and comparing it to every tine in the answer. When it finds the line that gives you the best score, it considers that a match. LEDGER Score: 2/376 Account: Cash Account No. 11 ITEM ROST. DEBIT CREDIT DEBALACREDIT 1 Nov DATE Account: Accounts Receivable Account - Account: Prepaid Insurance : Account Equipment - Account: Notes Payable Account Accounts Payable Account No. 9999999999999 MARRAS Account ees Eamed - Account: Wages Expense Account Account Beniler Erpense Account Truck Expense Account: Miscellaneous Expense ASSOU Account Account Points: 0.66 / 124 Unadjusted Trial Balance 3. Prepare an unadjusted trial balance for Heritage Designs as of November 30, 2079 Score: 0/68 CREDIT Question not attempted. Heritage Designs UNADJUSTED TRIAL BALANCE November 30, 2019 ACCOUNT TITLE DEBIT 1 Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Insurance 5 Equipment 6 Truck 7 Notes Payable 8 Accounts Payable 9 Common Stock 10 Retained Eamings 11 Dividends 12 Fees Eamed 13 Wages Expense 14 Rent Expense 15 Utilities Expense 16 Truck Expense 17 Miscellaneous Expense 18 orals Final Question 4. Determine the excess of revenues over expenses for November. Points: 0/1 Feedback Check My Work Calculate Revenues - Expenses = Net Income. 5. Can you think of any reason why the amount determined in (4) might not be the net income for November? Because the dividends are declared but not paid. Because the closing inventory balance is missing. Because necessary adjustment to expenses, like depreciation has not been made. Because the cash balance is incorrect. Points: 0/1