Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On November 1, 2020. Americo, a U.S. company with fiscal year-end on December 31 purchased inventory from a company in Spain for 30.000 euro ()

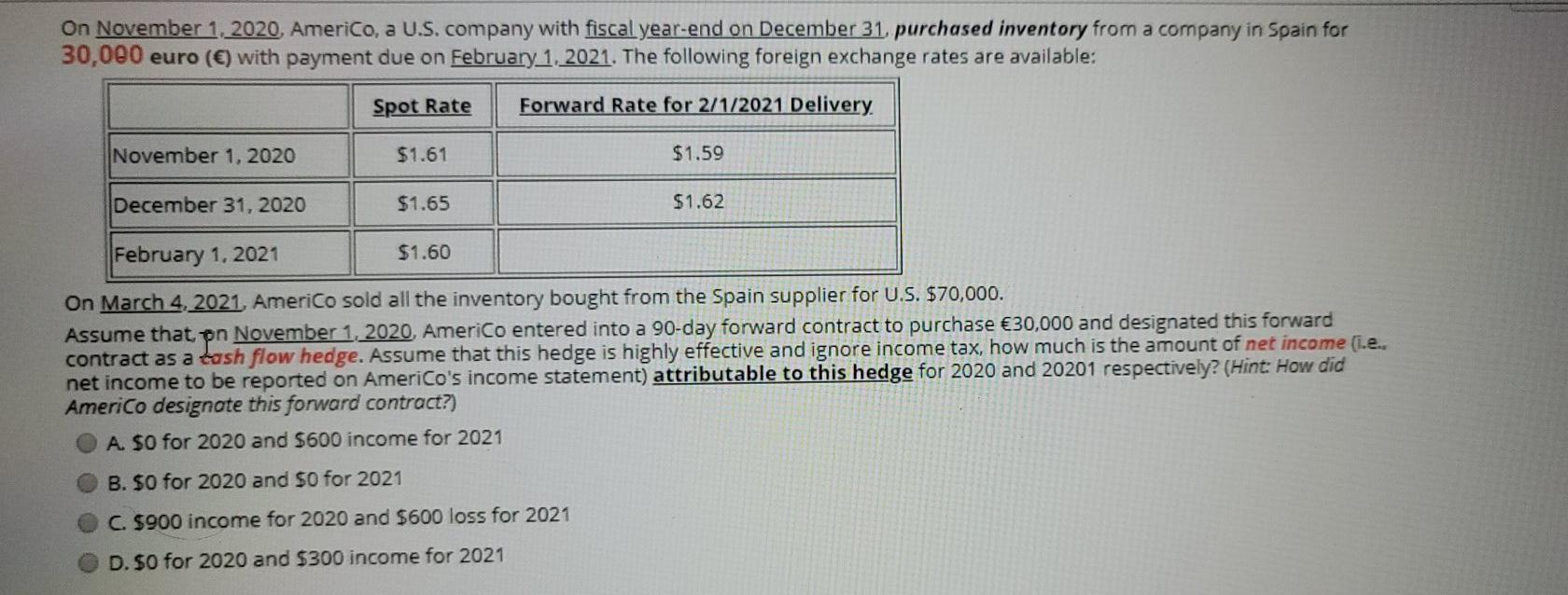

On November 1, 2020. Americo, a U.S. company with fiscal year-end on December 31 purchased inventory from a company in Spain for 30.000 euro () with payment due on February 1, 2021. The following foreign exchange rates are available: Spot Rate Forward Rate for 2/1/2021 Delivery November 1, 2020 $1.61 $1.59 December 31, 2020 $1.65 $1.62 February 1, 2021 $1.60 On March 4, 2021. Americo sold all the inventory bought from the Spain supplier for U.S. $70,000. Assume that on November 1, 2020 Americo entered into a 90-day forward contract to purchase 30,000 and designated this forward contract as a tash flow hedge. Assume that this hedge is highly effective and ignore income tax, how much is the amount of net income (1.e.. net income to be reported on AmeriCo's income statement) attributable to this hedge for 2020 and 20201 respectively? (Hint: How did Americo designate this forward contract?) A SO for 2020 and $600 income for 2021 B. $0 for 2020 and $0 for 2021 C. $900 income for 2020 and $600 loss for 2021 D. $0 for 2020 and $300 income for 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started