Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On November 1, 2020, BCareful issued a 3-year, 7% P1,000,000 convertible bond at 105 . The bonds were selling at P923,865, without the conversion feature,

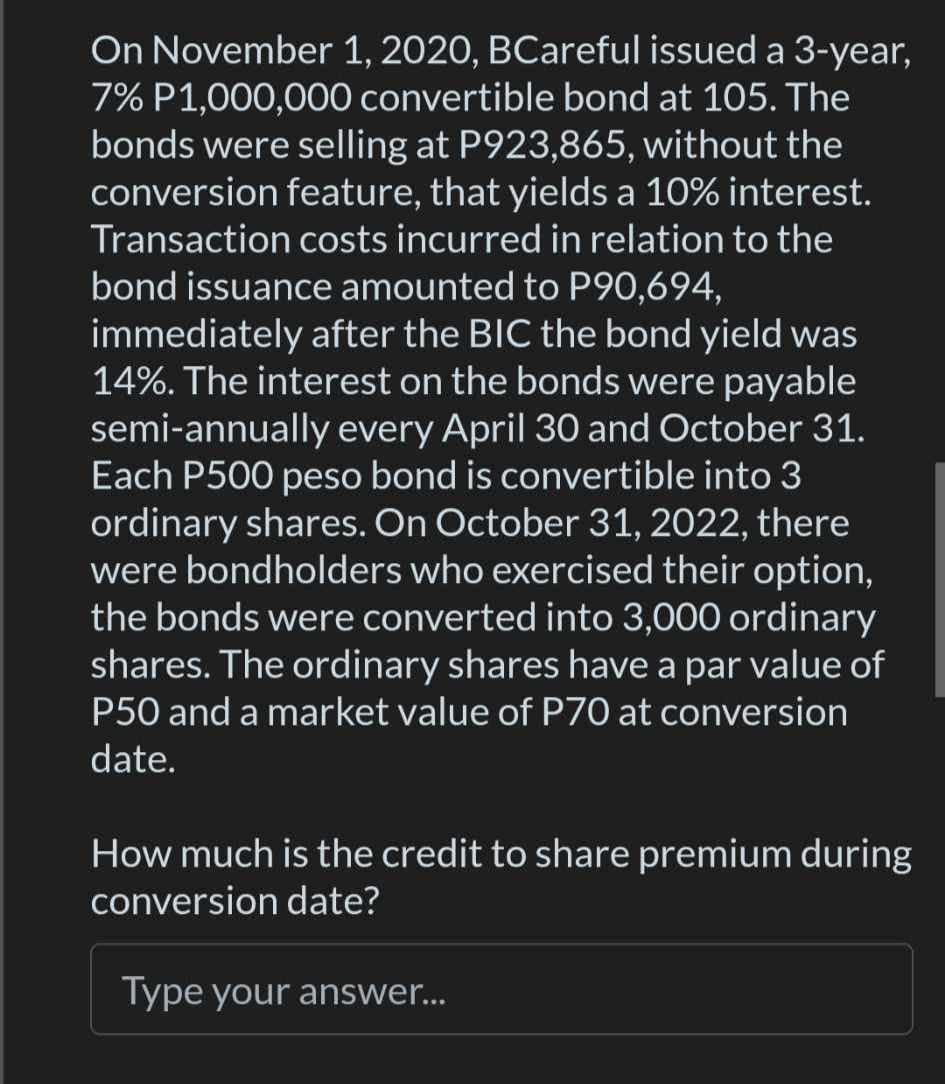

On November 1, 2020, BCareful issued a 3-year, 7% P1,000,000 convertible bond at 105 . The bonds were selling at P923,865, without the conversion feature, that yields a 10% interest. Transaction costs incurred in relation to the bond issuance amounted to P90,694, immediately after the BIC the bond yield was 14%. The interest on the bonds were payable semi-annually every April 30 and October 31. Each P500 peso bond is convertible into 3 ordinary shares. On October 31, 2022, there were bondholders who exercised their option, the bonds were converted into 3,000 ordinary shares. The ordinary shares have a par value of P50 and a market value of P70 at conversion date. How much is the credit to share premium during conversion date? Using the information in BCareful; How much is the amortization for 2022 ? Type your

On November 1, 2020, BCareful issued a 3-year, 7% P1,000,000 convertible bond at 105 . The bonds were selling at P923,865, without the conversion feature, that yields a 10% interest. Transaction costs incurred in relation to the bond issuance amounted to P90,694, immediately after the BIC the bond yield was 14%. The interest on the bonds were payable semi-annually every April 30 and October 31. Each P500 peso bond is convertible into 3 ordinary shares. On October 31, 2022, there were bondholders who exercised their option, the bonds were converted into 3,000 ordinary shares. The ordinary shares have a par value of P50 and a market value of P70 at conversion date. How much is the credit to share premium during conversion date? Using the information in BCareful; How much is the amortization for 2022 ? Type your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started