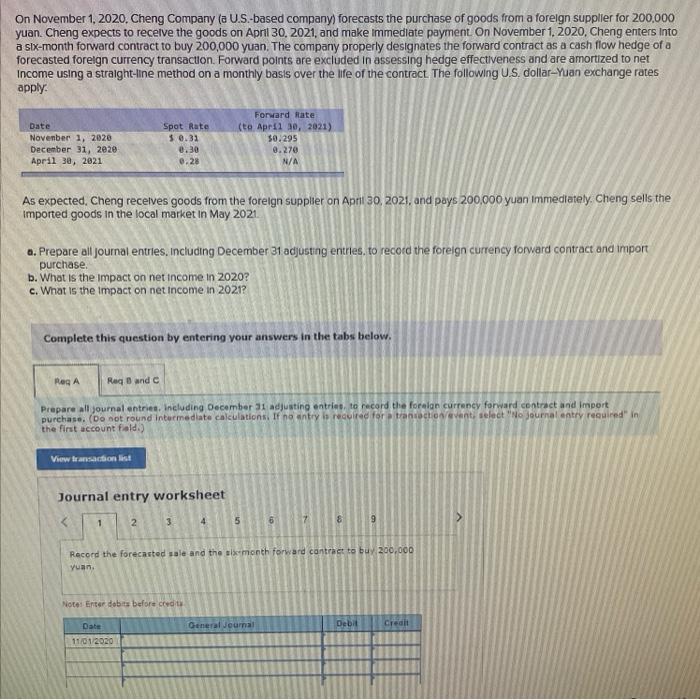

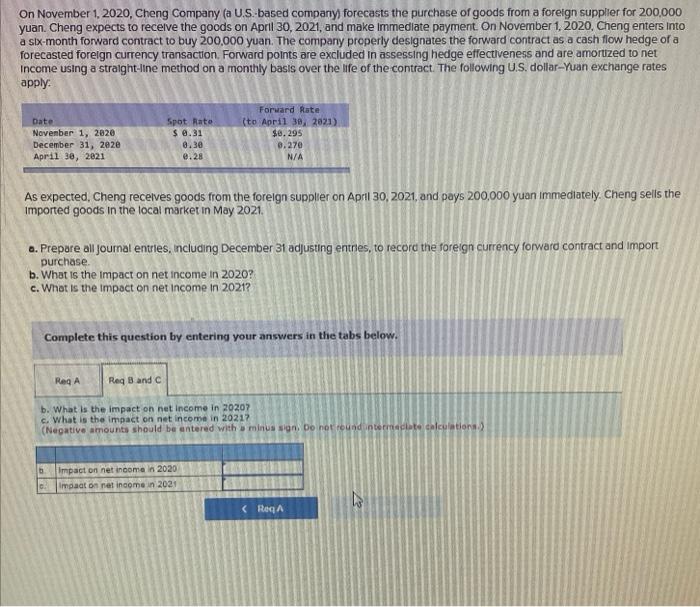

On November 1, 2020. Cheng Company (a U.S.-based company) forecasts the purchase of goods from a forelgn supplier for 200,000 yuan. Cheng expects to recelve the goods on April 30,2021, and make immedlate payment. On November 1, 2020, Cheng enters Into a six-month forward contract to buy 200,000 yuan. The company properly designates the forward contract as a cash flow hedge of a forecasted foreign currency transaction. Forward points are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis over the life of the contract. The following U.S. dollar-Yuan exchange rates apply. As expected, Cheng recelves goods from the forelgn supplier on Apri 30,2021 , and pays 200,000 yuan immediately. Cheng sells the imported goods in the local market in May 2021 a. Prepare all journal entries, Including December 31 adjusting entries, to record the foreign currency forward contract and import purchase. b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021 ? Complete this question by entering your answers in the tabs below. Prepare all journal entries. Including Oecember 31 adjusting entries, to record the forelgn currency forward contract and import the first iccount fialdi) Journal entry worksheet ruan. Note: riser dobta befor= cetaty. On November 1, 2020, Cheng Company (a U.S. based company) forecasts the purchase of goods from a foreign supplier for 200,000 yuan. Cheng expects to recelve the goods on April 30,2021, and make immedlate payment. On November 1, 2020, Cheng enters into a six-month forward contract to buy 200,000 yuan. The company properly designates the forward contract as a cash flow hedge of a forecasted foreign currency transaction. Forward points are excluded in assessing hedge effectiveness and are amortized to net Income using a straight-line method on a monthly basis over the life of the contract. The following U.S. dollar-Yuan exchange rates apply: As expected, Cheng recelves goods from the forelgn supplier on April 30, 2021, and pays 200,000 yuan immediately. Cheng sells the imported goods in the local market in May 2021. 0. Prepare all journal entries, including December 31 adjusting entres, to record the foreign currency forward contract and import purchase. b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021 ? Complete this question by entering your answers in the tabs below. b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021