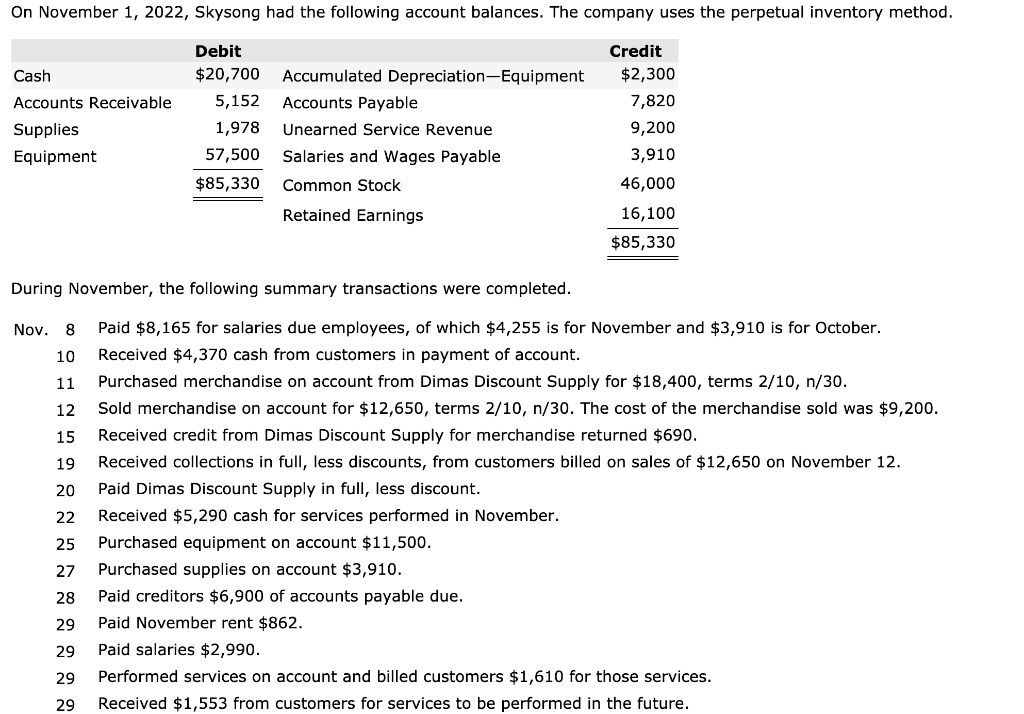

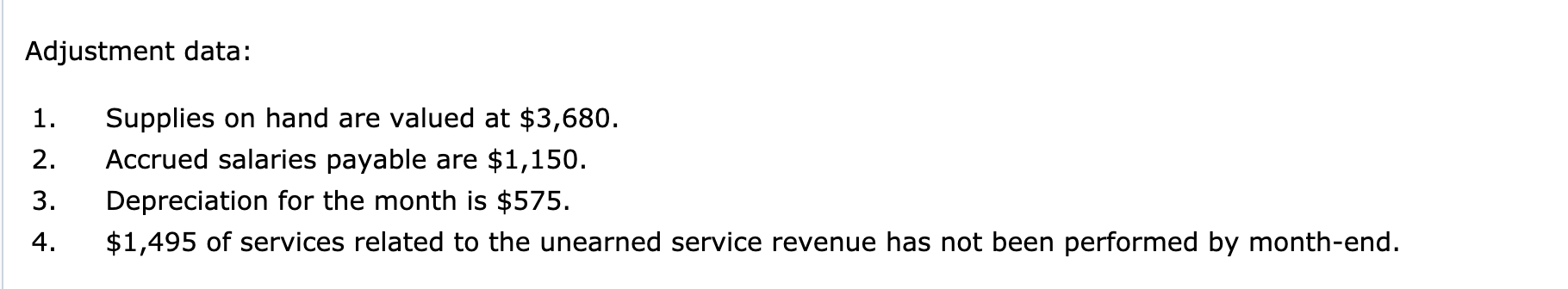

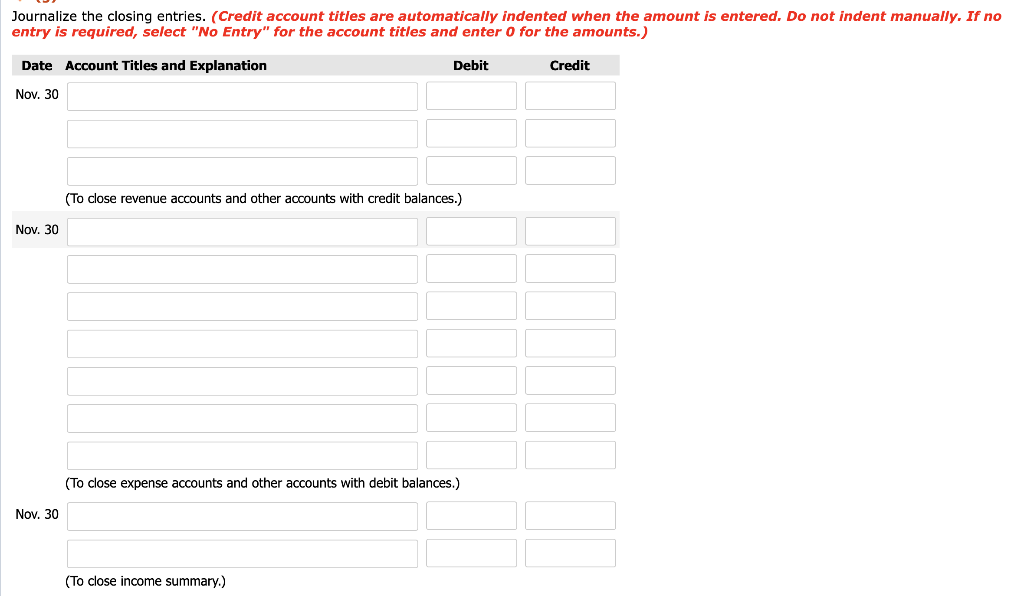

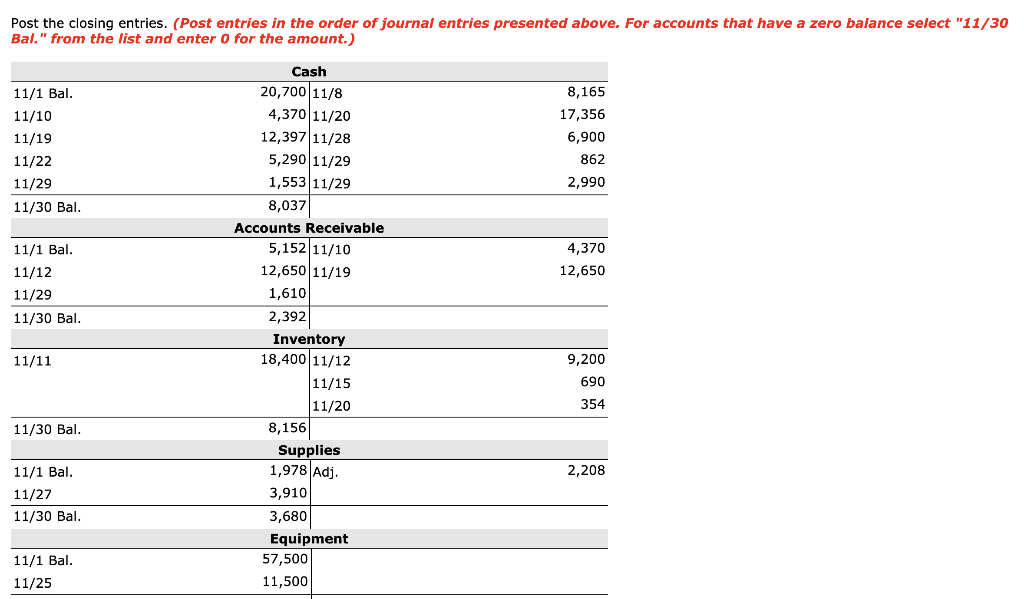

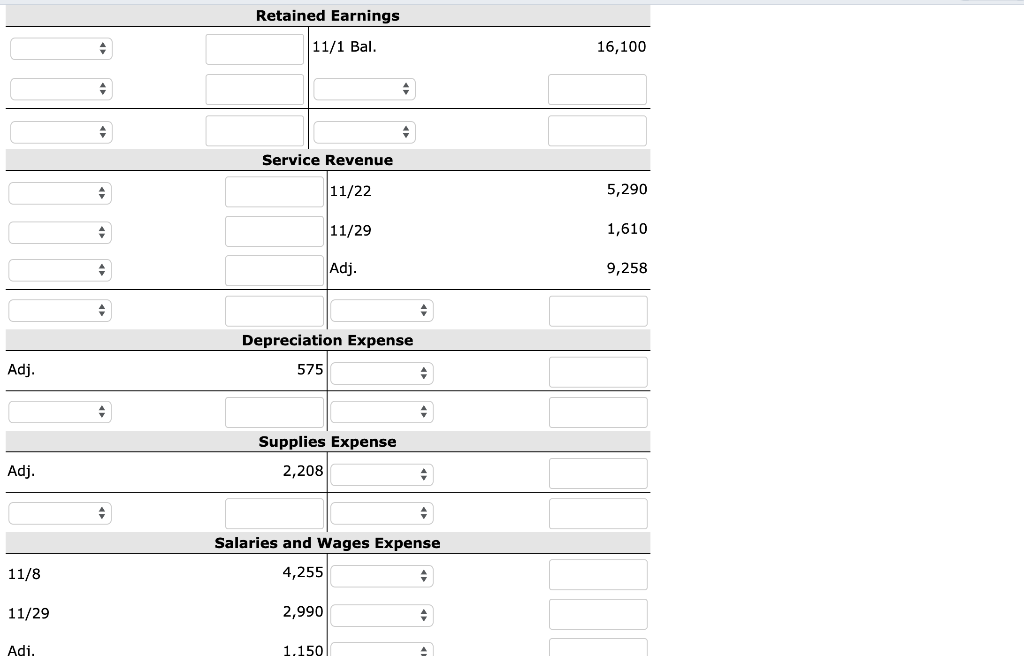

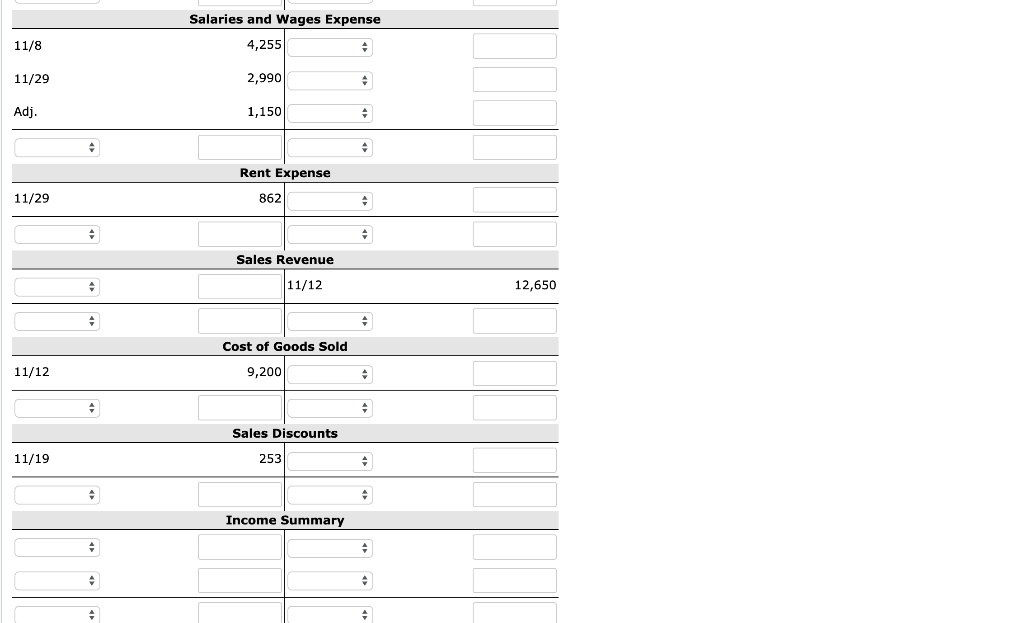

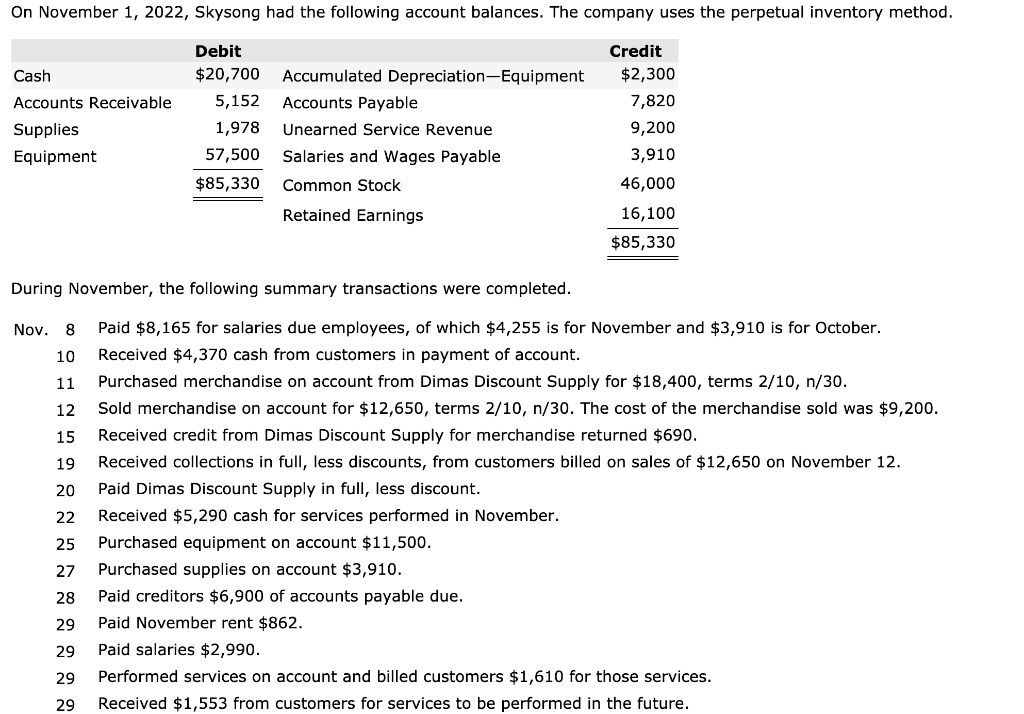

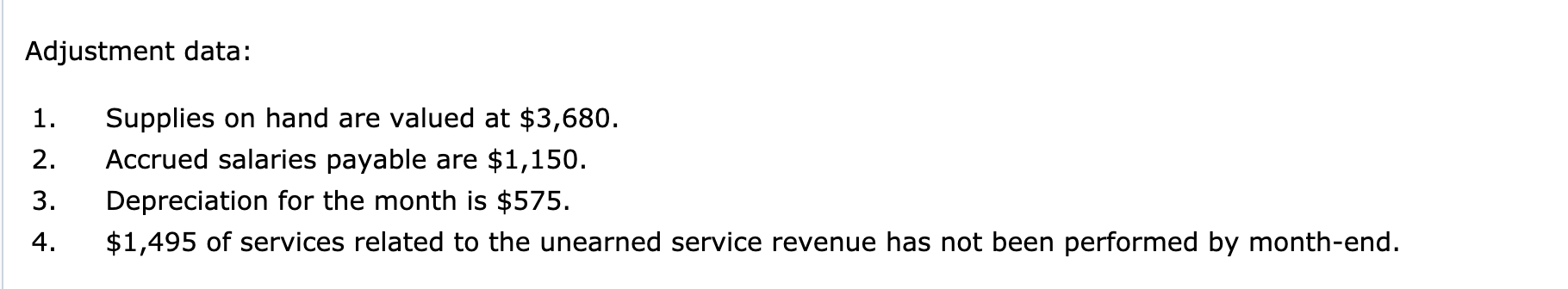

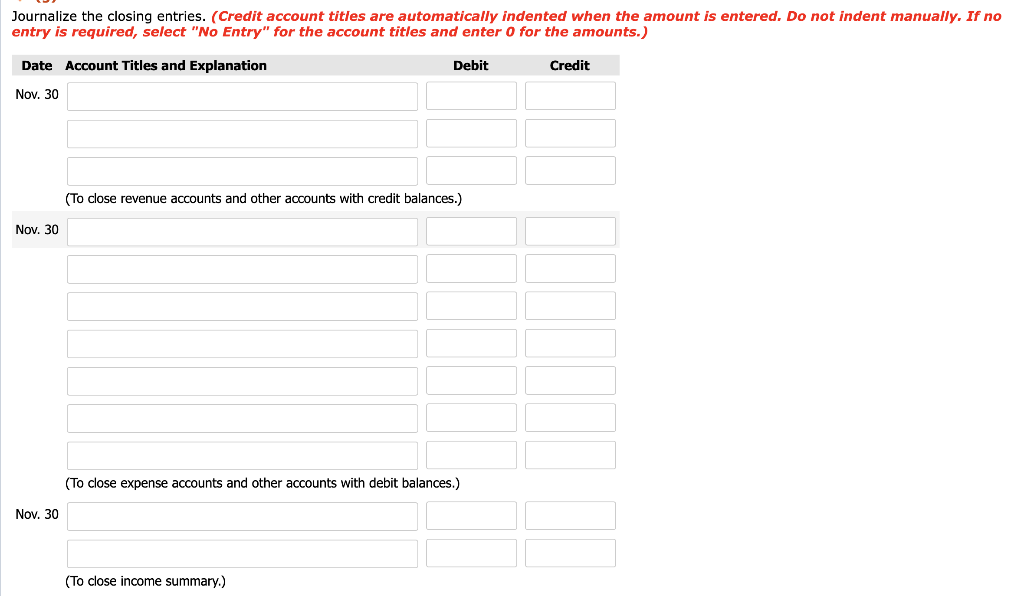

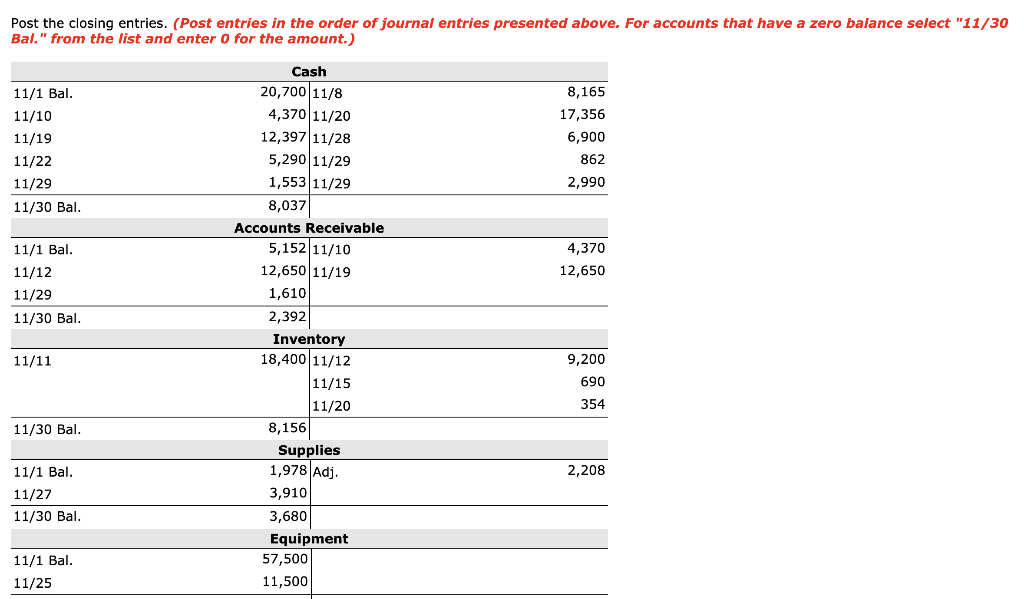

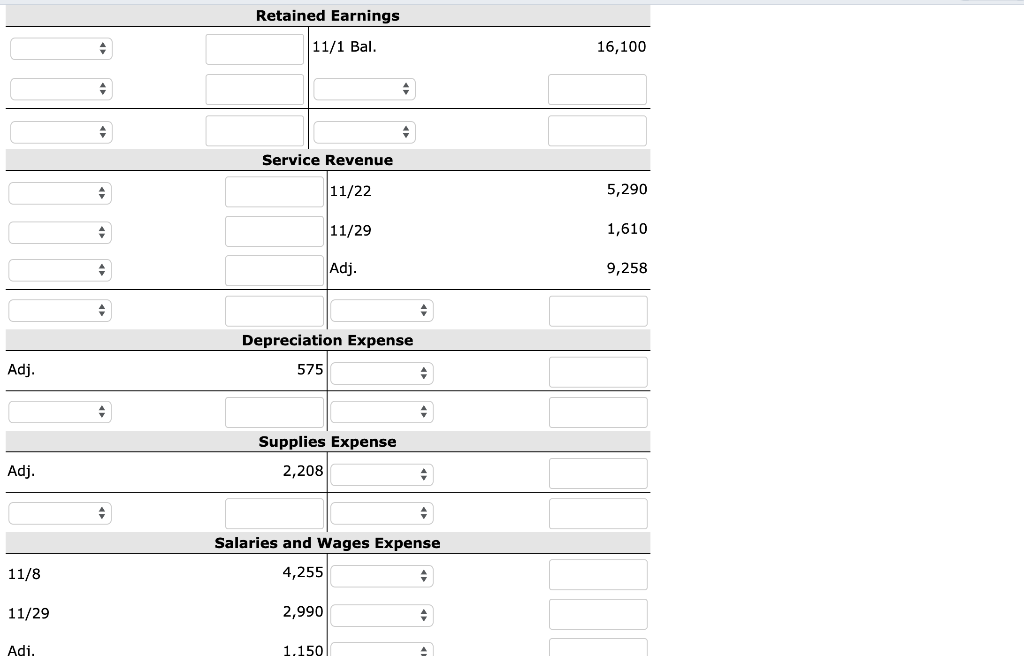

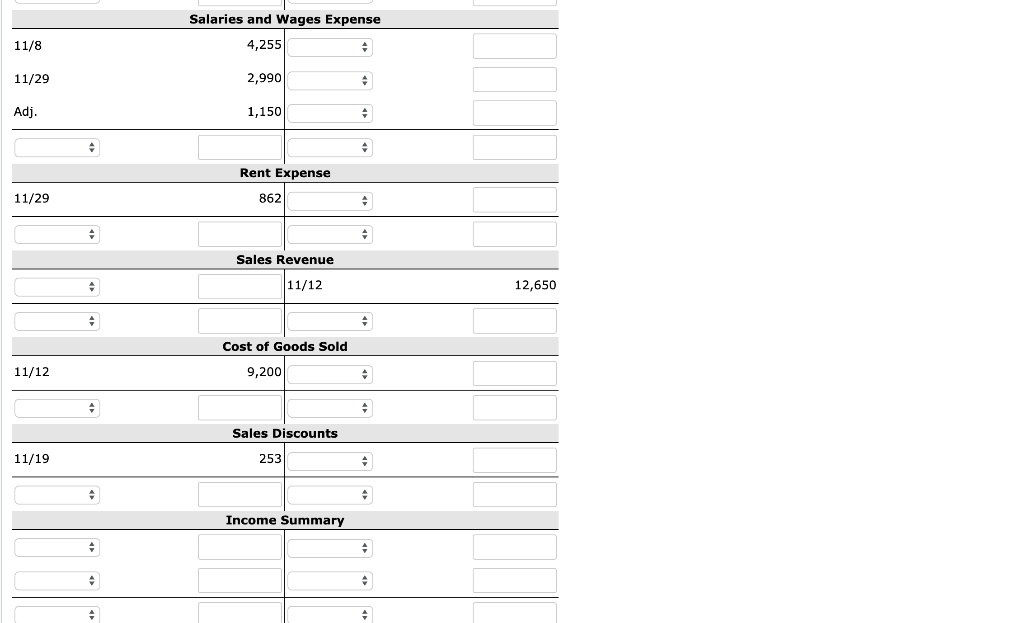

On November 1, 2022, Skysong had the following account balances. The company uses the perpetual inventory method. Cash Accounts Receivable Supplies Equipment Debit $20,700 5,152 1,978 57,500 $85,330 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Common Stock Retained Earnings Credit $2,300 7,820 9,200 3,910 46,000 16,100 $85,330 During November, the following summary transactions were completed. Nov. 8 Paid $8,165 for salaries due employees, of which $4,255 is for November and $3,910 is for October. 10 Received $4,370 cash from customers in payment of account. 11 Purchased merchandise on account from Dimas Discount Supply for $18,400, terms 2/10, n/30. 12 Sold merchandise on account for $12,650, terms 2/10, n/30. The cost of the merchandise sold was $9,200. 15 Received credit from Dimas Discount Supply for merchandise returned $690. Received collections in full, less discounts, from customers billed on sales of $12,650 on November 12. 20 Paid Dimas Discount Supply in full, less discount. 22 Received $5,290 cash for services performed in November. 25 Purchased equipment on account $11,500. 27 Purchased supplies on account $3,910. 28 Paid creditors $6,900 of accounts payable due. 29 Paid November rent $862. 29 Paid salaries $2,990. 29 Performed services on account and billed customers $1,610 for those services. 29 Received $1,553 from customers for services to be performed in the future. Adjustment data: 1. Supplies on hand are valued at $3,680. Accrued salaries payable are $1,150. Depreciation for the month is $575. $1,495 of services related to the unearned service revenue has not been performed by month-end. 3. 4. Post the closing entries. (Post entries in the order of journal entries presented above. For accounts that have a zero balance select "11/30 Bal." from the list and enter o for the amount.) 11/1 Bal. 11/10 11/19 11/22 11/29 11/30 Bal. 8,165 17,356 6,900 862 2,990 4,370 12,650 11/1 Bal. 11/12 11/29 11/30 Bal. Cash 20,700 11/8 4,370 11/20 12,397 11/28 5,290 11/29 1,55311/29 8,037 Accounts Receivable 5,152 11/10 12,650 11/19 1,610 2,392 Inventory 18,400 11/12 11/15 11/20 8,156 Supplies 1,978 Adj. 3,910 3,680 Equipment 57,500 11,500 11/11 9,200 690 354 11/30 Bal. 2,208 11/1 Bal. 11/27 11/30 Bal. 11/1 Bal. 11/25 Retained Earnings 11/1 Bal. 16,100 Service Revenue 11/22 5,290 11/29 1,610 Adj. 9,258 Depreciation Expense 575 Adj. Supplies Expense 2,208 Adj. Salaries and Wages Expense 4,255 11/8 11/29 2,990 Adi. 1.159 Salaries and Wages Expense 4,255 11/8 11/29 2,990 Adj. 1,150 Rent Expense 862 11/29 Sales Revenue 11/12 12,650 Cost of Goods Sold 9,200 11/12 Sales Discounts 253 11/19 Income Summary