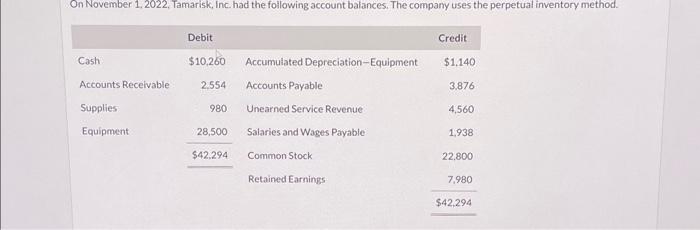

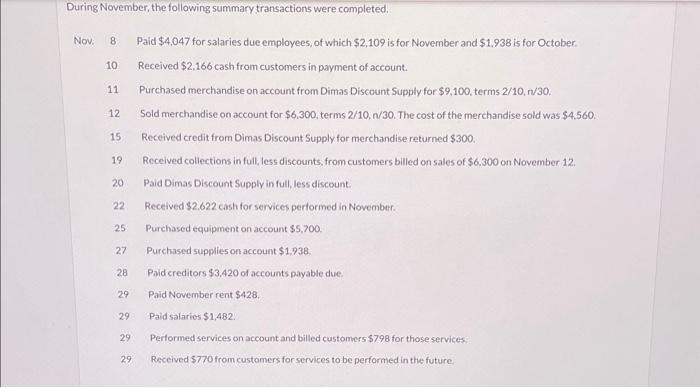

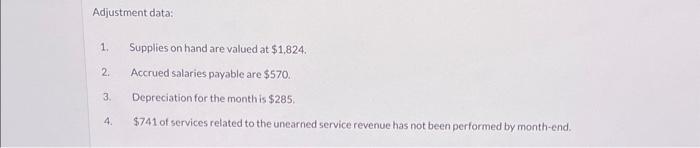

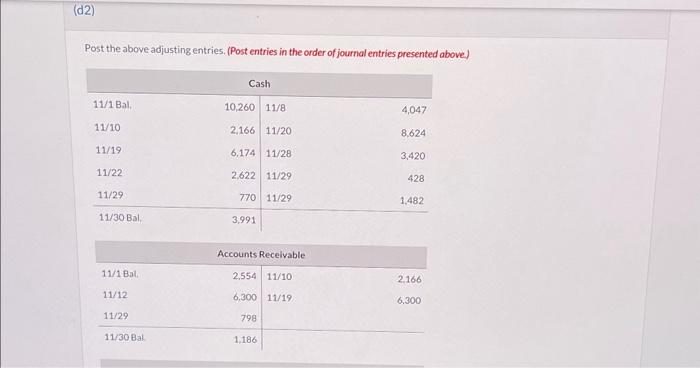

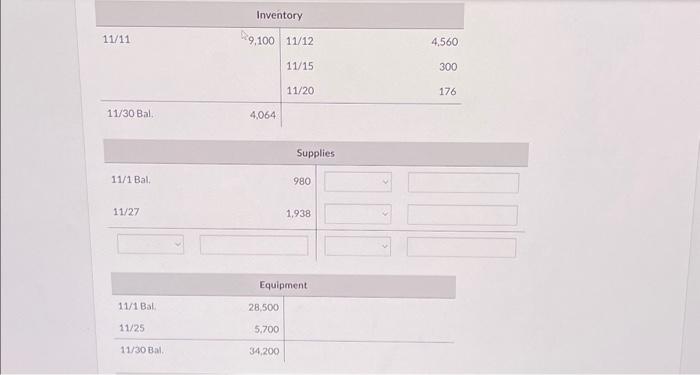

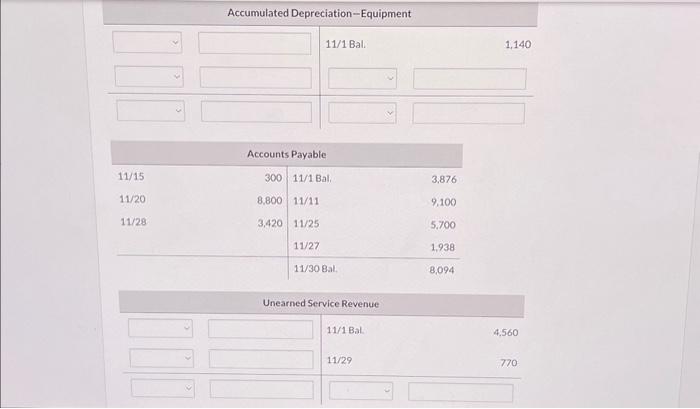

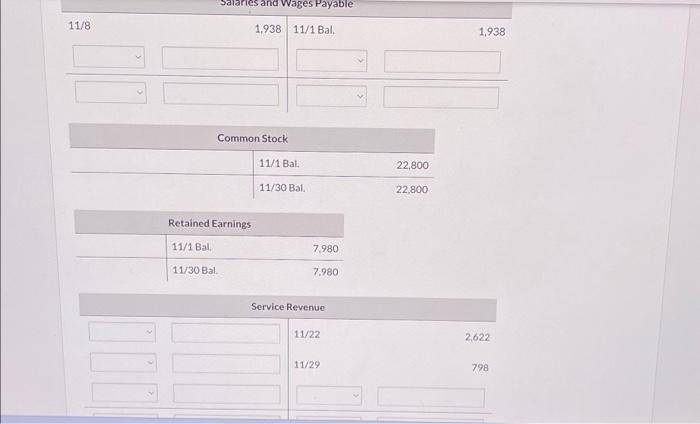

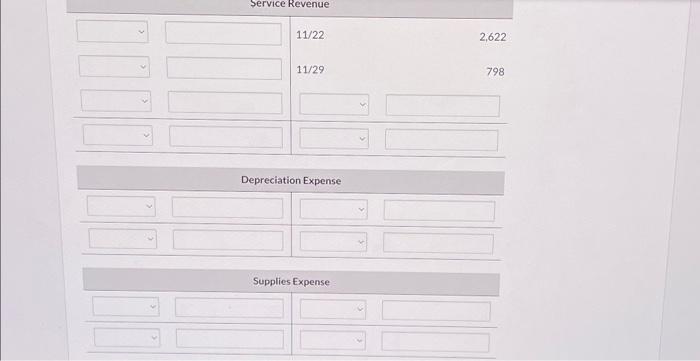

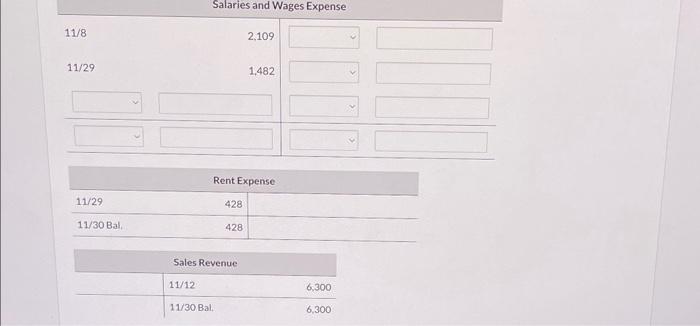

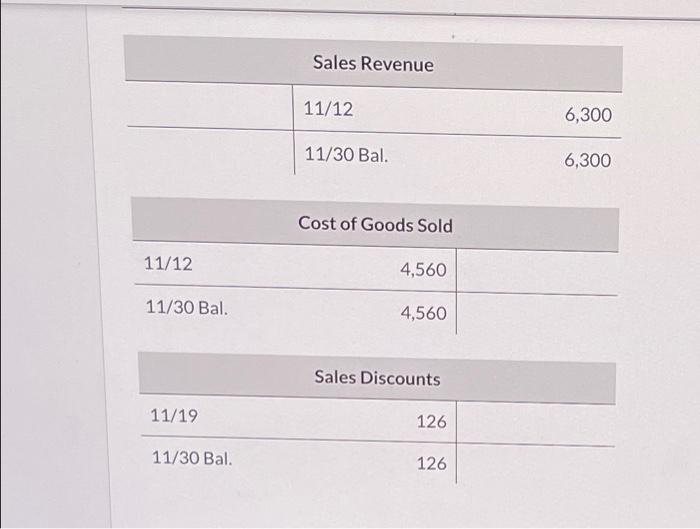

On November 1, 2022, Tamarisk, Inc. had the foilowing account balances. The compary uses the perpetual inventory method. CashAccountsReceivableSuppliesEquipmentDebit$10,2602,55498028,500$42,294AccumulatedDepreciation-EquipmentAccountsPayableUnearnedServiceRevenueSalariesandWagesPayableCommonStockRetainedEarningsCredit$1,1403,8764,5601,93822,8007,980$4,294 Nov: 8 Paid $4,047 for salaries due employees, of which $2,109 is for November and $1,938 is for October. 10 Received $2,166 cash from customers in payment of account. 11 Purchased merchandise on account from Dimas Discount Supply for $9,100, terms 2/10, n/30. 12 Sold merchandise on account for $6,300, terms 2/10,n/30. The cost of the merchandise sold was $4,560. 15 Received credit from Dimas Discount Supply for merchandise returned $300. 19 Received collections in full, less discounts, from customers billed on sales of $6,300 on November 12. 20 Paid Dimas Discount Supply in full, less discount. 22 Received $2.622 cish for services performed in November. 25 Purchased equipment on account $5,700 27 Purchased supplies on account $1.938 28 Paid creditors $3,420 of accounts payable due. 29 Paid November rent $428. 29 Paid salaries $1,482 29 Pertormed services on account and billed customers $798 for those services 29 Received $770 from customers for services to be performed in the future Adjustment data: 1. Supplies on hand are valued at $1,824. 2. Accrued salaries payable are $570. 3. Depreciation for the month is $285 4. \$741 of services related to the unearned service revenue has not been performed by month-end. Post the above adjusting entries, (Post entries in the order of journal entries presented above) \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Supplies } \\ \hline 11/1 Bal: & 980 \\ \hline 11/27 & 1,938 & \\ \hline & Equipment \\ \hline 11/1BaL & 28,500 \\ \hline 11/25 & 5,700 \\ \hline 11/30Bal. & 34,200 \\ \hline \end{tabular} Accumulated Depreciation-Equipment \begin{tabular}{|r|l|l|} \hline & & \\ \hline & & \\ \hline Accounts Payable & \\ \hline 300 & 11/1 Bal. Bal. \\ \hline 8,800 & 11/11 & 3,876 \\ \hline 3,420 & 11/25 & 9,100 \\ & 11/27 & 5.700 \\ \hline & 11/30Bal. & 1,938 \\ \hline \end{tabular} Unearned Service Revenue 11/1BaL 11/29 770 Service Revenue 11/22 2,622 11/29 798 Depreciation Expense Supplies Expense Salaries and Wages Expense 11/8 2,109 11/29 1.482 Sales Revenue \begin{tabular}{l|lr} \hline & \multicolumn{1}{|l}{ Sales Revenue } & 6,300 \\ \hline & 11/12 & 6,300 \\ & 11/30 Bal. & \\ \hline \multicolumn{2}{l|}{ Cost of Goods Sold } & \\ \hline 11/12 & 4,560 & \\ \hline 11/30Bal. & 4,560 & \\ & & \end{tabular} Sales Discounts \begin{tabular}{lr|} \hline 11/19 & 126 \\ \hline 11/30Bal. & 126 \end{tabular}