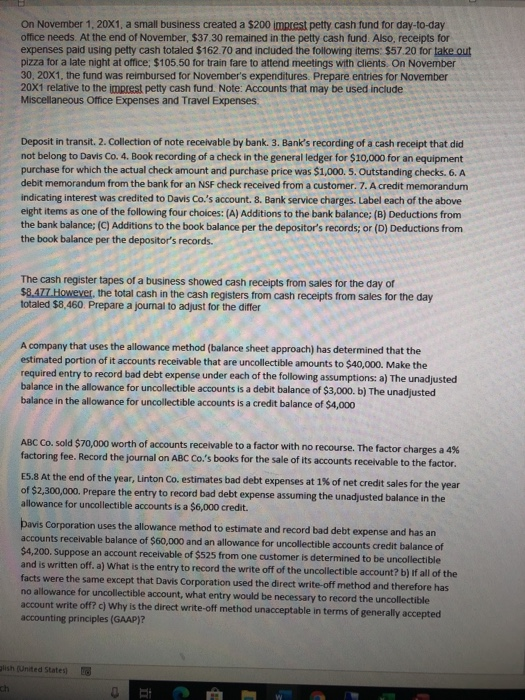

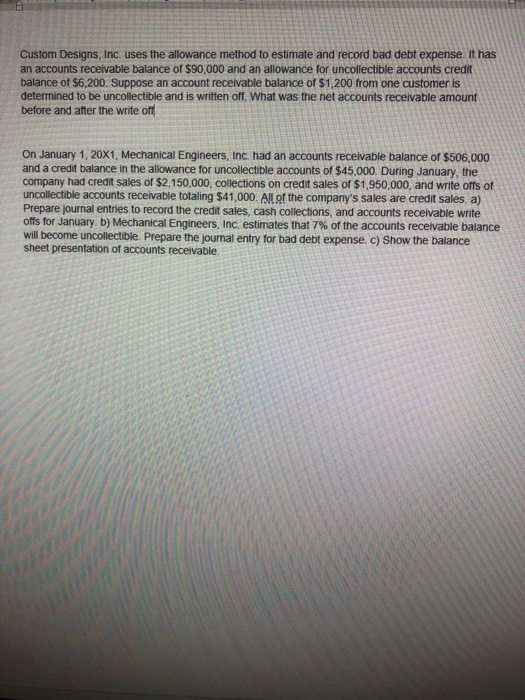

On November 1, 20X1, a small business created a $200 imprest petty cash fund for day-to-day office needs. At the end of November, $37.30 remained in the petty cash fund. Also, receipts for expenses paid using petty cash totaled $162.70 and included the following items: $57.20 for take out pizza for a late night at office: $105.50 for train fare to attend meetings with clients. On November 30, 20X1. the fund was reimbursed for November's expenditures. Prepare entries for November 20X1 relative to the imprest petty cash fund. Note: Accounts that may be used include Miscellaneous Office Expenses and Travel Expenses Deposit in transit. 2. Collection of note receivable by bank. 3. Bank's recording of a cash receipt that did not belong to Davis Co. 4. Book recording of a check in the general ledger for $10,000 for an equipment purchase for which the actual check amount and purchase price was $1,000. 5. Outstanding checks. 6. A debit memorandum from the bank for an NSF check received from a customer. 7. A credit memorandum indicating interest was credited to Davis Co.'s account. 8. Bank service charges. Label each of the above eight items as one of the following four choices: (A) Additions to the bank balance; (B) Deductions from the bank balance; (C) Additions to the book balance per the depositor's records; or (D) Deductions from the book balance per the depositor's records. The cash register tapes of a business showed cash receipts from sales for the day of $8.477. However, the total cash in the cash registers from cash receipts from sales for the day totaled $8,460. Prepare a journal to adjust for the differ A company that uses the allowance method (balance sheet approach) has determined that the estimated portion of it accounts receivable that are uncollectible amounts to $40,000. Make the required entry to record bad debt expense under each of the following assumptions: a) The unadjusted balance in the allowance for uncollectible accounts is a debit balance of $3,000. b) The unadjusted balance in the allowance for uncollectible accounts is a credit balance of $4,000 ABC Co. sold $70,000 worth of accounts receivable to a factor with no recourse. The factor charges a 4% factoring fee. Record the journal on ABC Co.'s books for the sale of its accounts receivable to the factor. E5.8 At the end of the year, Linton Co. estimates bad debt expenses at 1% of net credit sales for the year of $2,300,000. Prepare the entry to record bad debt expense assuming the unadjusted balance in the allowance for uncollectible accounts is a $6,000 credit Davis Corporation uses the allowance method to estimate and record bad debt expense and has an accounts receivable balance of $60,000 and an allowance for uncollectible accounts credit balance of $4,200. Suppose an account receivable of $525 from one customer is determined to be uncollectible and is written off. a) What is the entry to record the write off of the uncollectible account? b) if all of the facts were the same except that Davis Corporation used the direct write-off method and therefore has no allowance for uncollectible account, what entry would be necessary to record the uncollectible account write off? c) Why is the direct write-off method unacceptable in terms of generally accepted accounting principles (GAAP)? ish (United States Lo Custom Designs, Inc uses the allowance method to estimate and record bad debt expense. It has an accounts receivable balance of $90,000 and an allowance for uncollectible accounts credit balance of $6,200. Suppose an account receivable balance of $1,200 from one customer is determined to be uncollectible and is written off. What was the net accounts receivable amount before and after the write off On January 1, 20x1, Mechanical Engineers, Inc. had an accounts receivable balance of $506,000 and a credit balance in the allowance for uncollectible accounts of $45,000. During January, the company had credit sales of $2,150,000, collections on credit sales of $1,950,000, and write offs of uncollectible accounts receivable totaling $41,000. All of the company's sales are credit sales. a) Prepare journal entries to record the credit sales, cash collections, and accounts receivable write offs for January. b) Mechanical Engineers, Inc. estimates that 7% of the accounts receivable balance will become uncollectible. Prepare the journal entry for bad debt expense. c) Show the balance sheet presentation of accounts receivable