Answered step by step

Verified Expert Solution

Question

1 Approved Answer

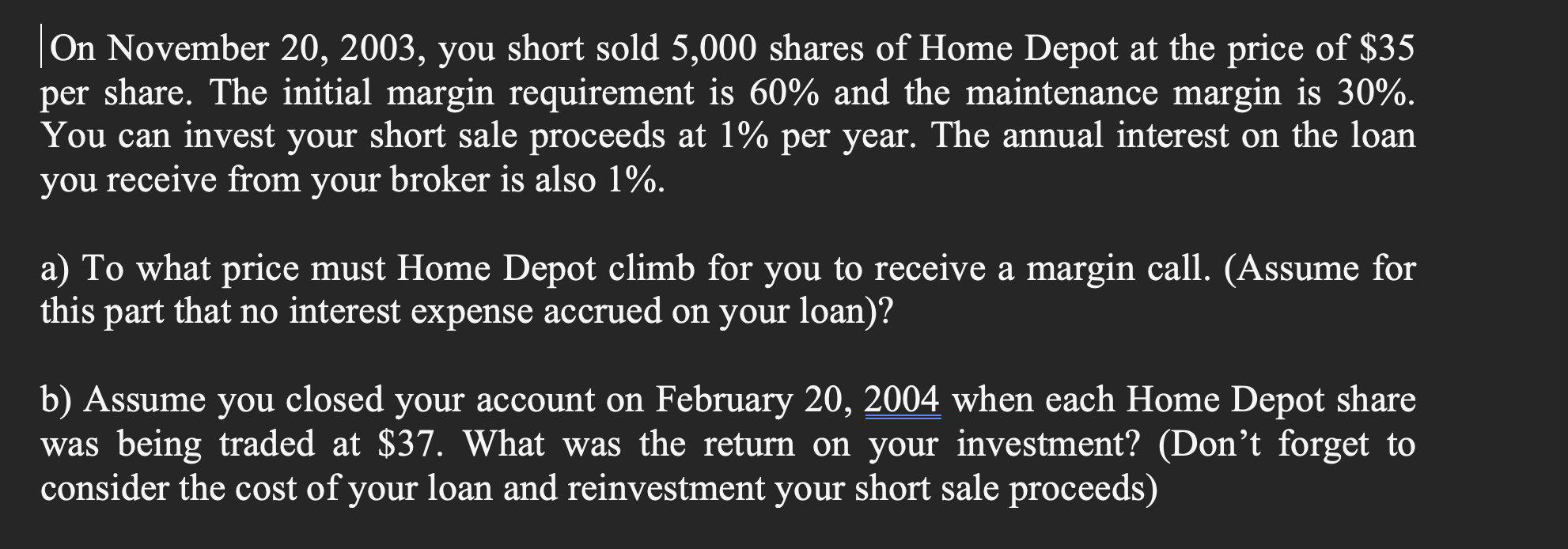

On November 2 0 , 2 0 0 3 , you short sold 5 , 0 0 0 shares of Home Depot at the price

On November you short sold shares of Home Depot at the price of $

per share. The initial margin requirement is and the maintenance margin is

You can invest your short sale proceeds at per year. The annual interest on the loan

you receive from your broker is also

a To what price must Home Depot climb for you to receive a margin call. Assume for

this part that no interest expense accrued on your loan

b Assume you closed your account on February when each Home Depot share

was being traded at $ What was the return on your investment? Dont forget to

consider the cost of your loan and reinvestment your short sale proceeds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started