Answered step by step

Verified Expert Solution

Question

1 Approved Answer

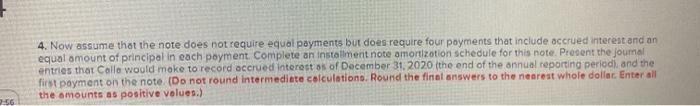

On November 30,2020, calla resources ltd. borrowed 230,000 from a bank by sjgning a four year installment note bearing interest at 6%. the terms lf

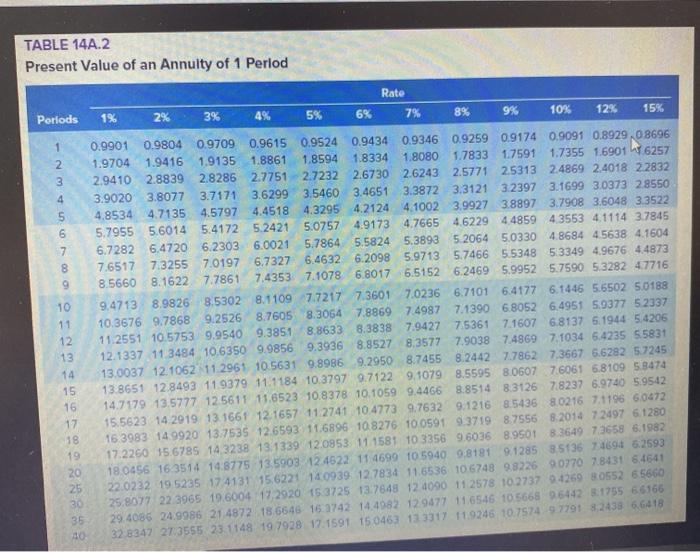

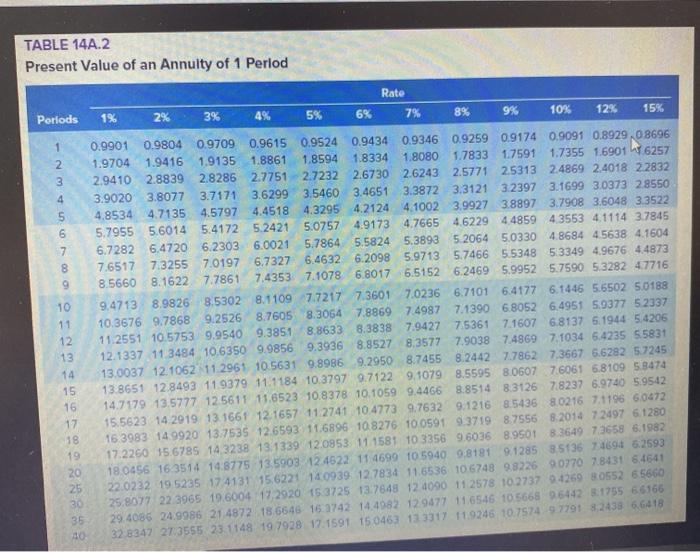

On November 30,2020, calla resources ltd. borrowed 230,000 from a bank by sjgning a four year installment note bearing interest at 6%. the terms lf the note require equal payments each year on November 30, starting November 30,2021 use the table below

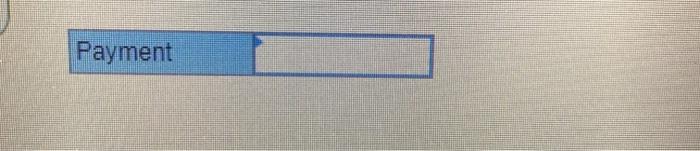

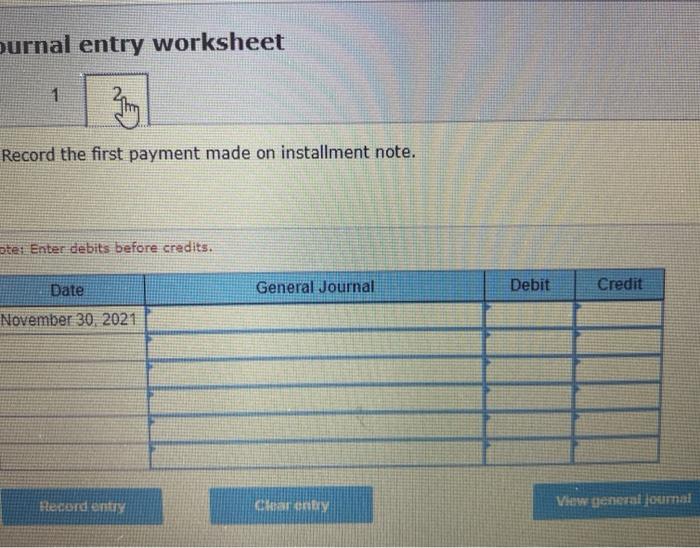

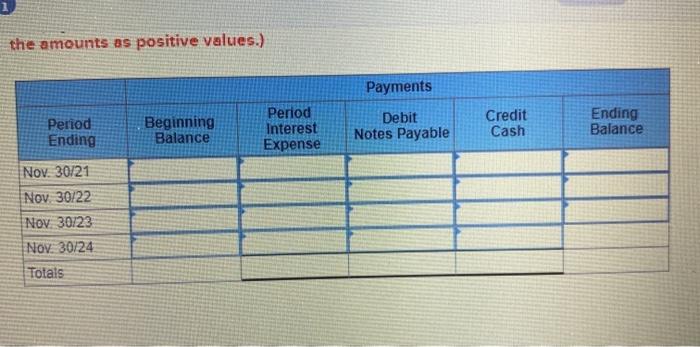

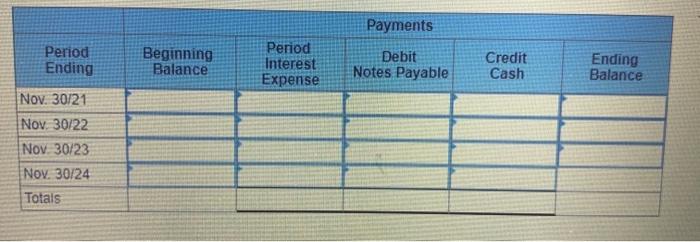

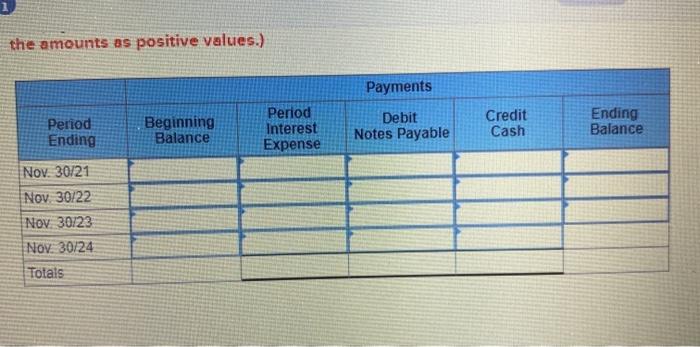

TABLE 14A.2 Present Value of an Annuity of 1 Period Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 25 30 35 Rate 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929,08696 1.9704 1.9416 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.7591 1.7355 1.6901 W 6257 2.9410 2.8839 2.8285 2.7751 2.7232 2.6730 2.6243 2.5771 25313 2.4869 2.4018 22832 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 3.0373 28550 4.8534 4.7135 4.5797 4.4518 4.3295 4.2124 4 1002 3.9927 38897 3.7908 3.6048 3.3522 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 4.62294485943553 4.1114 3.7845 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 5.03304.8684 45638 4.1604 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.5348 53349 4.9676 4.4873 8.5660 8.1622 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 5.9952 5.7590 5.3282 47716 9.4713 8.9826 8.5302 8.11097.7217 7.3601 7.0236 6.7101 6.4177 6.1446 5.6502 5.0188 10.3676 9.7868 9.2526 8.7605 8.3064 7.8869 7.4987 7.1390 6.805264951 5.9377 52337 11.2551 10.5753 9.9540 9.3851 8.8633 8.3838 7.9427 7.5361 7.1607 6.8137 6.1944 5.4206 12.1337 11 3484 10.6350 9.9856 9.3936 8.8527 8,3577 7.9038 7.4869 7.1034 5.4235 5.5831 13.0037 12 1062 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.78627.3667 6.6282 5.7245 13.865112.8493 119379 11.1184 10.37979.7122 9.1079 8.5595 8.0607 7.6061 6.8109 5.8474 14.7179 13.5777 12 5611 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237 6.9740 5.9542 15.5623 14 2919 13.166 12.1657 112741 10 4773 9.7632 9.1216 8.5436 8.0216 7.119660472 163983 14.9920 13.7535 12.6593 11.6896 108276 10.05919.3719 8.7556 8.2014 72497 6.1280 17.2260 15.6785 14 3238 13.1339 120953 111581 10 3356 9.6036 8.9501 83649 73658 6.1982 180456 16 3514 14.8775 13590312 4622 11 4699 1059409,8181 91285 3.513674694 6.2593 22.0232 19 5235 17 4131 15.6221 14.0939 12.7834 11.6536 10 674898226 90770 7.8431 64641 25.8077 22 3965 19.6004 17.2920 15 3725 13.7648 12 4090 11 2578 10 273794269 30552 65660 29.4086 24.9986 214872 18,6648 16 3742 14.4982 129477 11,6546105668 96442 3.1755 66166 32 8347 27:3555 23. 1148 19.7928 17.1591 150463 123317 11.9246 10.7574 97791 3.2438 6.6418 30 Payment Payments Period Ending Beginning Balance Period Interest Expense Debit Notes Payable Credit Cash Ending Balance Nov. 30/21 Nov. 30/22 Nov. 30/23 Nov. 30/24 Totals ournal entry worksheet 1 Record the first payment made on installment note. ote: Enter debits before credits. Date General Journal Debit Credit November 30, 2021 Hecord entry Chareny View general journal the amounts as positive values.) Payments Period Ending Beginning Balance Period Interest Expense Debit Notes Payable Credit Cash Ending Balance Nov. 30/21 Nov 30/22 Nov. 30/23 Nov. 30/24 Totats

Calculate the size of wach installment payment

Complete an installment note amortization schedule for this note

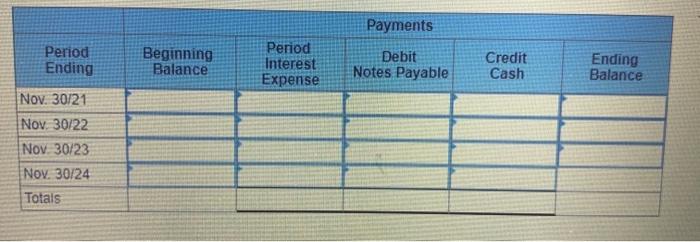

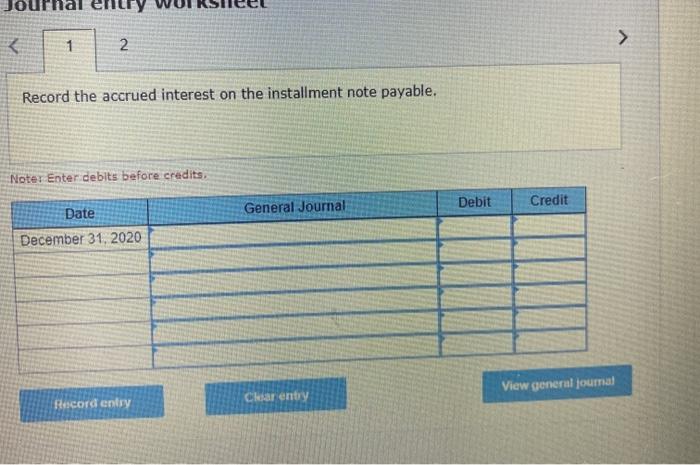

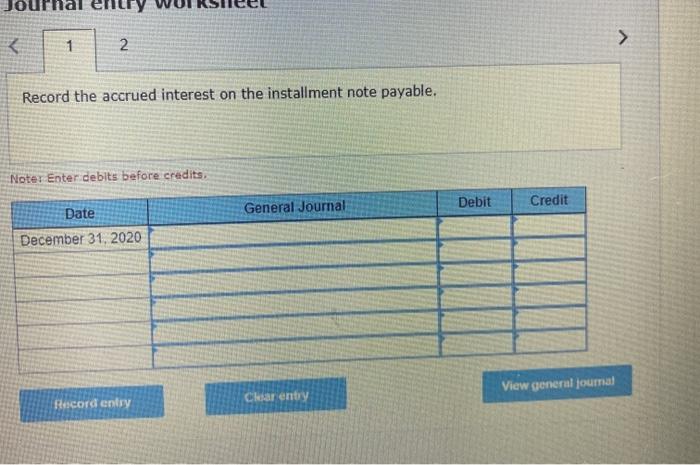

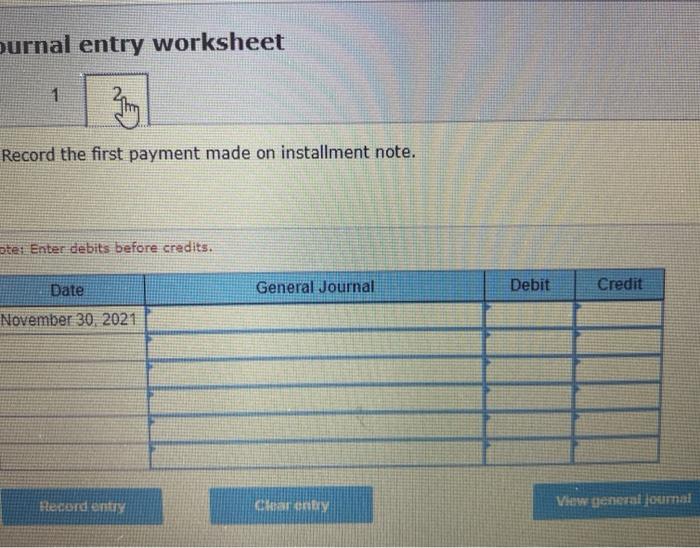

Present journal entries to record accrued interest as at December 31,2020 the end of the annual reporting period and the first payment on the note

Answer the following question:

A)Record the accrued interest on the installment note payable

B) Record the first payment made on installment note

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started