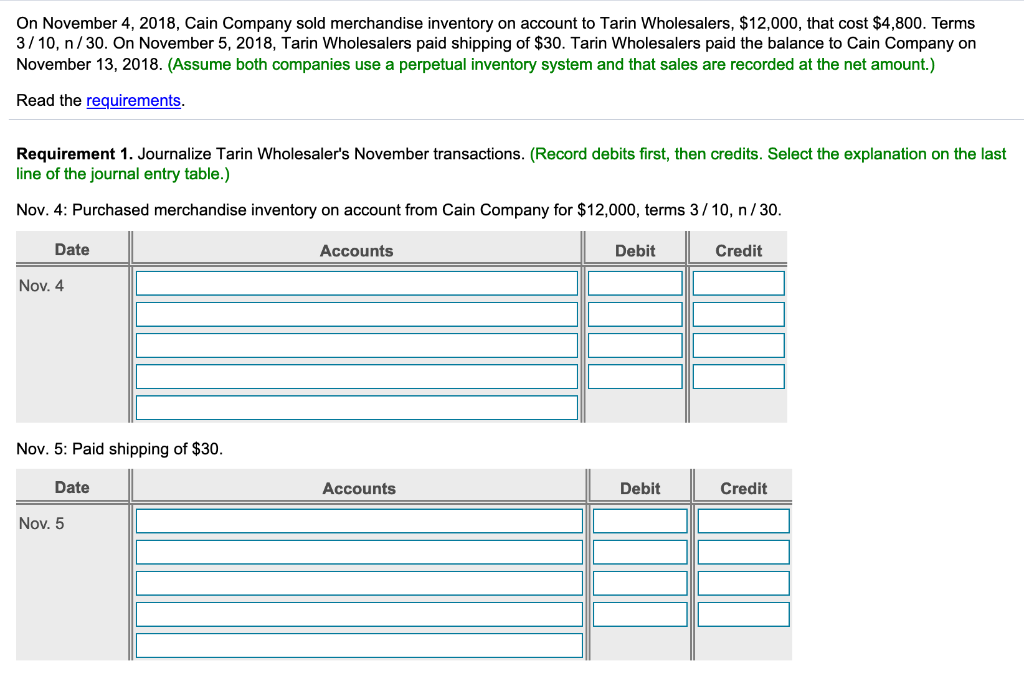

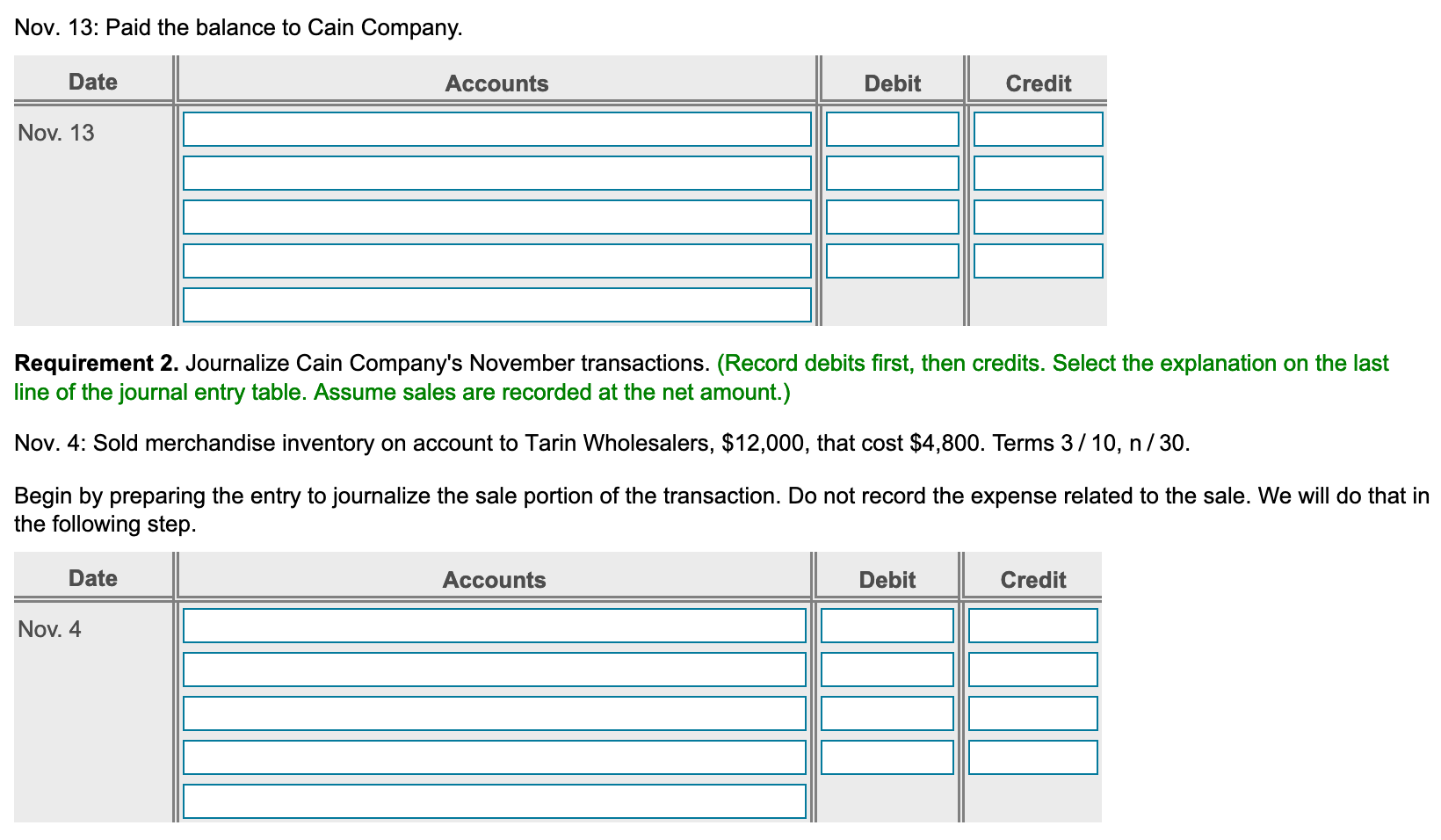

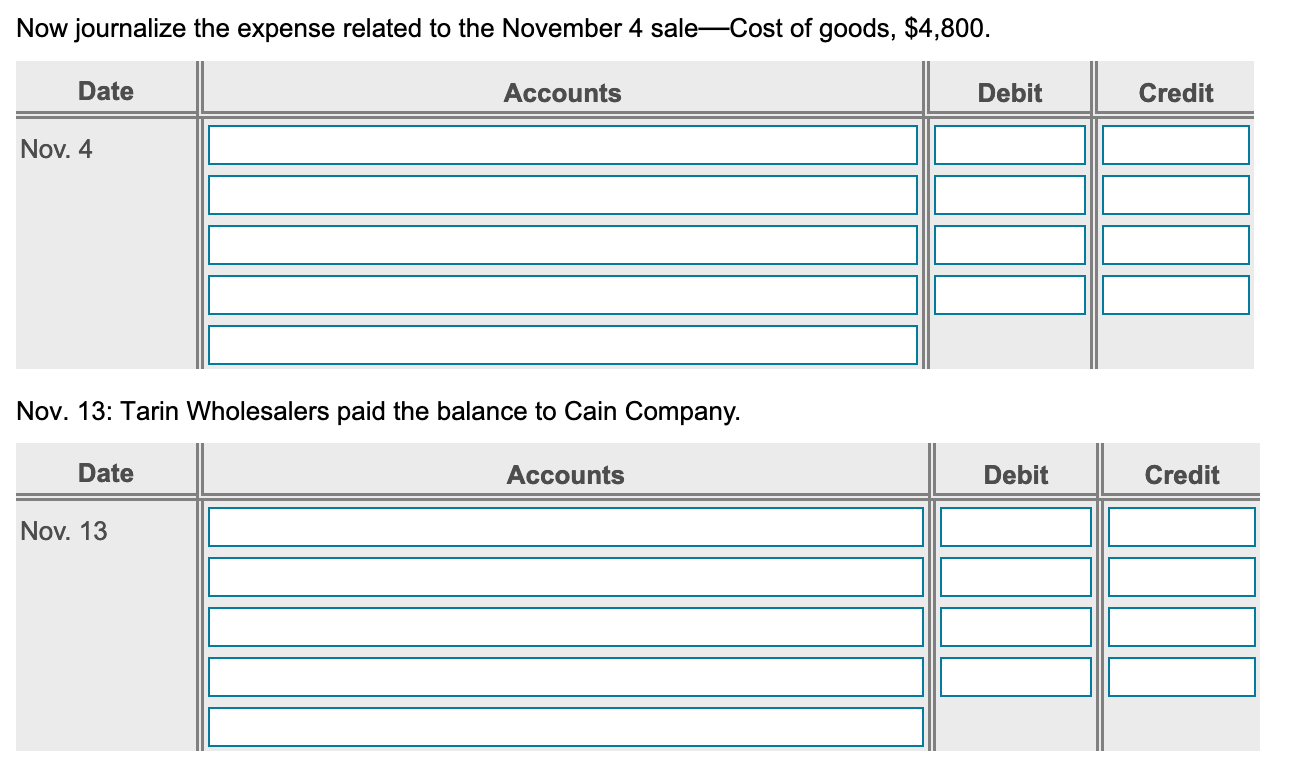

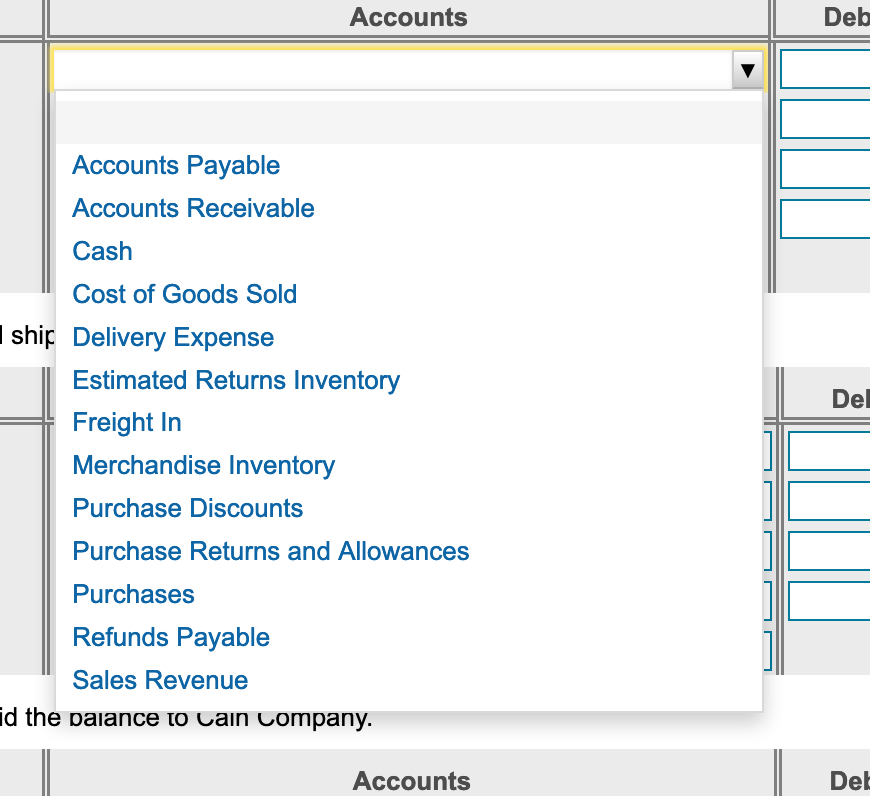

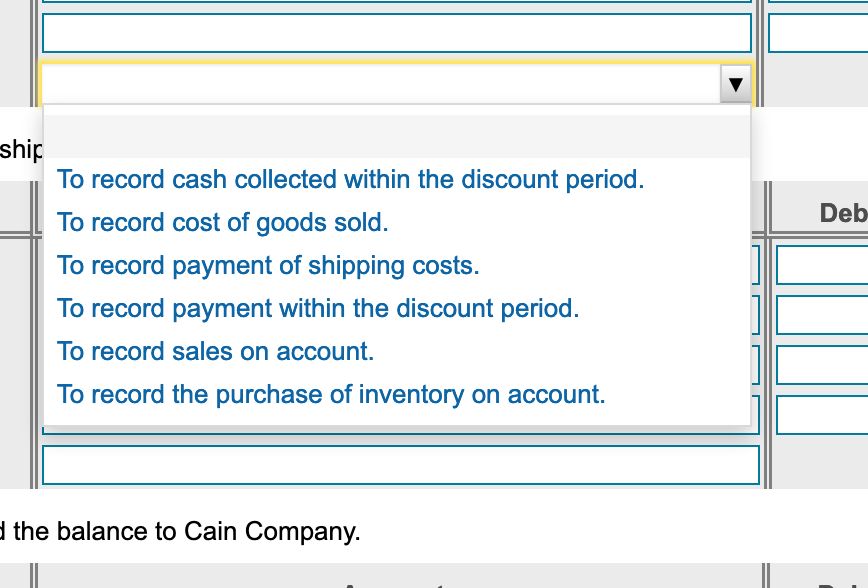

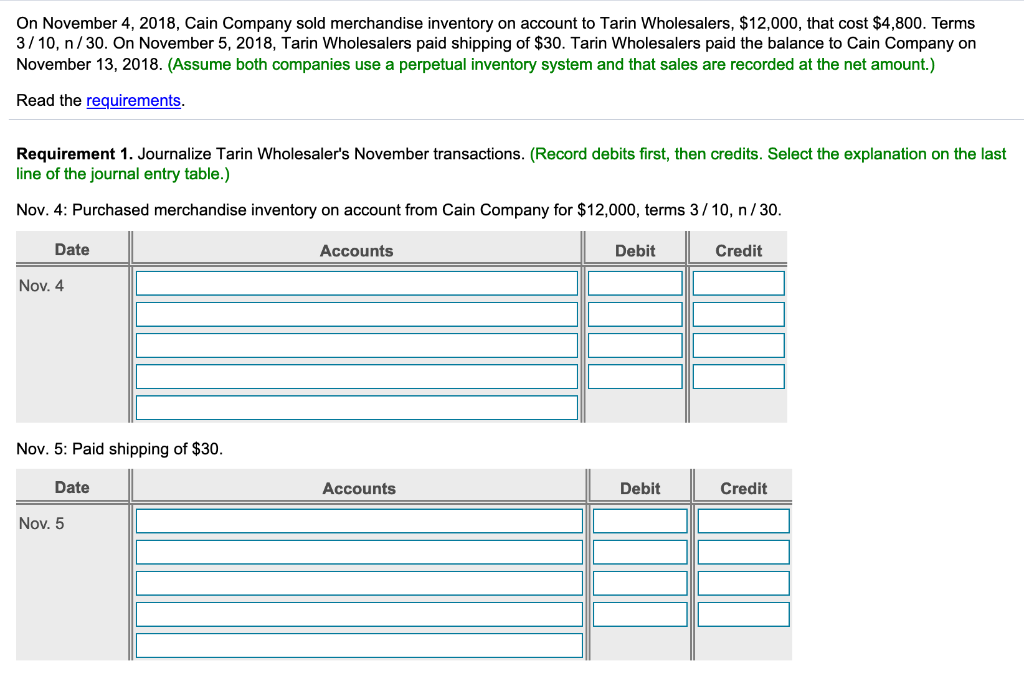

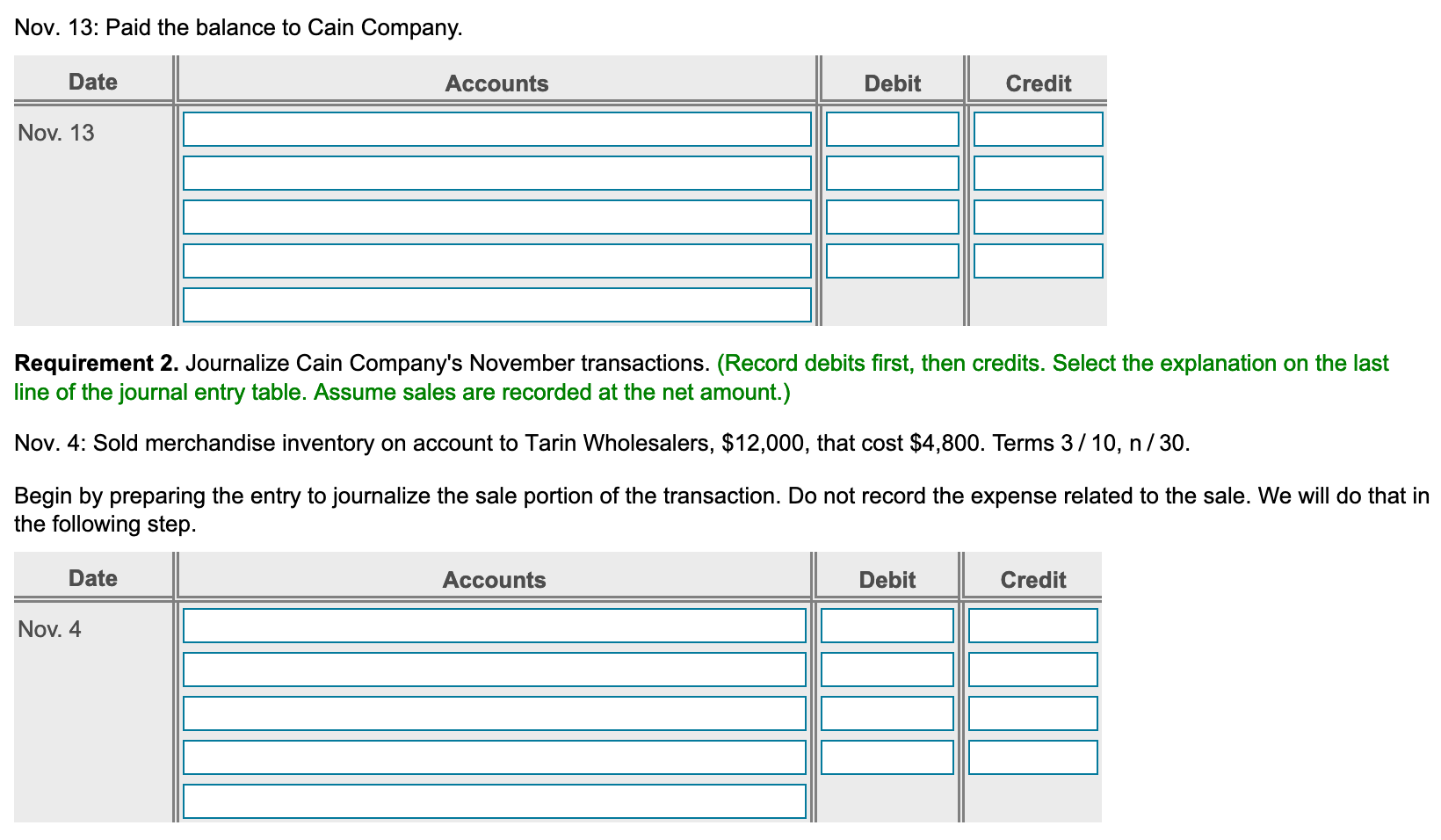

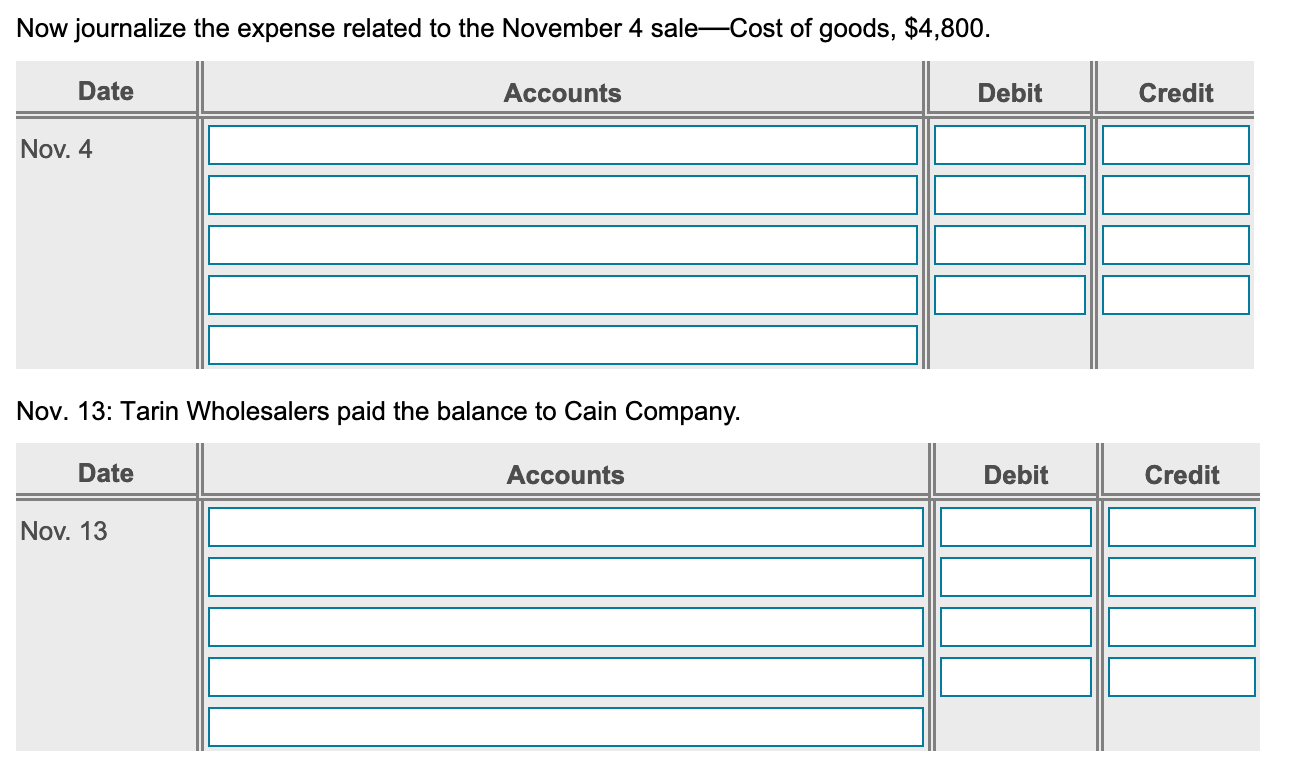

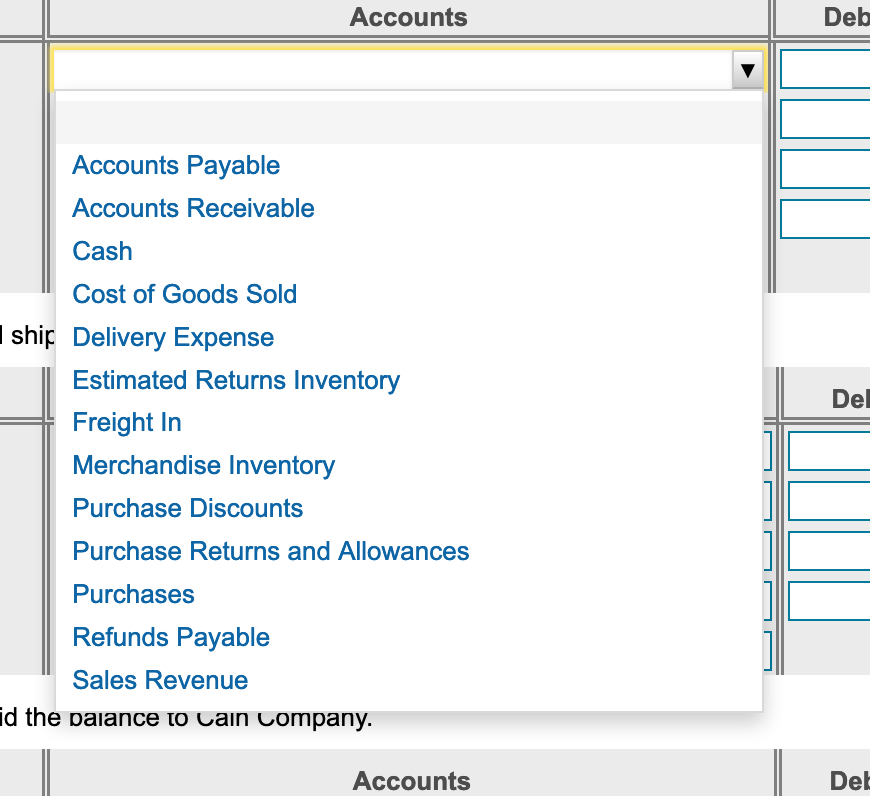

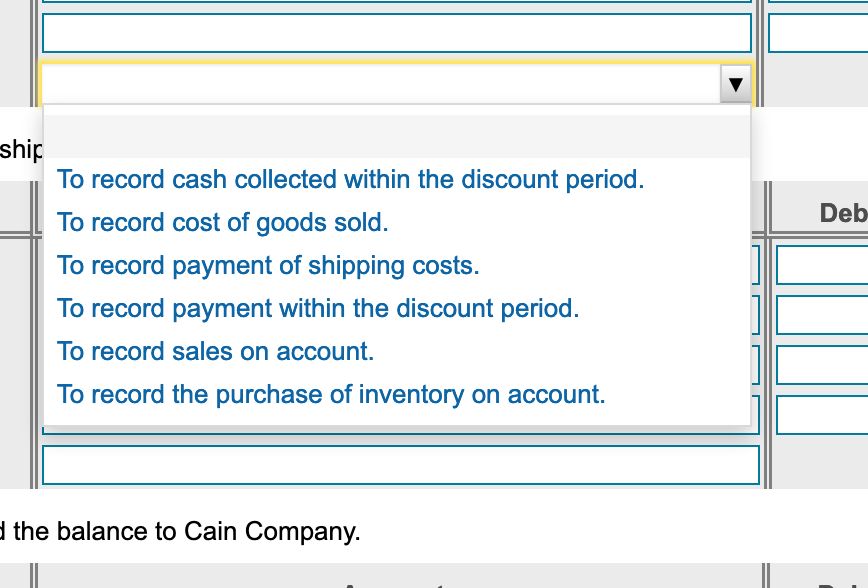

On November 4, 2018, Cain Company sold merchandise inventory on account to Tarin Wholesalers, $12,000, that cost $4,800. Terms 3/10, n/30. On November 5, 2018, Tarin Wholesalers paid shipping of $30. Tarin Wholesalers paid the balance to Cain Company on November 13, 2018. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.) Read the requirements. Requirement 1. Journalize Tarin Wholesaler's November transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Nov. 4: Purchased merchandise inventory on account from Cain Company for $12,000, terms 3/10, n/30. Date Accounts Debit Credit Nov. 4 Nov. 5: Paid shipping of $30. Date Accounts Debit Credit Nov. 5 Nov. 13: Paid the balance to Cain Company. Date Accounts Debit Credit Nov. 13 Requirement 2. Journalize Cain Company's November transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Assume sales are recorded at the net amount.) Nov. 4: Sold merchandise inventory on account to Tarin Wholesalers, $12,000, that cost $4,800. Terms 3/10, n/30. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit Nov. 4 Now journalize the expense related to the November 4 saleCost of goods, $4,800. Date Accounts Debit Credit Nov. 4 Nov. 13: Tarin Wholesalers paid the balance to Cain Company. Date Accounts Debit Credit Nov. 13 Accounts Deb Del Accounts Payable Accounts Receivable Cash Cost of Goods Sold ship Delivery Expense Estimated Returns Inventory Freight In Merchandise Inventory Purchase Discounts Purchase Returns and Allowances Purchases Refunds Payable Sales Revenue id the palance to Lain company. Accounts Del ship Deb To record cash collected within the discount period. To record cost of goods sold. To record payment of shipping costs. To record payment within the discount period. To record sales on account. To record the purchase of inventory on account. the balance to Cain Company