Answered step by step

Verified Expert Solution

Question

1 Approved Answer

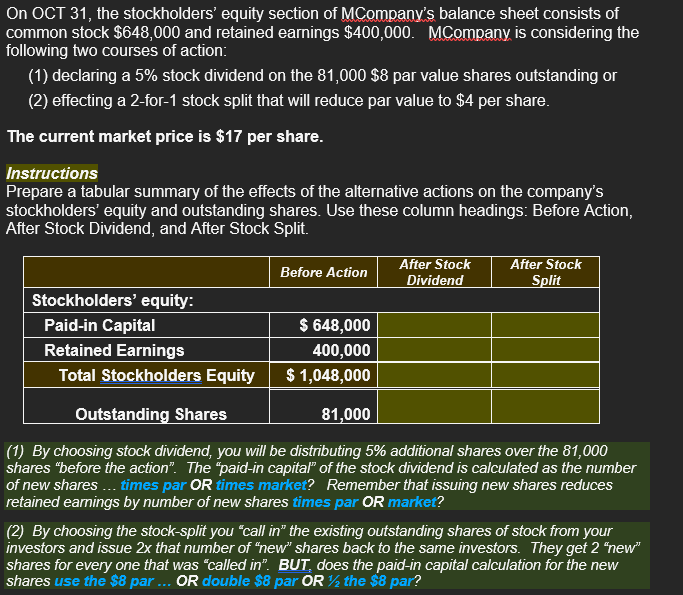

On OCT 3 1 , the stockholders' equity section of MCompany's balance sheet consists of common stock $ 6 4 8 , 0 0 0

On OCT the stockholders' equity section of MCompany's balance sheet consists of common stock $ and retained earnings $ MCompany is considering the following two courses of action:

declaring a stock dividend on the $ par value shares outstanding or

effecting a for stock split that will reduce par value to $ per share.

The current market price is $ per share.

Instructions

Prepare a tabular summary of the effects of the alternative actions on the company's stockholders' equity and outstanding shares. Use these column headings: Before Action, After Stock Dividend, and After Stock Split.

tableBefore Action,tableAfter StockDividendtableAfter StockSplitStockholders equity:Paidin Capital,$Retained Earnings,Total Stockholders Equity,$Outstanding Shares,

By choosing stock dividend, you will be distributing additional shares over the shares "before the action". The "paidin capital" of the stock dividend is calculated as the number of new shares times par OR times market? Remember that issuing new shares reduces retained eamings by number of new shares times par OR market?

By choosing the stocksplit you "call in the existing outstanding shares of stock from your investors and issue that number of "new" shares back to the same investors. They get "new" shares for every one that was "called in BUT, does the paidin capital calculation for the new shares use the $ par OR double $ par OR the $ par?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started