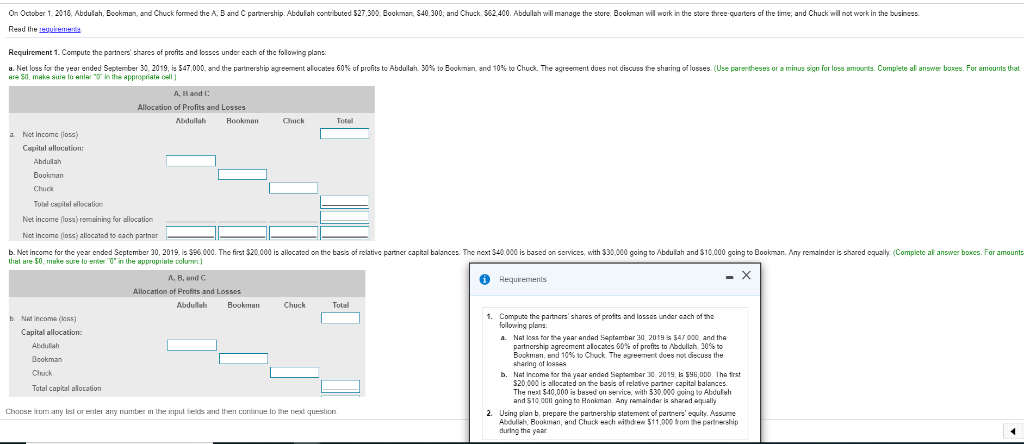

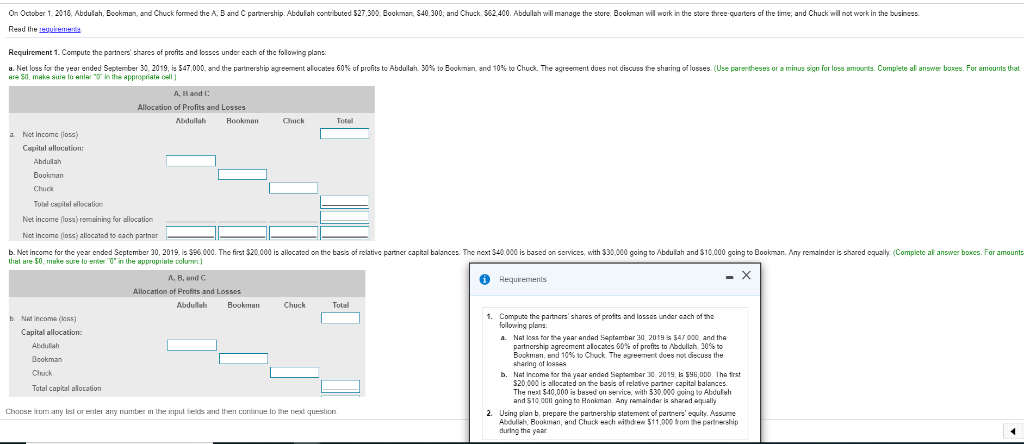

On Octobar 1, 2018, Abdulah, Ecokman, and Chuck formed the A, B and C partnership. Abdulah contr buted $27,300 Boakman, 540,300; and Chuck, $62 400. Abdulah will manage the stare, Bookman will work in the store three-quarters of the time; and Chuckwilnat work in the business Read the ouirmer Requirement 1. Compute the partners' chares of profits and eases under cach of the following plans a. Net loss or heyear ended bem er 3 2019 is $47,000. a d ie par nership agre ar sa, make sure to enter-0" in the appropriata oall ] en aloca es 60% of profits o Abdulah 30% to Book s and 10% o Chu The agreer en does not d'acuss tahan o osses Use pare eses or a minus 5 n or oss emorts Comp ete al answer boxes. For amounts that A, B and Allocation of Profits and Losses Abdullah Bookman Net income(loss Capitul allocution . Tolel capilsl allocalion Net income los) remaining for allocation Net Incoma (loss) alccatad to cach partnar b. Net income for the year ended September 30, 2019 s S 6 000. The fir S20 000 is allocated on the bas s o relat e par er caph balances. The next S40 000 s based on se ces, with $30.000 going to Abdulah and $10.000 gang o Boo man. M r remainder is shared equal (Complete al answer bo es. For amount A, B, and Allocation of Profits and Losscs AbdulahBookman Chuck Total 1. Compute the partners shares of protts and losses undar cach of the ollowing plans a. Nat loass tor the yaar andad Septamhar b Nat incoma (loss) Capital allocation 2 547000 and tha partnership agreement locates 00% of profits to Abdullah 30% to Bookrnwn. tnd 10% to Chuck The sgro,ment does not discuss lhe sharing lcokman Clack Total capital alocation b. Nat incoma for tha yaar endad Saptabar 30 201s, $96,00DD Tha firat 520,000 is allocated on the basis of relive partner capital balances The neat $40,000 is based on servive, with 530,000 ging to Abdulah and S10 don going to Honkman Any ram aindark shared y Chouse iri any lst or enle any numbes in the rput felts and then cenbne Io he next quesben 2. Using plan b, prepare the partnership statement of parthers' equity. Aasume Abdullsh, Bookman, and Chuck c wihdew 511,000 om the pathership during the yar On Octobar 1, 2018, Abdulah, Ecokman, and Chuck formed the A, B and C partnership. Abdulah contr buted $27,300 Boakman, 540,300; and Chuck, $62 400. Abdulah will manage the stare, Bookman will work in the store three-quarters of the time; and Chuckwilnat work in the business Read the ouirmer Requirement 1. Compute the partners' chares of profits and eases under cach of the following plans a. Net loss or heyear ended bem er 3 2019 is $47,000. a d ie par nership agre ar sa, make sure to enter-0" in the appropriata oall ] en aloca es 60% of profits o Abdulah 30% to Book s and 10% o Chu The agreer en does not d'acuss tahan o osses Use pare eses or a minus 5 n or oss emorts Comp ete al answer boxes. For amounts that A, B and Allocation of Profits and Losses Abdullah Bookman Net income(loss Capitul allocution . Tolel capilsl allocalion Net income los) remaining for allocation Net Incoma (loss) alccatad to cach partnar b. Net income for the year ended September 30, 2019 s S 6 000. The fir S20 000 is allocated on the bas s o relat e par er caph balances. The next S40 000 s based on se ces, with $30.000 going to Abdulah and $10.000 gang o Boo man. M r remainder is shared equal (Complete al answer bo es. For amount A, B, and Allocation of Profits and Losscs AbdulahBookman Chuck Total 1. Compute the partners shares of protts and losses undar cach of the ollowing plans a. Nat loass tor the yaar andad Septamhar b Nat incoma (loss) Capital allocation 2 547000 and tha partnership agreement locates 00% of profits to Abdullah 30% to Bookrnwn. tnd 10% to Chuck The sgro,ment does not discuss lhe sharing lcokman Clack Total capital alocation b. Nat incoma for tha yaar endad Saptabar 30 201s, $96,00DD Tha firat 520,000 is allocated on the basis of relive partner capital balances The neat $40,000 is based on servive, with 530,000 ging to Abdulah and S10 don going to Honkman Any ram aindark shared y Chouse iri any lst or enle any numbes in the rput felts and then cenbne Io he next quesben 2. Using plan b, prepare the partnership statement of parthers' equity. Aasume Abdullsh, Bookman, and Chuck c wihdew 511,000 om the pathership during the yar