Answered step by step

Verified Expert Solution

Question

1 Approved Answer

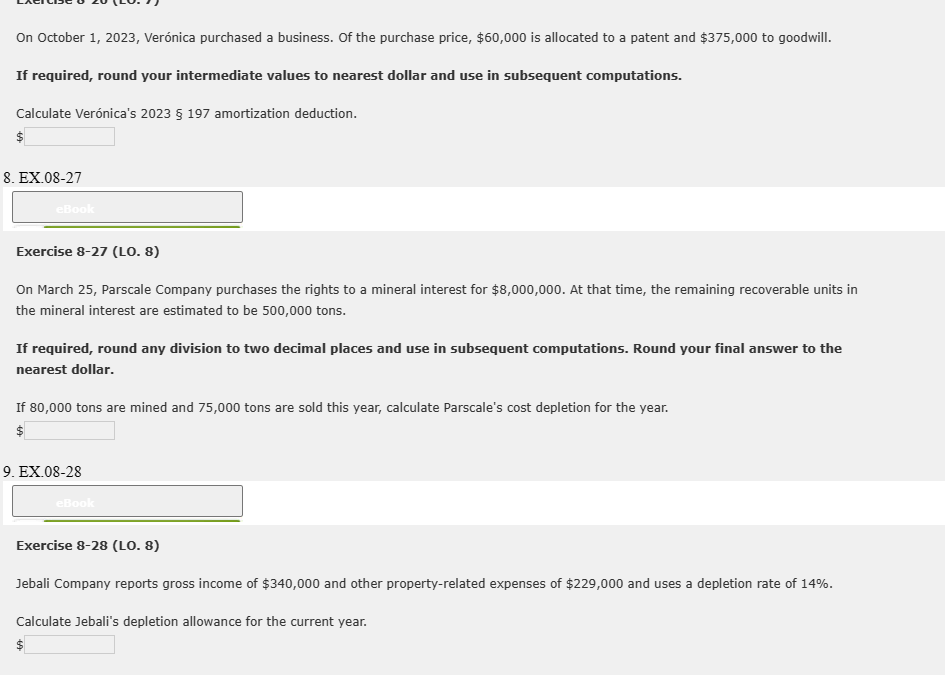

On October 1 , 2 0 2 3 , Ver nica purchased a business. Of the purchase price, $ 6 0 , 0 0 0

On October Vernica purchased a business. Of the purchase price, $ is allocated to a patent and $ to goodwill.

If required, round your intermediate values to nearest dollar and use in subsequent computations.

Calculate Vernicas amortization deduction.

$

EX

Exercise L

On March Parscale Company purchases the rights to a mineral interest for $ At that time, the remaining recoverable units in

the mineral interest are estimated to be tons.

If required, round any division to two decimal places and use in subsequent computations. Round your final answer to the

nearest dollar.

If tons are mined and tons are sold this year, calculate Parscale's cost depletion for the year.

EX

Exercise LO

Jebali Company reports gross income of $ and other propertyrelated expenses of $ and uses a depletion rate of

Calculate Jebali's depletion allowance for the current year.

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started