Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 1, 2009, A Ltd. acquired 80 per cent of B Ltd.'s issued voting shares for $5,800,000. The investment was accounted for on

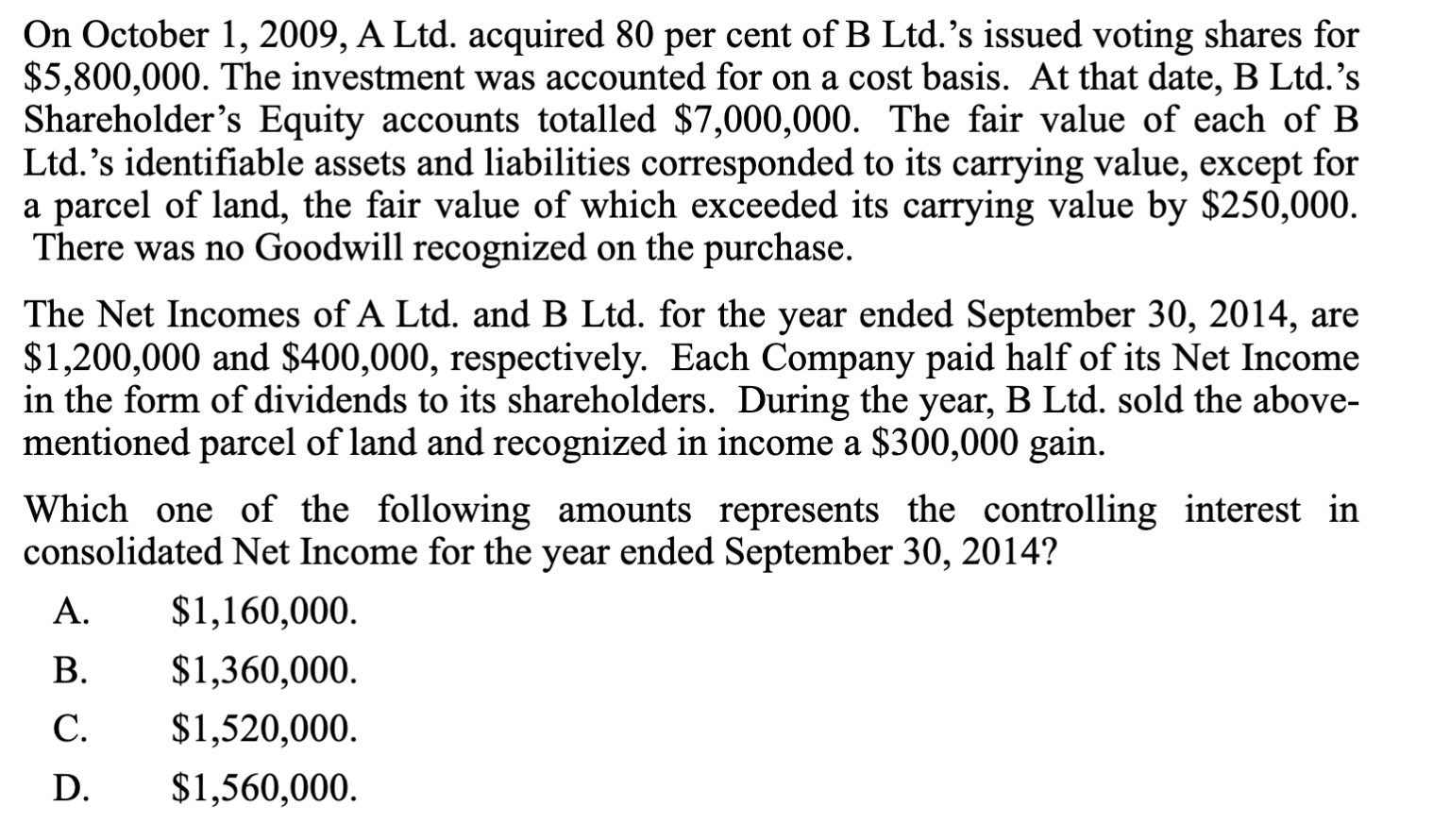

On October 1, 2009, A Ltd. acquired 80 per cent of B Ltd.'s issued voting shares for $5,800,000. The investment was accounted for on a cost basis. At that date, B Ltd.'s Shareholder's Equity accounts totalled $7,000,000. The fair value of each of B Ltd.'s identifiable assets and liabilities corresponded to its carrying value, except for a parcel of land, the fair value of which exceeded its carrying value by $250,000. There was no Goodwill recognized on the purchase. The Net Incomes of A Ltd. and B Ltd. for the year ended September 30, 2014, are $1,200,000 and $400,000, respectively. Each Company paid half of its Net Income in the form of dividends to its shareholders. During the year, B Ltd. sold the above- mentioned parcel of land and recognized in income a $300,000 gain. Which one of the following amounts represents the controlling interest in consolidated Net Income for the year ended September 30, 2014? A. $1,160,000. B. $1,360,000. C. $1,520,000. D. $1,560,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the controlling interest in consolidated net income for the year ended September 30 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started