Question

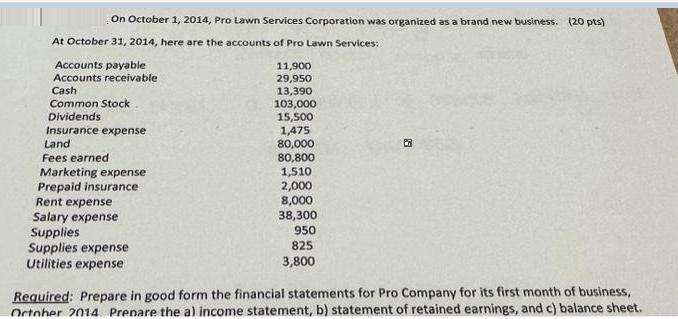

On October 1, 2014, Pro Lawn Services Corporation was organized as a brand new business. (20 pts) At October 31, 2014, here are the

On October 1, 2014, Pro Lawn Services Corporation was organized as a brand new business. (20 pts) At October 31, 2014, here are the accounts of Pro Lawn Services: Accounts payable Accounts receivable Cash Common Stock Dividends Insurance expense Land Fees earned Marketing expense Prepaid insurance Rent expense Salary expense Supplies Supplies expense Utilities expense 11,900 29,950 13,390 103,000 15,500 1,475 80,000 80,800 1,510 2,000 8,000 38,300 950 825 3,800 1.6 Required: Prepare in good form the financial statements for Pro Company for its first month of business, October 2014 Prenare the a) income statement, b) statement of retained earnings, and c) balance sheet.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Walter Harrison, Charles Horngren, William Thomas

10th edition

133796833, 133427536, 9780133796834, 978-0133427530

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App