Question

On October 1, 2018, the Allegheny Corporation purchased machinery for $278,000. The estimated service life of the machinery is 10 years and the estimated residual

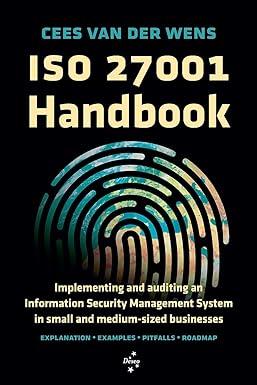

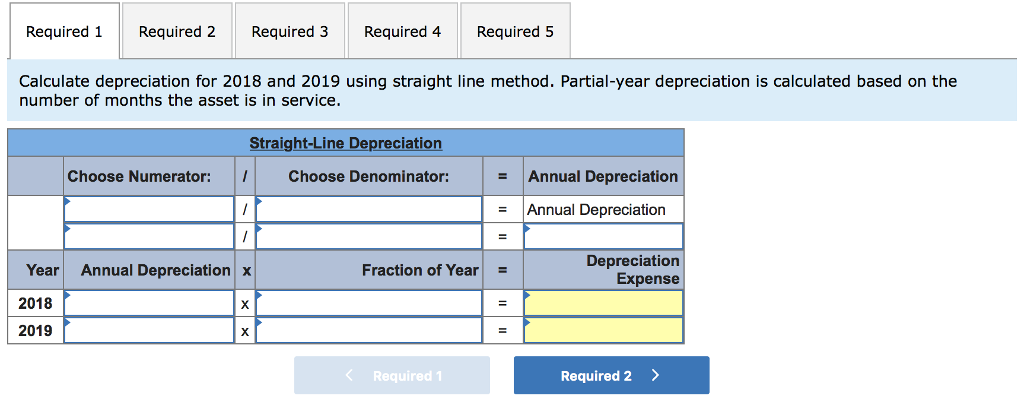

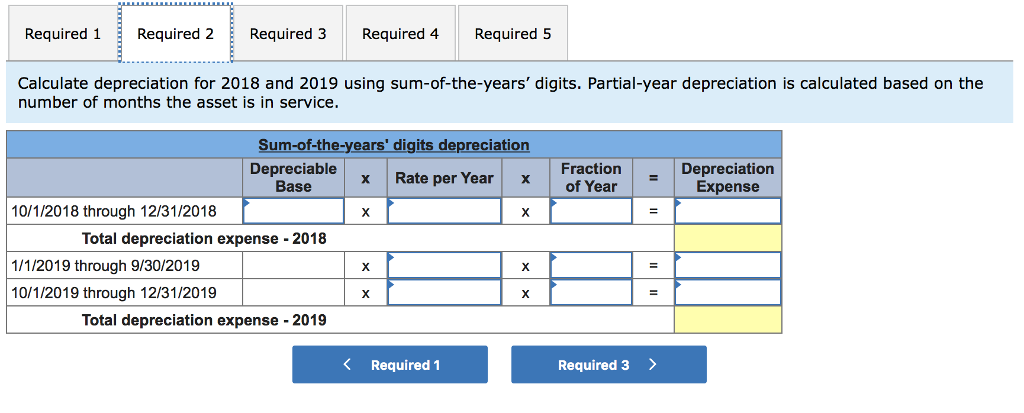

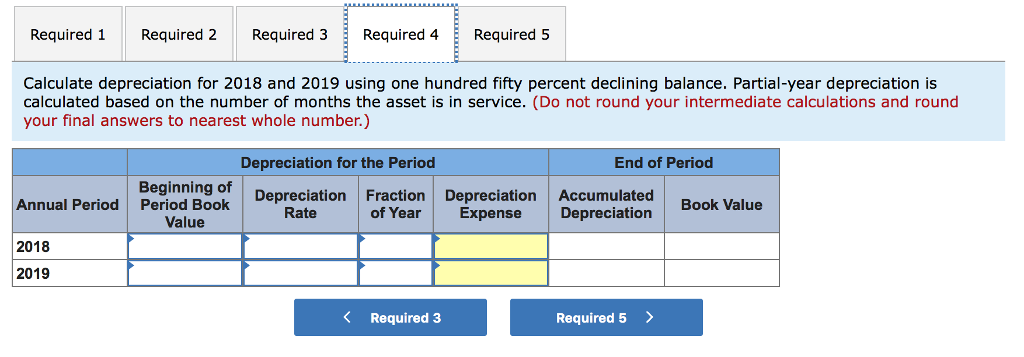

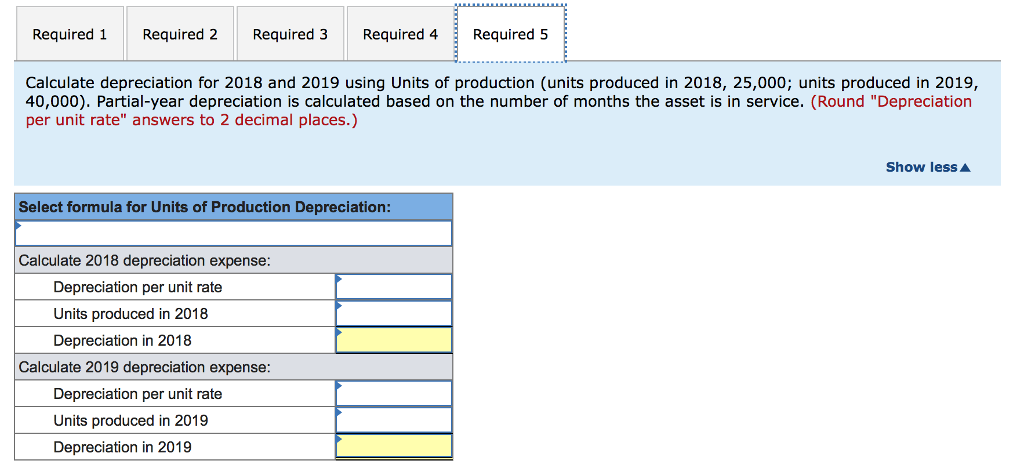

On October 1, 2018, the Allegheny Corporation purchased machinery for $278,000. The estimated service life of the machinery is 10 years and the estimated residual value is $3,000. The machine is expected to produce 550,000 units during its life. Required: Calculate depreciation for 2018 and 2019 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. 1. Straight line. 2. Sum-of-the-years-digits. 3. Double-declining balance. 4. One hundred fifty percent declining balance. 5. Units of production (units produced in 2018, 25,000; units produced in 2019, 40,000).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started