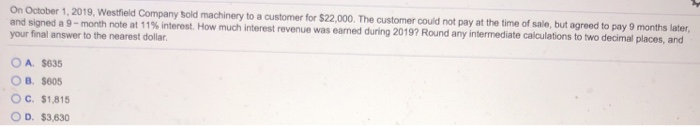

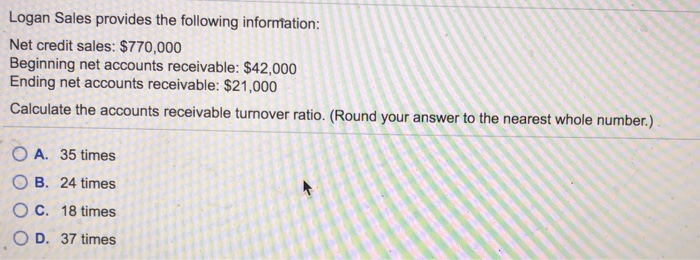

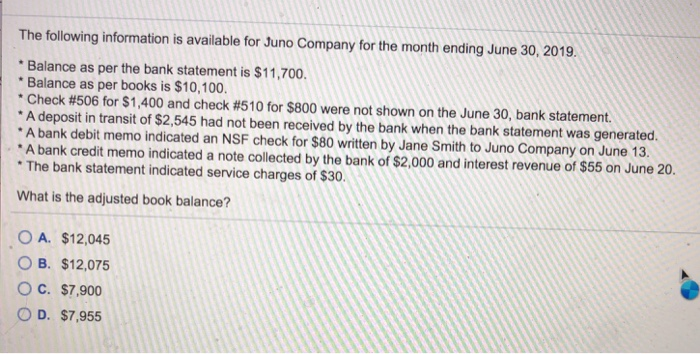

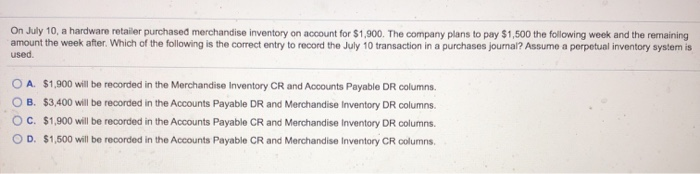

On October 1, 2019, Westfield Company Sold machinery to a customer for $22,000. The customer could not pay at the time of sale, but agreed to pay 9 months later, and signed a 9-month note at 11% interest. How much interest revenue was earned during 2019? Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar O A. $635 OB. 8605 OC 51815 OD. $3,630 Logan Sales provides the following information: Net credit sales: $770,000 Beginning net accounts receivable: $42.000 Ending net accounts receivable: $21,000 Calculate the accounts receivable turnover ratio. (Round your answer to the nearest whole number.) O A. 35 times OB. 24 times O C. 18 OD. 37 DO The following information is available for Juno Company for the month ending June 30, 2019. * Balance as per the bank statement is $11.700. * Balance as per books is $10,100. * Check #506 for $1,400 and check #510 for $800 were not shown on the June 30, bank statement. * A deposit in transit of $2,545 had not been received by the bank when the bank statement was generated. * A bank debit memo indicated an NSF check for $80 written by Jane Smith to Juno Company on June 13. * A bank credit memo indicated a note collected by the bank of $2,000 and interest revenue of $55 on June 20. * The bank statement indicated service charges of $30. What is the adjusted book balance? O A. $12,045 OB. $12,075 O C. $7,900 OD. $7,955 On July 10, a hardware retailer purchased merchandise inventory on account for $1,900. The company plans to pay $1,500 the following week and the remaining amount the week after. Which of the following is the correct entry to record the July 10 transaction in a purchases journal? Assume a perpetual inventory system is used O A $1,900 will be recorded in the Merchandise Inventory CR and Accounts Payable DR columns. OB. $3,400 will be recorded in the Accounts Payable DR and Merchandise Inventory DR columns OC. $1,900 will be recorded in the Accounts Payable CR and Merchandise Inventory DR columns OD. $1,500 will be recorded in the Accounts Payable CR and Merchandise Inventory CR columns