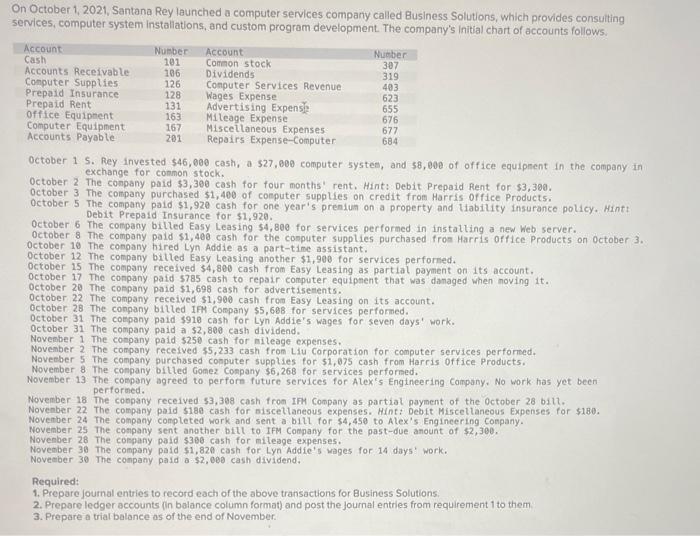

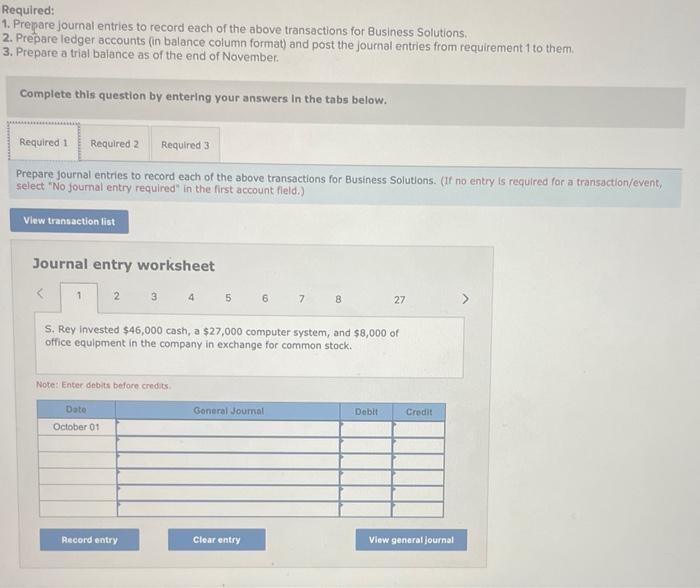

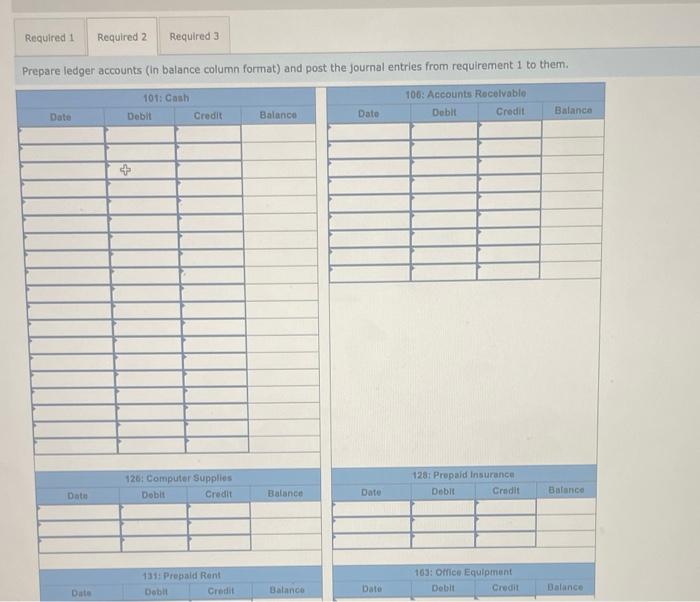

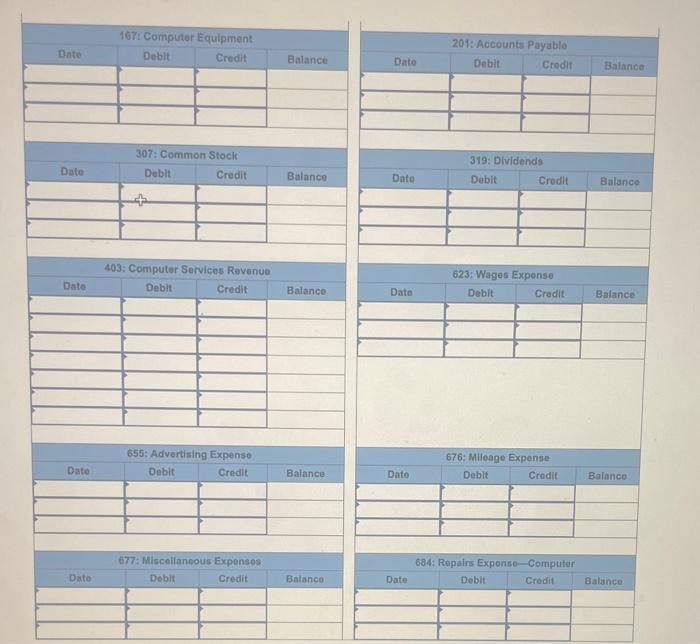

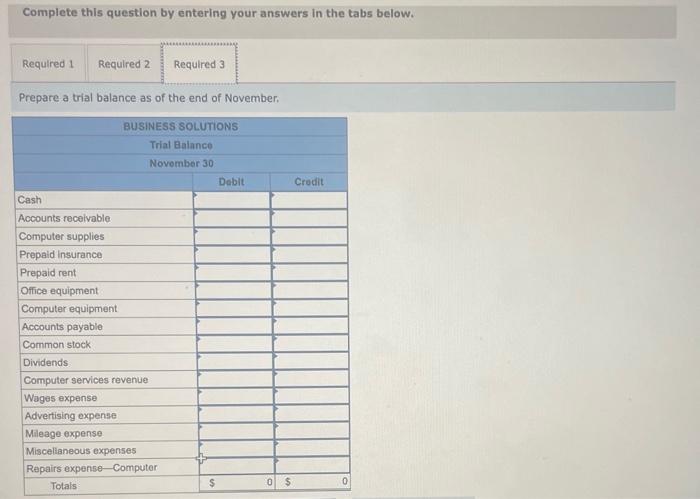

On October 1, 2021, Santana Rey launched a computer services company called Business Solutions, which provides consuiting services, computer system installations, and custom program development. The company's initial chart of accounts follows. October 1 5. Rey invested $46,000 cash, a $27,600 computer systes, and 58,000 of office equipnent in the company in october 2 exchange for conmon stock. October 2 The company paid $3,300 cash for four month' rent. Hint: Debit Prepaid Rent for $3,300. 0ctober 3 the company purchased $1,400 of coeputer supplies on credit from Harris office Products. October 5 The company paid $1,920 cash for one year's prenium on a property and thability insurance policy. Hintt Debit Prepaid Insurance for $1,920. October 6 The company billed Easy Leasing $4,800 for services performed in installing a new Web server. October 8 The company paid $1,400 cash for the conputer supplies purchased fron Harris office. Products on october 3. October 10 The company hired Lyn Addie as a part-time assistant. october 12 The company bitled Easy Leasing another $1,900 for services perforned. October 15 The company received 34,800 cash from Easy Leasing as partial payment on its account. October 17 the conpany paid 5785 cash to repair computer equipnent that was damaged when noving it. october 20 The conpany paid $1,698 cash for advertisenents. October 22 The company received 51,900 cash from Easy Leasing on its account. october 28 The conpany bitled IfM Company $5,608 for services performed. october 31 the company paid $910 cash for Lyn Addie's wages for seven days' work. October 31 The company paid a 52,800 cash dividend. November 1 The company paid 5252 cash for nileage expenses. November 2 The company received 35,233 cash trom Liu Corporation for computer services performed. Novedber 5 The company purchased conputer supplies tor 51,075 cash from Harris office Products. November 8 The company brthed Gomez conpany $6,268 for 5 ervices performed. November 13 The company agreed to perforn future services for Alex's Engineering Campany. No work has yet been perforned. November 18 The conpany received 53,308 cash from IFM Company as partial payment of the October 28 bitl. Novenber 22 The company paid $180 cash for niscetlaneous expenses. Hint: Debit Miscellaneous Expenses for $180. Novenber 24 The company completed work and sent a bill for $4,450 to Alex's Engineering conpany. November 25 The company sent another bill to IFM Company for the past-due anount of $2,300. Novenber 28 The conpany paid $300 cash for mileage expenses. November 30 The company paid $1,820 cash for Lyn Addie's wages for 14 days' work. November 30 The company paid a $2,060 cash dividend, Required: 1. Prepare joumal entries to record each of the above transactions for Business Solutions. 2. Prepare ledger accounts (in balance column format) and post the journal entries from requirement 1 to them. 3. Prepare a trial balance as of the end of November. Requlred: 1. Prepare journal entries to record each of the above transactions for Business Solutions, 2. Prepare ledger accounts (in balance column format) and post the journal entries from requirement 1 to them. 3. Prepare a trial balance as of the end of November. Complete this question by entering your answers in the tabs below. Prepare journal entries to record each of the above transactions for Business Solutions. (if no entry is required for a transaction/event, select "No foumal entry required" in the first account fleld.) Journal entry worksheet S. Rey invested $46,000 cash, a $27,000 computer system, and $8,000 of office equipment in the company in exchange for common stock. Note: Enter debits before credits. Prepare ledger accounts (in balance column format) and post the journal entries from requirement 1 to them. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{1}{|c|}{ 107: Computer Equlpment } \\ \hline Date & Deblt & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. Prepare a trial balance as of the end of November