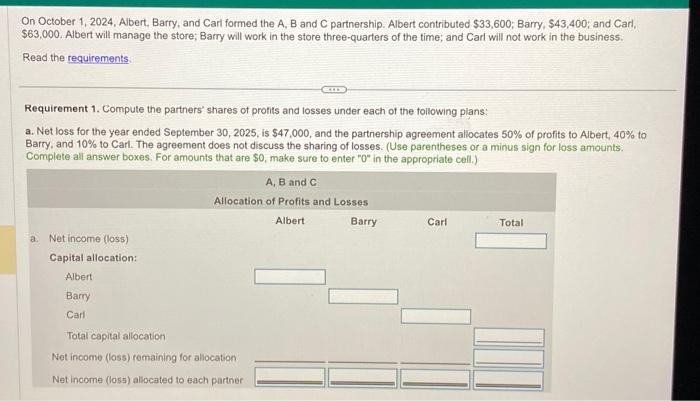

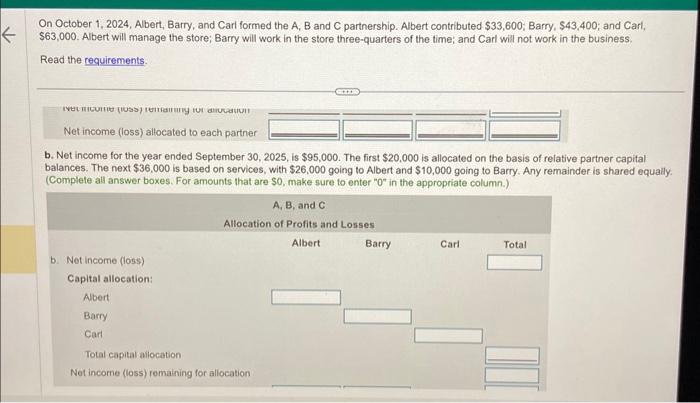

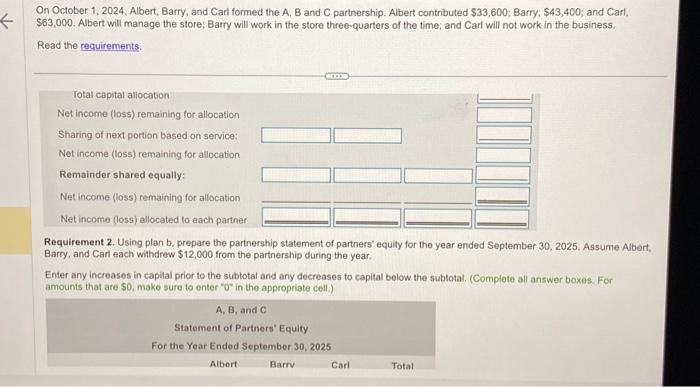

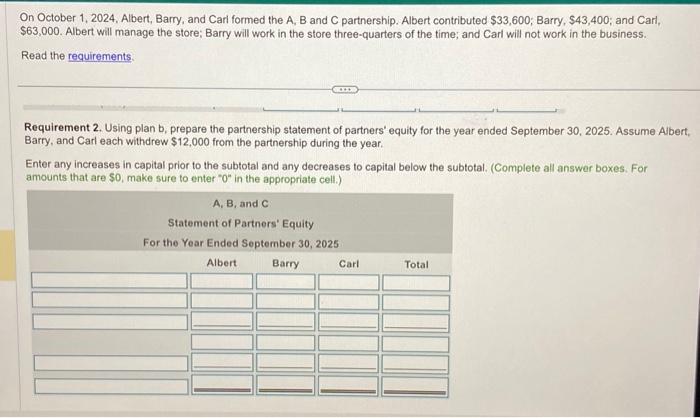

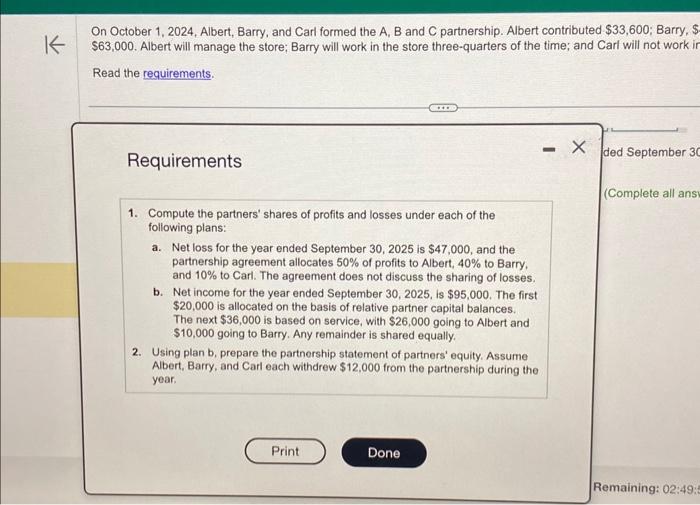

On October 1, 2024, Albert, Barry, and Carl formed the A, B and C partnership. Albert contributed $33,600;Barry,$43,400; and Carl, $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work in the business. Read the requirements. Requirement 1. Compute the parthers' shares of protits and losses under each of the following plans: a. Net loss for the year ended September 30,2025 , is $47,000, and the partnership agreement allocates 50% of profits to Albert, 40% to Barry, and 10% to Carl. The agreement does not discuss the sharing of losses. (Use parentheses or a minus sign for loss amounts: Complete all answer boxes. For amounts that are $0, make sure to enter "0 in the appropriate cell.) On October 1,2024, Albert, Barry, and Carl formed the A, B and C partnership. Albert contributed $33,600;B, Barry, $43,400; and Carl, $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work in the business. Read the requirements. b. Net income for the year ended September 30,2025 , is $95,000. The first $20,000 is allocated on the basis of relative partner capital balances. The next $36,000 is based on services, with $26,000 going to Albert and $10,000 going to Barry. Any remainder is shared equally. (Complete all answer boxes. For amounts that are \$0, make sure to enter " 0 " in the appropriate column.) On October 1, 2024, Albert, Barry, and Cart formed the A, B and C partnership. Albert contributed $33,600;B arry, $43,400; and Carl. $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work in the business. Read the requirements. Requirement 2. Using plan b, prepare the partnership statement of partners' equily for the year ended September 30, 2025. Assume Albert, Barry, and Carl each withdrew $12,000 from the partnership during the year. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. (Complete all answer boxes. For amounts that are $0, make sure to enter 0 in the appropriate cell.) On October 1, 2024, Albert, Barry, and Carl formed the A, B and C partnership. Albert contributed $33,600; Barry, $43,400; and Carl, $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work in the business. Read the requirements. Requirement 2. Using plan b, prepare the partnership statement of partners' equity for the year ended September 30, 2025. Assume Albert Barry, and Carl each withdrew $12,000 from the partnership during the year. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. (Complete all answer boxes. For amounts that are $0, make sure to enter " 01 in the appropriate cell.) On October 1, 2024, Albert, Barry, and Carl formed the A, B and C partnership. Albert contributed $33,600; Barry, $ $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work i Read the requirements. Requirements ded September 3C 1. Compute the partners' shares of profits and losses under each of the following plans: a. Net loss for the year ended September 30,2025 is $47,000, and the partnership agreement allocates 50% of profits to Albert, 40% to Barry, and 10% to Carl. The agreement does not discuss the sharing of losses. b. Net income for the year ended September 30,2025 , is $95,000. The first $20,000 is allocated on the basis of relative partner capital balances. The next $36,000 is based on service, with $26,000 going to Albert and $10,000 going to Barry. Any remainder is shared equally. 2. Using plan b, prepare the partnership statement of partners' equity. Assume Albert, Barry, and Carl each withdrew $12,000 from the partnership during the year. Remaining: 02:49: On October 1, 2024, Albert, Barry, and Carl formed the A, B and C partnership. Albert contributed $33,600;Barry,$43,400; and Carl, $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work in the business. Read the requirements. Requirement 1. Compute the parthers' shares of protits and losses under each of the following plans: a. Net loss for the year ended September 30,2025 , is $47,000, and the partnership agreement allocates 50% of profits to Albert, 40% to Barry, and 10% to Carl. The agreement does not discuss the sharing of losses. (Use parentheses or a minus sign for loss amounts: Complete all answer boxes. For amounts that are $0, make sure to enter "0 in the appropriate cell.) On October 1,2024, Albert, Barry, and Carl formed the A, B and C partnership. Albert contributed $33,600;B, Barry, $43,400; and Carl, $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work in the business. Read the requirements. b. Net income for the year ended September 30,2025 , is $95,000. The first $20,000 is allocated on the basis of relative partner capital balances. The next $36,000 is based on services, with $26,000 going to Albert and $10,000 going to Barry. Any remainder is shared equally. (Complete all answer boxes. For amounts that are \$0, make sure to enter " 0 " in the appropriate column.) On October 1, 2024, Albert, Barry, and Cart formed the A, B and C partnership. Albert contributed $33,600;B arry, $43,400; and Carl. $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work in the business. Read the requirements. Requirement 2. Using plan b, prepare the partnership statement of partners' equily for the year ended September 30, 2025. Assume Albert, Barry, and Carl each withdrew $12,000 from the partnership during the year. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. (Complete all answer boxes. For amounts that are $0, make sure to enter 0 in the appropriate cell.) On October 1, 2024, Albert, Barry, and Carl formed the A, B and C partnership. Albert contributed $33,600; Barry, $43,400; and Carl, $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work in the business. Read the requirements. Requirement 2. Using plan b, prepare the partnership statement of partners' equity for the year ended September 30, 2025. Assume Albert Barry, and Carl each withdrew $12,000 from the partnership during the year. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. (Complete all answer boxes. For amounts that are $0, make sure to enter " 01 in the appropriate cell.) On October 1, 2024, Albert, Barry, and Carl formed the A, B and C partnership. Albert contributed $33,600; Barry, $ $63,000. Albert will manage the store; Barry will work in the store three-quarters of the time; and Carl will not work i Read the requirements. Requirements ded September 3C 1. Compute the partners' shares of profits and losses under each of the following plans: a. Net loss for the year ended September 30,2025 is $47,000, and the partnership agreement allocates 50% of profits to Albert, 40% to Barry, and 10% to Carl. The agreement does not discuss the sharing of losses. b. Net income for the year ended September 30,2025 , is $95,000. The first $20,000 is allocated on the basis of relative partner capital balances. The next $36,000 is based on service, with $26,000 going to Albert and $10,000 going to Barry. Any remainder is shared equally. 2. Using plan b, prepare the partnership statement of partners' equity. Assume Albert, Barry, and Carl each withdrew $12,000 from the partnership during the year. Remaining: 02:49