On October 1, 2024, the Allegheny Corporation purchased equipment for $203,000. The estimated service life of the equipment is 10 years and the estimated

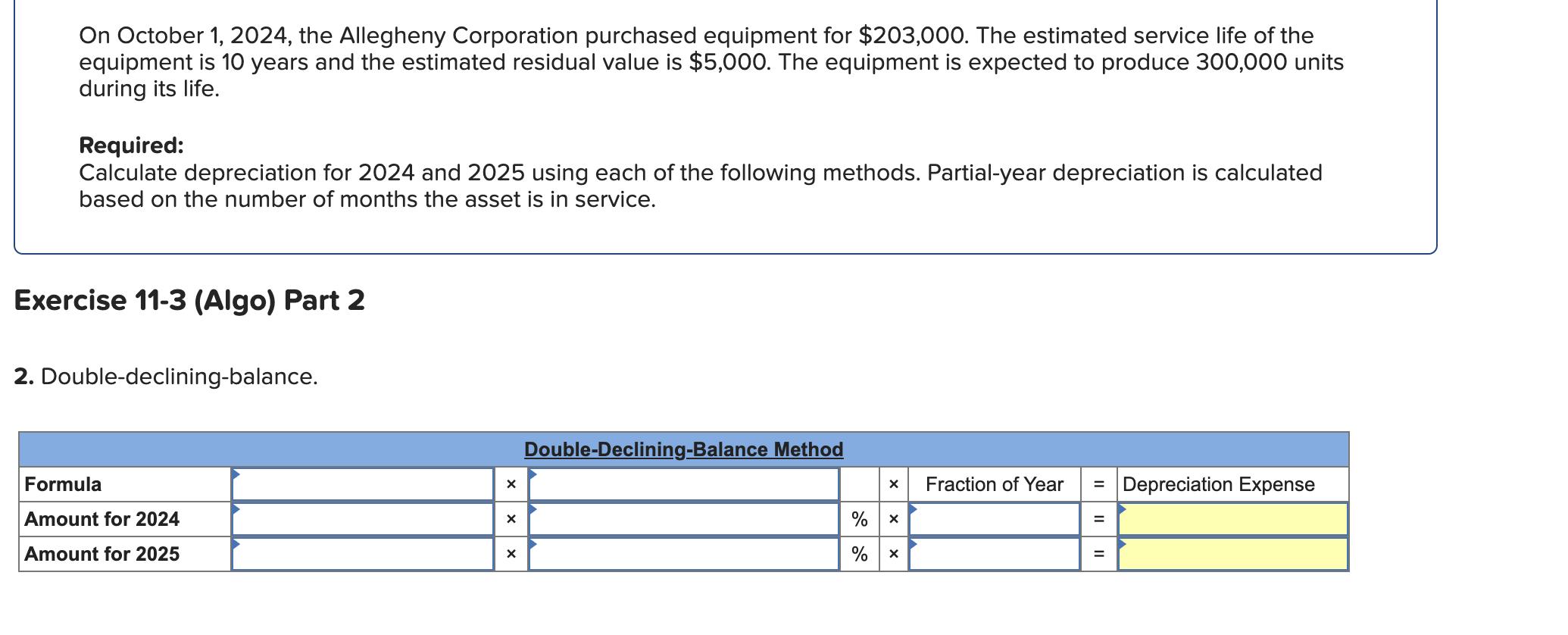

On October 1, 2024, the Allegheny Corporation purchased equipment for $203,000. The estimated service life of the equipment is 10 years and the estimated residual value is $5,000. The equipment is expected to produce 300,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. Exercise 11-3 (Algo) Part 2 2. Double-declining-balance. Formula Amount for 2024 Amount for 2025 Double-Declining-Balance Method % % x Fraction of Year II = Depreciation Expense

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Purchased equipment203000 Sal...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started