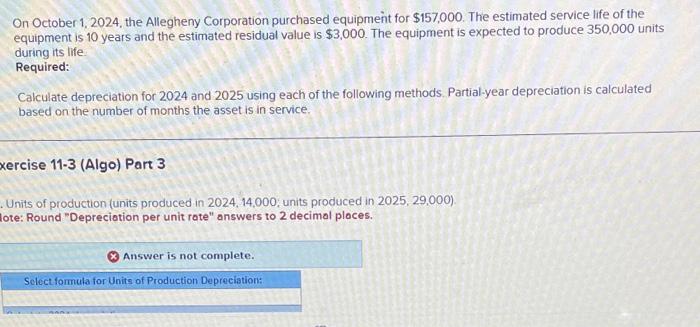

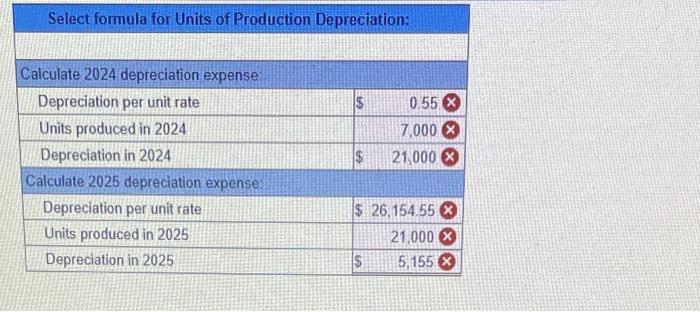

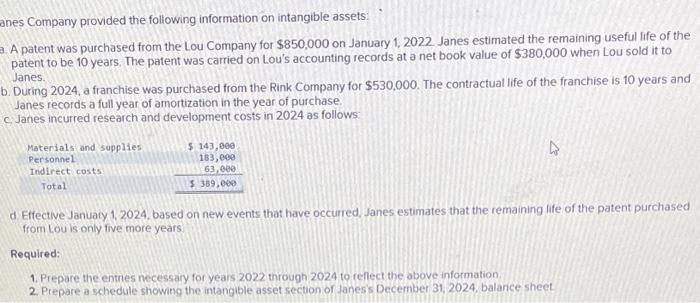

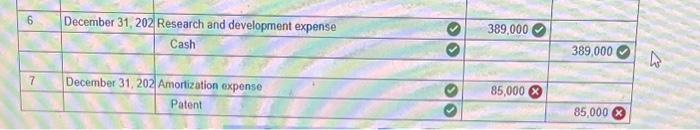

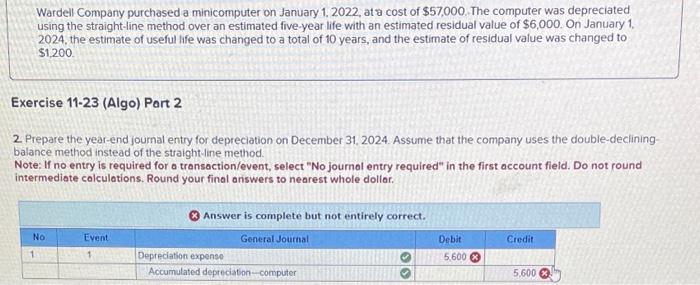

On October 1, 2024, the Allegheny Corporation purchased equipment for $157,000. The estimated service life of the equipment is 10 years and the estimated residual value is $3,000. The equipment is expected to produce 350,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. xercise 11-3 (Algo) Part 3 Units of production (units produced in 2024, 14,000, units produced in 2025, 29,000). ote: Round "Depreciotion per unit rote" answers to 2 decimal ploces. nes Company provided the following information on intangible assets: A patent was purchased from the Lou Company for $850,000 on January 1, 2022. Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou's accounting records at a net book value of $380,000 when Lou sold it to Janes. During 2024, a franchise was purchased from the Rink Company for $530,000. The contractual life of the franchise is 10 years and Janes records a full year of amortization in the year of purchase. c. Janes incurred research and development costs in 2024 as follows: d. Effective January 1, 2024, based on new events that have occurred, Janes estimates that the remaining life of the patent purchased from Lou is only five more years: Required: 1. Prepare the entries necessary for years 2022 through 2024 to reflect the above information. 2. Prepare a schedule showing the intangible asset section of Janes's December 31,2024 , balarice sheet. Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $57,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $6,000. On January 1 . 2024, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $1,200 Exercise 11-23 (Algo) Part 2 2. Prepare the year-end journal entry for depreciation on December 31, 2024. Assume that the company uses the double-decliningpalance method instead of the straight-line method. Note: If no entry is required for o transoction/event, select "No journal entry required" in the first account field. Do not round intermediate colculations. Round your final answers to nearest whole dollar