Answered step by step

Verified Expert Solution

Question

1 Approved Answer

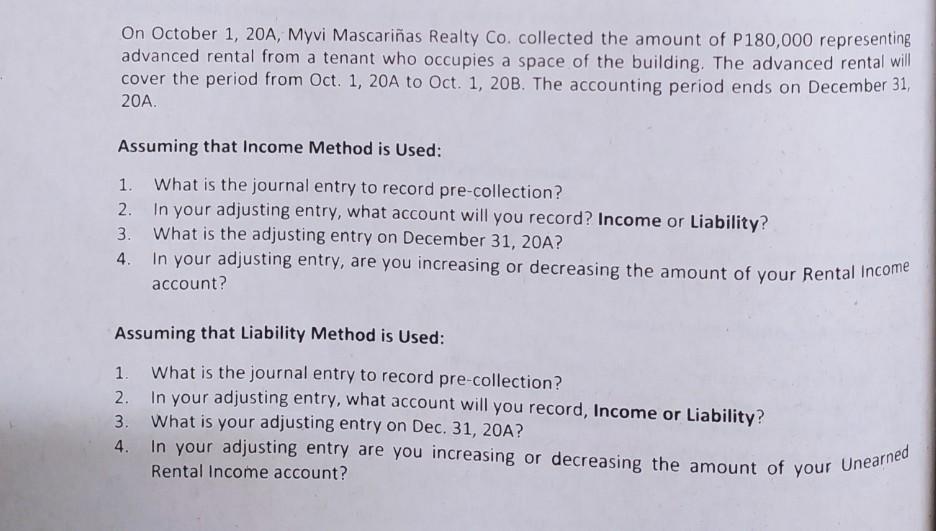

On October 1, 20A, Myvi Mascarias Realty Co. collected the amount of P180,000 representing advanced rental from a tenant who occupies a space of the

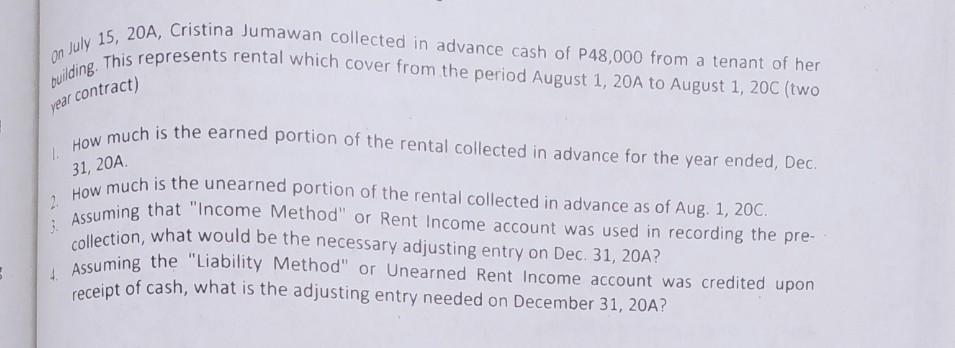

On October 1, 20A, Myvi Mascarias Realty Co. collected the amount of P180,000 representing advanced rental from a tenant who occupies a space of the building. The advanced rental will cover the period from Oct. 1, 20A to Oct. 1, 20B. The accounting period ends on December 31, 20A. Assuming that Income Method is Used: 1. What is the journal entry to record pre-collection? 2. In your adjusting entry, what account will you record? Income or Liability? 3. What is the adjusting entry on December 31, 20A? 4. In your adjusting entry, are you increasing or decreasing the amount of your Rental Income account? Assuming that Liability Method is Used: 1. What is the journal entry to record pre-collection? 2. In your adjusting entry, what account will you record, Income or Liability? 3 What is your adjusting entry on Dec. 31, 20A? In your adjusting entry are you increasing or decreasing the amount of your Unearned Rental Income account? year contract) building. This represents rental which cover from the period August 1, 20A to August 1, 20C (two on July 15, 20A, Cristina Jumawan collected in advance cash of P48,000 from a tenant of her 1. How much is the earned portion of the rental collected in advance for the year ended, Dec. 2 How much is the unearned portion of the rental collected in advance as of Aug 1, 20C. 3. Assuming that "Income Method" or Rent Income account was used in recording the pre- collection, what would be the necessary adjusting entry on Dec. 31, 20A? Assuming the "Liability Method" or Unearned Rent Income account was credited upon receipt of cash, what is the adjusting entry needed on December 31, 20A? 31, 20A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started