Answered step by step

Verified Expert Solution

Question

1 Approved Answer

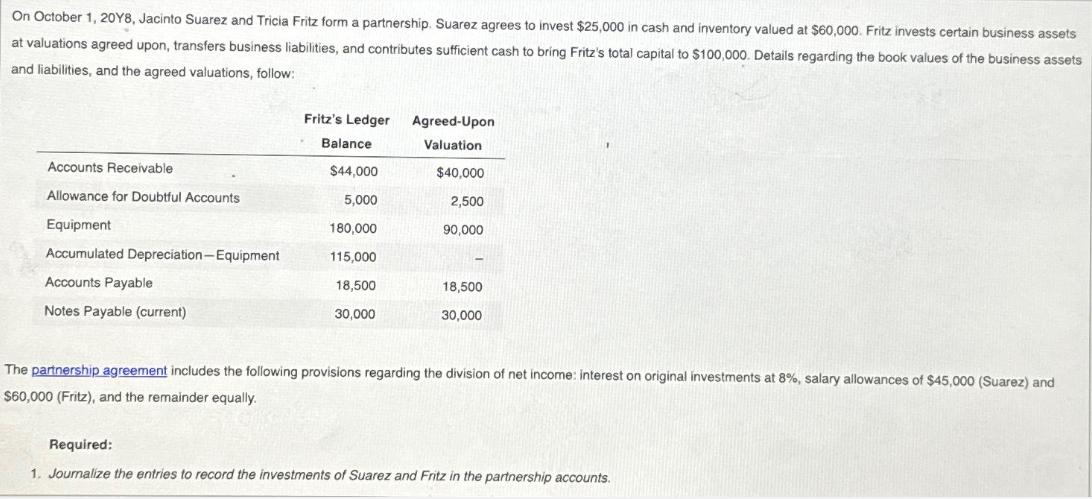

On October 1, 20Y8, Jacinto Suarez and Tricia Fritz form a partnership. Suarez agrees to invest $25,000 in cash and inventory valued at $60,000.

On October 1, 20Y8, Jacinto Suarez and Tricia Fritz form a partnership. Suarez agrees to invest $25,000 in cash and inventory valued at $60,000. Fritz invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring Fritz's total capital to $100,000. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow: Fritz's Ledger Agreed-Upon Balance Valuation Accounts Receivable $44,000 $40,000 Allowance for Doubtful Accounts 5,000 2,500 Equipment 180,000 90,000 Accumulated Depreciation-Equipment 115,000 Accounts Payable 18,500 18,500 Notes Payable (current) 30,000 30,000 The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 8%, salary allowances of $45,000 (Suarez) and $60,000 (Fritz), and the remainder equally. Required: 1. Journalize the entries to record the investments of Suarez and Fritz in the partnership accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you with that Here are the journal entries to record the investments of Suarez and Fritz in the partnership accounts For Jacinto Suarez Debit Cash for 25000 Debit Inventory for 60000 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started