Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 1, C. R. Yazici investstl0,000 cash in an advertising company to be known as Pioneer Advertising Agency Inc. Transaction The asset Cash

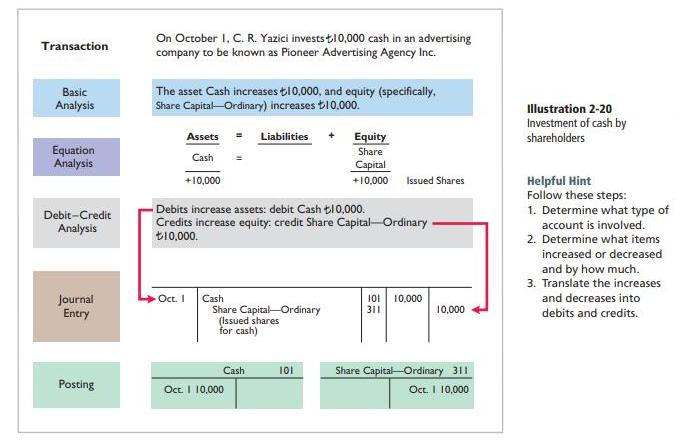

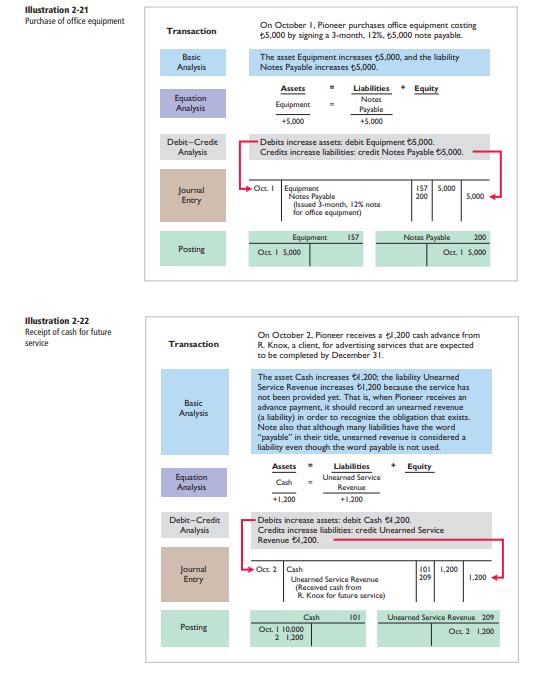

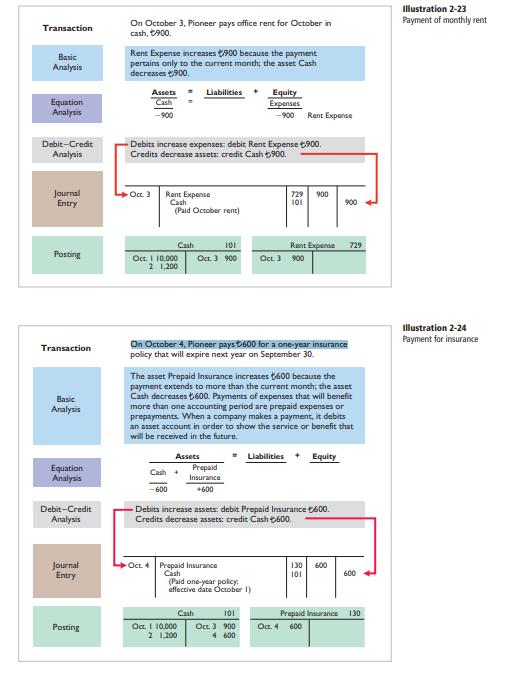

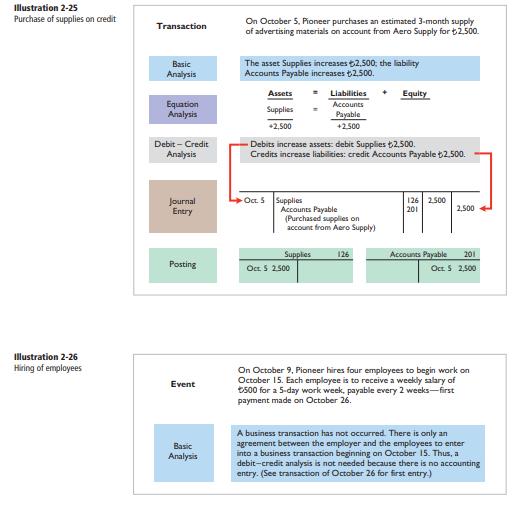

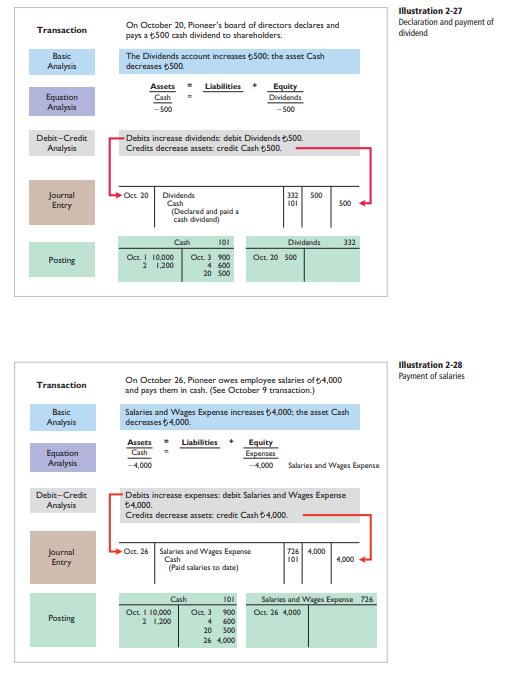

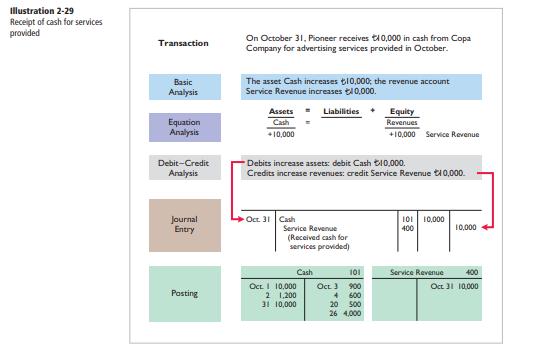

On October 1, C. R. Yazici investstl0,000 cash in an advertising company to be known as Pioneer Advertising Agency Inc. Transaction The asset Cash increases tl0,000, and equity (specifically, Share Capital-Ordinary) increases t10,000. Basic Analysis Illustration 2-20 Investment of cash by Assets Liabilities Equity Share shareholders Equation Analysis Cash Capital +10,000 +10,000 Issued Shares - Debits increase assets: debit Cash t10,000, Credits increase equity: credit Share Capital-Ordinary. DI0,000. Helpful Hint Follow these steps: 1. Determine what type of account is involved. Debit-Credit Analysis 2. Determine what items increased or decreased and by how much. 3. Translate the increases Oct. I 101 311 and decreases into Journal Entry Cash Share Capital-Ordinary (Issued shares for cash) 10,000 10,000 debits and credits. 101 Share CapitalOrdinary 311 Cash Posting Occ. I 10,000 Oct. I 10,000 Illustration 2-21 Purchase of office equipment On October 1, Pioneer purchases office equipment costing t5,000 by signing a 3-month, 12%, t5,000 note payable. Transaction Basic The asset Equipment increases t5,000, and the liability Notes Payable increases t5,000. Analysis Assets Liabilities Notes Equity Equation Analysis Equipment Payable +5,000 +5,000 Debits increase assets: debit Equipment t5.000. Credits increase liabilities: credit Notes Payable t5.000. Debit-Credit Analysis Journal Entry Oct I Equipment 157 5,000 200 Notes Payable (Issued 3-month, 12% note for office equipment) 5,000 Equipment 157 Notes Payable 200 Posting Oct. I 5,000 Oct. I 5.000 Illustration 2-22 Receipt of cash for future service On October 2. Pioneer receives a tl.200 cash advance from R. Knox, a client, for advertising services that are expected to be completed by December 31. Transaction The asset Cash increases ti.200, the liability Unearned Service Revenue increases b1,200 because the service has not been provided yet. That is, when Pioneer receives an advance payment, it should record an unearned revenue (a liability) in order to recognize the obligation that exists. Note also that although many liabilities have the word "payable" in their tidle, unearned revenue is considered liability even though the word payable is not used. Basic Analysis Assets + Equity Liabilities Equation Analysis Unearned Service Revenue Cash +1,200 +1,200 Debits increase assets: debit Cash ti 200. Credits increase labilities: credit Uncarned Service Revenue ti.200. Debit-Credit Analysis Journal Entry Oct. 2 Cash 101 1,200 209 Unearned Service Revenue 1,200 (Received cash from R. Knox for future service) Unearned Service Revenue 209 Oc. 2 1,200 Cash 101 Posting Oct. I 10,000 2 1,200 Illustration 2-23 Payment of monthly rent On October 3, Pioneer pays office rent for October in cash, t900. Transaction Rent Expense increases 900 because the payment pertains only to the current month; the asset Cash decreases t900. Basic nalysis Equation Analysis Assets Cash Liabilities Equity Expenses -900 -900 Rent Experse Debit-Credit Debits increase expenses: debit Rent Expense t900. Credits decrease assets: credit Cash t900. Analysis Journal Entry Oc. ) Rent Expense Cash (Paid October rent) 729 900 101 900 Cash 101 Rent Expense 729 Posting Oct. I 10,000 2 1,200 Oct. 3 900 Oct 3 900 illustration 2-24 Payment for insurance On October 4, Pioneer pays 600 for a one-year insurance policy that will expire next year on September 30. Transaction The asset Prepaid Insurance increases t600 because the payment extends to more than the current month; the asset Cash decreases b600. Payments of expenses that will benefit more than one accounting period are prepaid expenses or prepayments. When a company makes a payment, it debits an asset account in order to show the service or benefit that Basic Analysis will be received in the future. Assets - Liabilities + Equity Equation Analysis Prepaid Insurance Cash + -600 *600 Debit-Credit Debits increase assets: debit Prepaid Insurance t600. Credits decrease assets: credit Cash 600. Analysis Journal Entry Occ 4 Prepaid Insurance 130 600 101 Cash (Paid one-year polcy effective date October 1) 600 Cash 101 Prepaid Insurance 130 Oct. I 10,000 2 1,200 Oc. 3 900 4 600 Posting Oct. 4 600 Illustration 2-25 Purchase of supplies on credit On October 5, Pioneer purchases an estimated 3-month supply of advertising materials on account from Aero Supply for t2.500. Transaction The asset Supplies increases 62,500, the liability Accounts Payable increases t2.500. Basic Analysis Assets Liabilities Equity Equation Analysis Accounts Payable Supplies *2,500 +2500 Debits increase assets: debit Supplies t2.500. Credits increase liabilities: credit Accounts Payable b2.500. Debit - Credit Analysis Journal Entry Oct. 5 Supplies 126 2500 201 2,500 Accounts Payable (Purchased supplies on account from Aero Supply) Supplies 126 Accounts Payable 201 Posting Oc. S 2500 Oct. S 2,500 Illustration 2-26 Hiring of employees On October 9, Pioneer hires four employees to begin work on October 15. Each employee is to receive a weekly salary of ts00 for a 5-day work week, payable every 2 weeks-first payment made on October 26. Event A business transaction has not occurred. There is only an agreement between the employer and the employees to enter into a business transaction beginning on October 15. Thus, a Basic Analysis debit-credit analysis is not needed because there is no accounting entry. (See transaction of October 26 for first entry.) Illustration 2-27 Declaration and payment of On October 20, Pioneer's board of directors declares and pays a t500 cash dividend to shareholders. Transaction dividend The Dividends account increases t500: the asset Cash decreases 6500. Basic Analysis Assets . Liabilities + Cash Equity Dividends Equation Analysis - 500 -500 Debit-Credit Debits increase dividends: debit Dividends 500. Credits decrease assets credit Cash t500. Analysis Oct. 20 Dividends Cash (Declared and pald a cash dividend) Journal Entry 332 S00 101 500 Cash 101 Dividends 332 Oct. I 10,000 2 1.200 Oct. 3 900 4 600 20 500 Oct 20 500 Posting Illustration 2-28 Payment of salaries On October 26, Pioneer owes employee salaries of t4,000 and pays them in cash. (See October 9 transaction.) Transaction Salaries and Wages Expense increases t4,000; the asset Cash decreases t4,000. Basic Analysis Assets Cash Liabilities Equity Expenses Equation Analysis -4,000 -4,000 Salaries and Wages Expense Debits increase expenses debit Salaries and Wages Expense b4.000. Credits decrease assets: credit Cash b4,000. Debit-Credit Analysis Oct. 26 Salaries and Wages Expense Cash (Paid salaries to date) 726 4,000 Journal Entry 4,000 Cash Oct I 10,000 2 1,200 101 Oct. 3 900 600 20 500 26 4,000 Salaries and Wages Expense 726 Oct. 26 4,000 Posting Illustration 2-29 Receipt of cash for services provided On October 31, Pioneer receives t10,000 in cash from Copa Company for advertising services provided in October. Transaction The asset Cash increases b10,000; the revenue account Service Revenue increases t0,000. Basic Analysis Assets Liabilities Equation Analysis Equity Revenues +10,000 Service Revenue Cash +10,000 Debits increase assets: debit Cash D10,000. Credits increase revenues: credit Service Revenue ti0,000. Debit-Credit Analysis Journal Entry Oc. 31 Cash 101 10,000 400 Service Revenue 10,000 (Received cash for services provided) Cash 101 Service Revenue 400 Oct I 10,000 2 1,200 31 10,000 Oct 3 900 600 20 500 26 4,000 Oct 31 10.000 Posting

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started