Question

On October 1, Organic Farming purchases wind turbines for $170,000. The wind turbines are expected to last five years, have a salvage value of

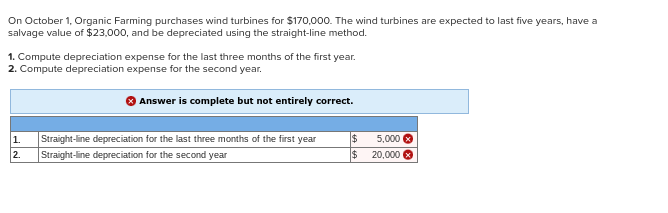

On October 1, Organic Farming purchases wind turbines for $170,000. The wind turbines are expected to last five years, have a salvage value of $23,000, and be depreciated using the straight-line method. 1. Compute depreciation expense for the last three months of the first year. 2. Compute depreciation expense for the second year. Answer is complete but not entirely correct. 1. Straight-line depreciation for the last three months of the first year $ 2. Straight-line depreciation for the second year $ 5,000 20,000 >

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

140000 20000 Cost of the turbine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J Wild, Ken Shaw

24th edition

1259916960, 978-1259916960

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App