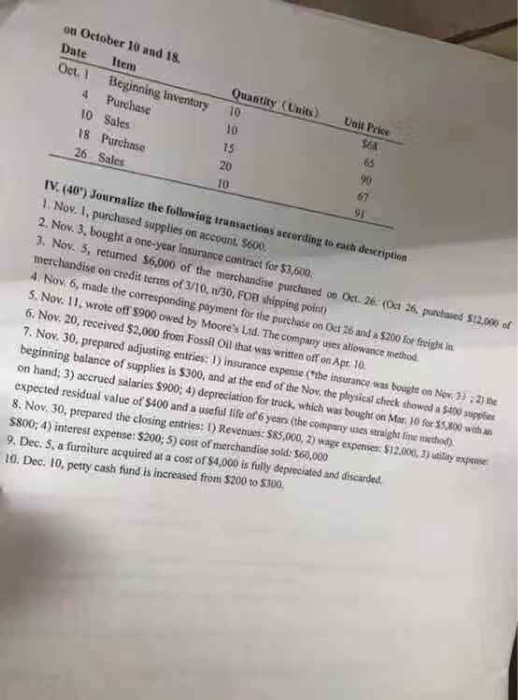

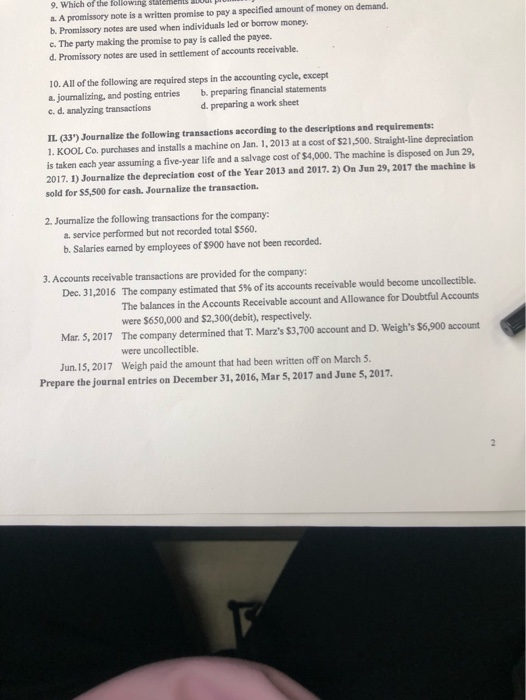

on October 10 and 18. Date Item Oct Beginning inventory 4 Purchase 10 Sales 18 Purchase Quantity Units) 10 Unit Price $6 26 15 Sales 20 TO IV. (40") Journalize the following transactions secording to each description 1. Nov. 1. purchased supplies on account. $600 2. Nov. 3. bought a one-year insurance contract for $3,600. 3. Noy. 5, returned $6,000 of the merchandise purchased 06 Oct 26 (Oct 26. purchased $12.000 of merchandise on credit terms of 3/10, 1/30, FOB shipping point 4. Nov 6, made the corresponding payment for the purchase on Oct 26 and a $200 for freight in 5. Nov. 11 wrote off $900 owed by Moore's Land. The company uses allowance method 6. Nov. 20, received $2,000 from Fossil On that was written off on Apt. 10 7. Nov. 30. prepared adjusting entries: 1) insurance expense the insurance was bought on Nov. 3)2) beginning balance of supplies is $300, and at the end of the Now, the physical check showed a $400 supplies on hand: 3) accrued salaries $900; 4) depreciation for track, which was bought on Mar 10 for $5800 with expected residual value of $400 and a useful life of 6 years the company uses straight linethod) 8. Nov, 30, prepared the closing entries: 1) Revenues: $85,000, 2) wage expenses: $12.000. 3) willy expose 5800; 4) interest expense: $200; 5) cost of merchandise sold: $60,000 9. Dec. 5. a furniture acquired at a cost of $4.000 is fully deprecated and discardet. 10. Dec. 10, petty cash fund is increased from $200 10 $300. 9. Which of the following statements out o n a. A promissory note is a written promise to pay a specified amount of money on demand. b. Promissory notes are used when individuals led or borrow money. c. The party making the promise to pay is called the payee. d. Promissory notes are used in settlement of accounts receivable. 10. All of the following are required steps in the accounting cycle, except a. journalizing, and posting entries b. preparing financial statements c. d. analyzing transactions d. preparing a work sheet IL (33) Journalize the following transactions according to the descriptions and requirements: 1. KOOL Co. purchases and installs a machine on Jan. 1, 2013 at a cost of $21,500. Straight-line depreciation is taken cach year assuming a five-year life and a salvage cost of $4,000. The machine is disposed on Jun 29, 2017. 1) Journalize the depreciation cost of the Year 2013 and 2017. 2) On Jun 29, 2017 the machine is sold for $5,500 for cash. Jourmalize the transaction. 2. Joumalize the following transactions for the company: a service performed but not recorded total $560. b. Salaries earned by employees of $900 have not been recorded. 3. Accounts receivable transactions are provided for the company: Dec. 31,2016 The company estimated that 5% of its accounts receivable would become uncollectible. The balances in the Accounts Receivable account and Allowance for Doubtful Accounts were $650,000 and $2,300(debit), respectively. Mar. 5, 2017 The company determined that T. Marz's $3,700 account and D. Weigh's $6,900 account were uncollectible. Jun 15, 2017 Weigh paid the amount that had been written off on March 5. Prepare the journal entries on December 31, 2016, Mar 5, 2017 and June 5, 2017