Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 2 2 nd , 2 0 1 8 , Dealer A purchased $ 1 million face amount of a 7 . 2 5

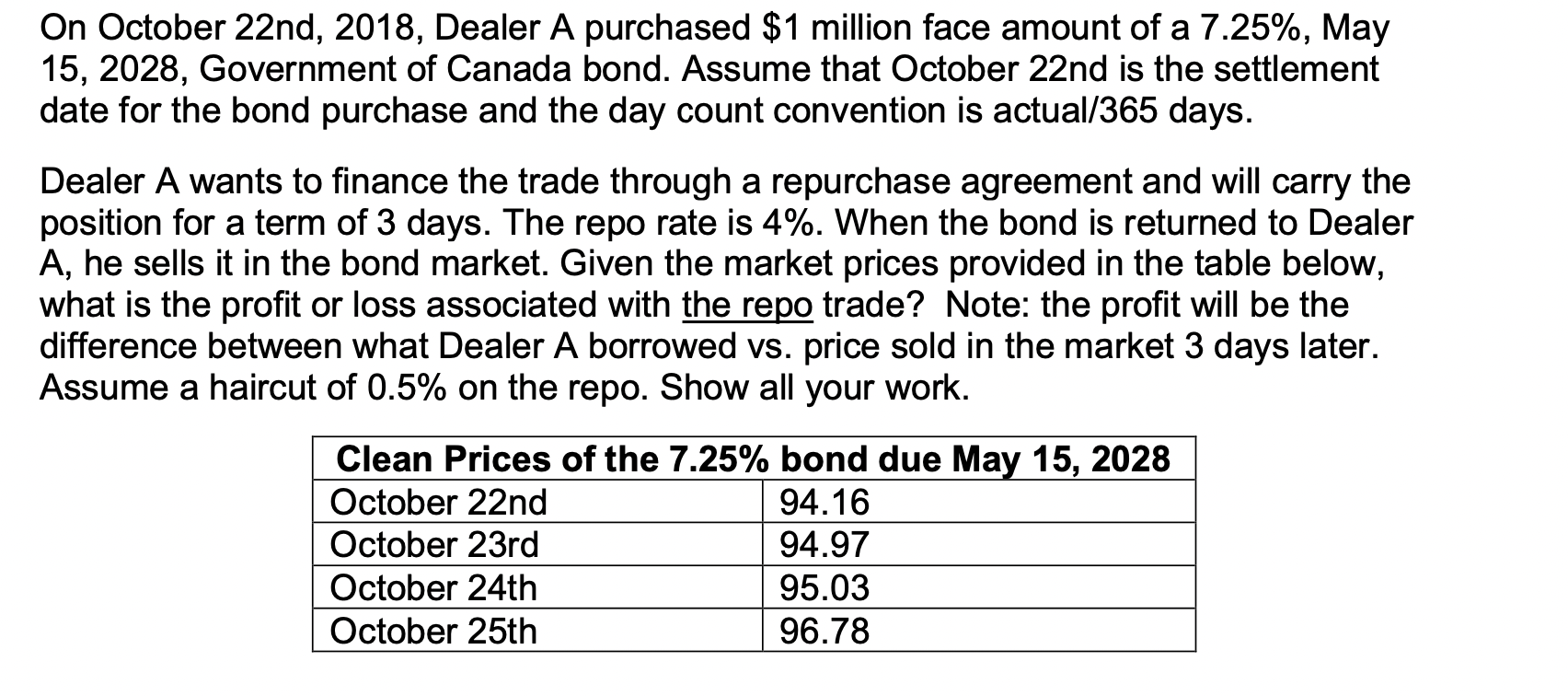

On October nd Dealer A purchased $ million face amount of a May

Government of Canada bond. Assume that October nd is the settlement

date for the bond purchase and the day count convention is actual days.

Dealer A wants to finance the trade through a repurchase agreement and will carry the

position for a term of days. The repo rate is When the bond is returned to Dealer

he sells it in the bond market. Given the market prices provided in the table below,

what is the profit or loss associated with the repo trade? Note: the profit will be the

difference between what Dealer A borrowed vs price sold in the market days later.

Assume a haircut of on the repo. Show all your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started