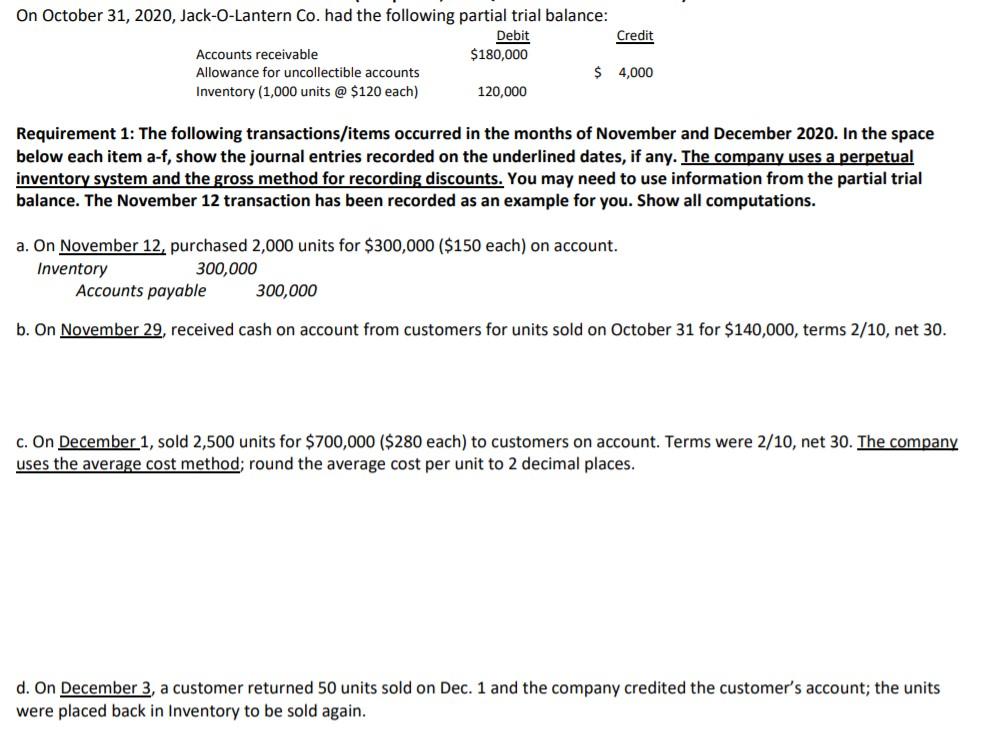

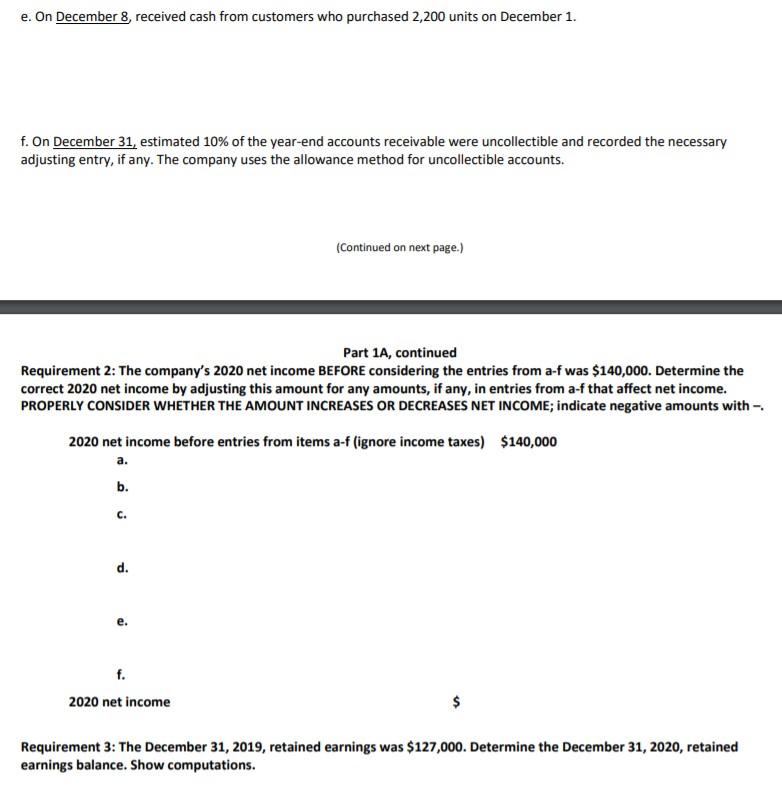

On October 31, 2020, Jack-O-Lantern Co. had the following partial trial balance: Debit Credit Accounts receivable $180,000 Allowance for uncollectible accounts $ 4,000 Inventory (1,000 units @ $120 each) 120,000 Requirement 1: The following transactions/items occurred in the months of November and December 2020. In the space below each item a-f, show the journal entries recorded on the underlined dates, if any. The company uses a perpetual inventory system and the gross method for recording discounts. You may need to use information from the partial trial balance. The November 12 transaction has been recorded as an example for you. Show all computations. a. On November 12, purchased 2,000 units for $300,000 ($150 each) on account. Inventory 300,000 Accounts payable 300,000 b. On November 29, received cash on account from customers for units sold on October 31 for $140,000, terms 2/10, net 30. c. On December 1, sold 2,500 units for $700,000 ($280 each) to customers on account. Terms were 2/10, net 30. The company uses the average cost method; round the average cost per unit to 2 decimal places. d. On December 3, a customer returned 50 units sold on Dec. 1 and the company credited the customer's account; the units were placed back in Inventory to be sold again. e. On December 8, received cash from customers who purchased 2,200 units on December 1. f. On December 31, estimated 10% of the year-end accounts receivable were uncollectible and recorded the necessary adjusting entry, if any. The company uses the allowance method for uncollectible accounts. (Continued on next page.) Part 1A, continued Requirement 2: The company's 2020 net income BEFORE considering the entries from a-f was $140,000. Determine the correct 2020 net income by adjusting this amount for any amounts, if any, in entries from a-f that affect net income. PROPERLY CONSIDER WHETHER THE AMOUNT INCREASES OR DECREASES NET INCOME; indicate negative amounts with 2020 net income before entries from items a-f (ignore income taxes) $140,000 b. C. d. f. 2020 net income $ Requirement 3: The December 31, 2019, retained earnings was $127,000. Determine the December 31, 2020, retained earnings balance. Show computations