Answered step by step

Verified Expert Solution

Question

1 Approved Answer

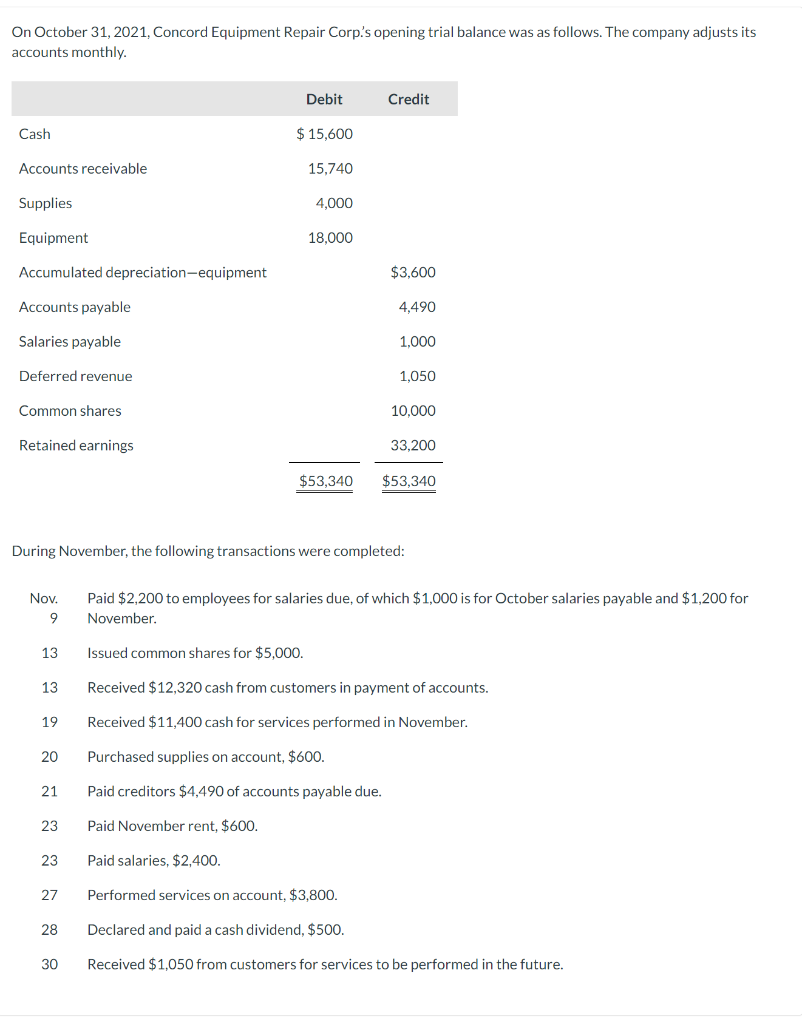

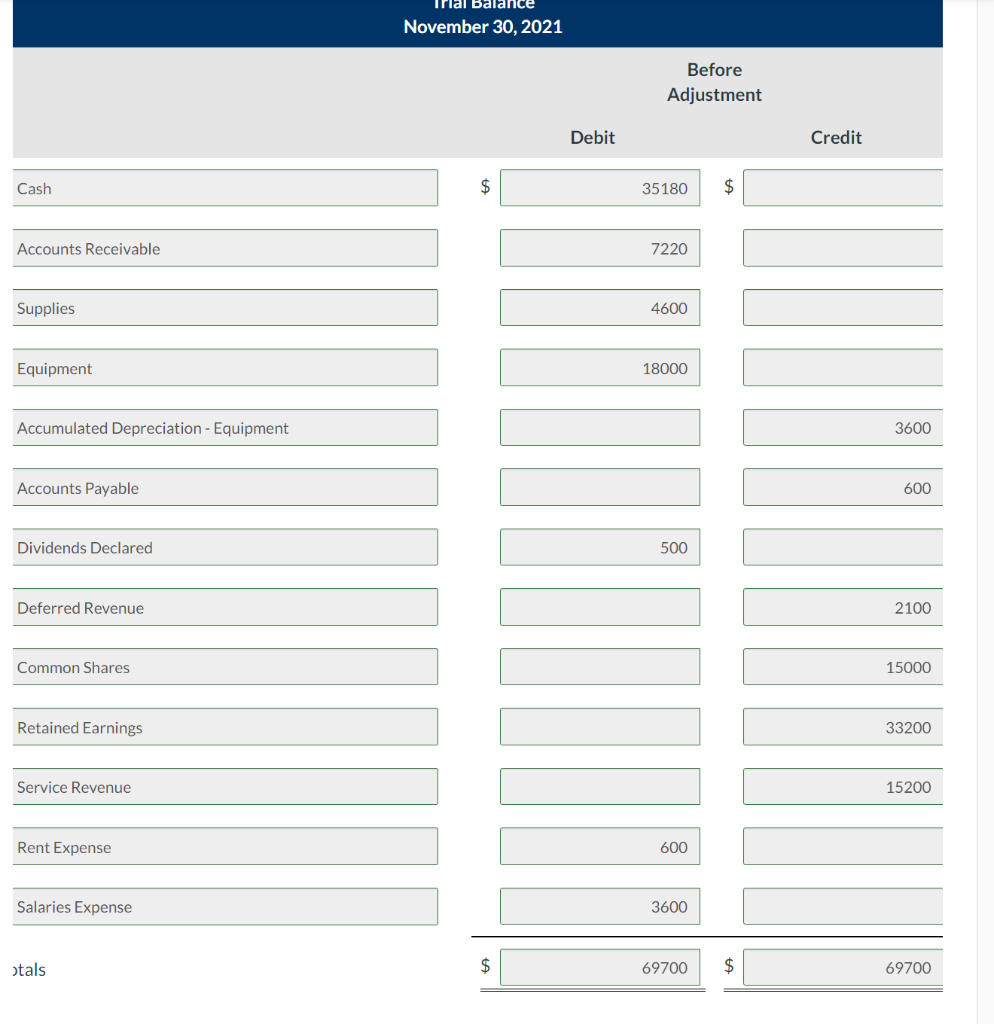

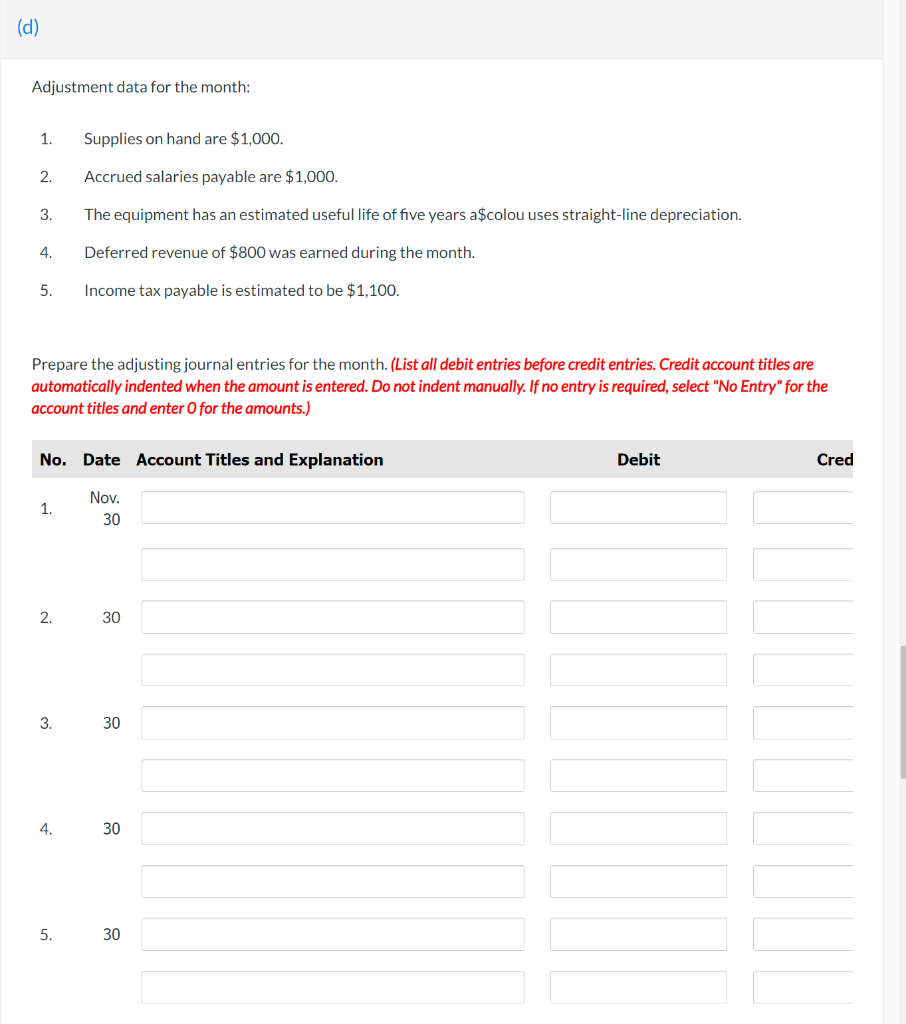

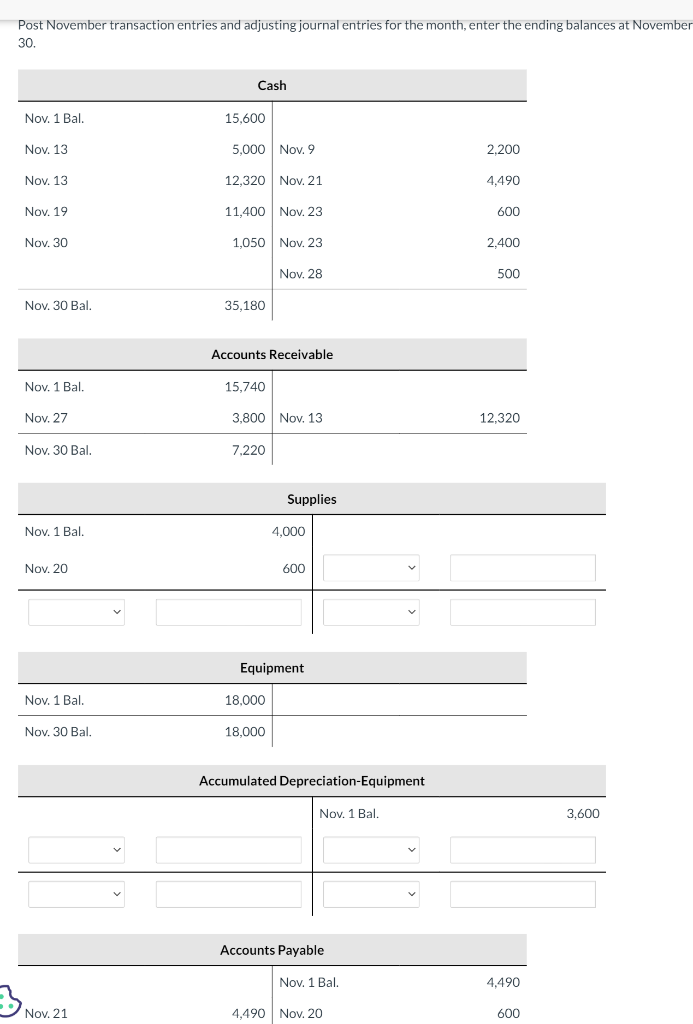

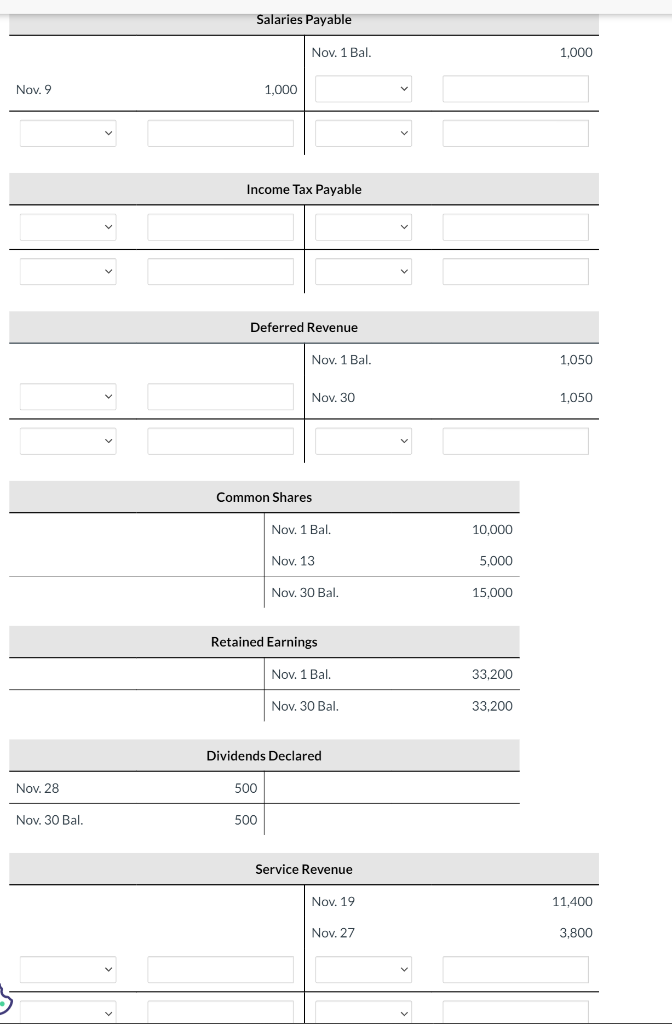

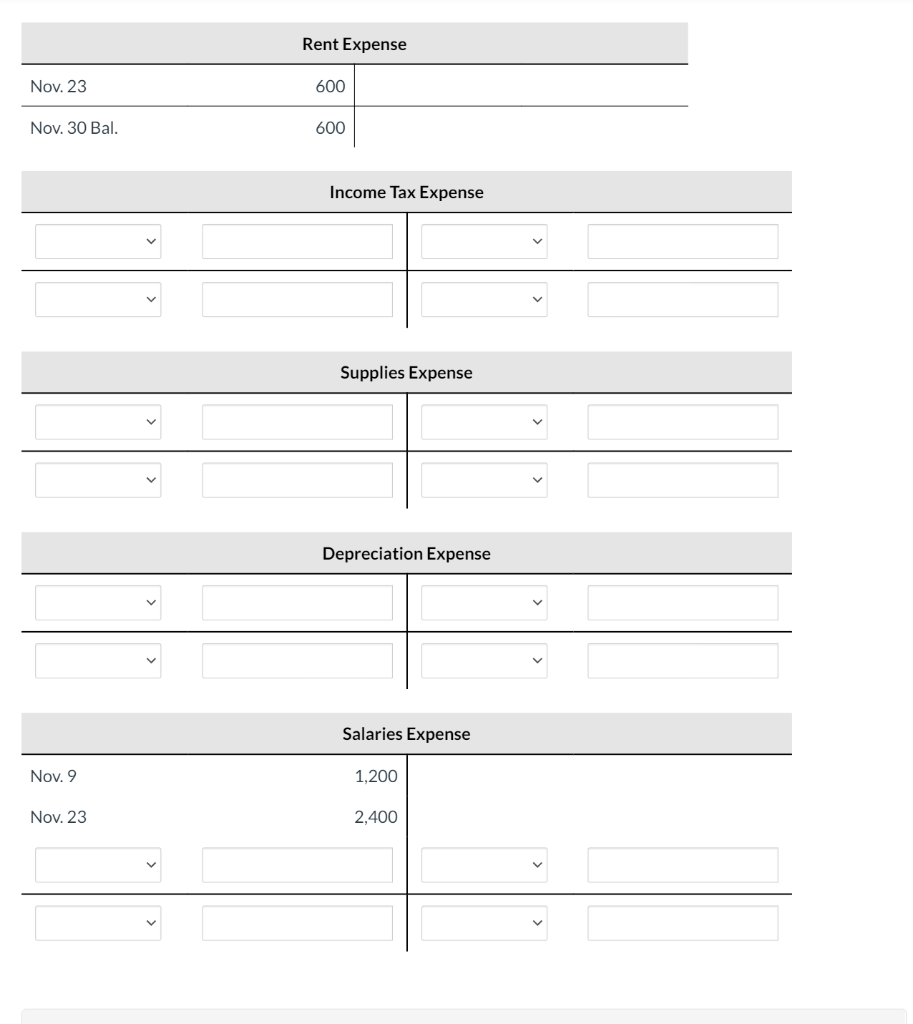

On October 31, 2021, Concord Equipment Repair Corp.'s opening trial balance was as follows. The company adjusts its accounts monthly. During November, the following transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started