Answered step by step

Verified Expert Solution

Question

1 Approved Answer

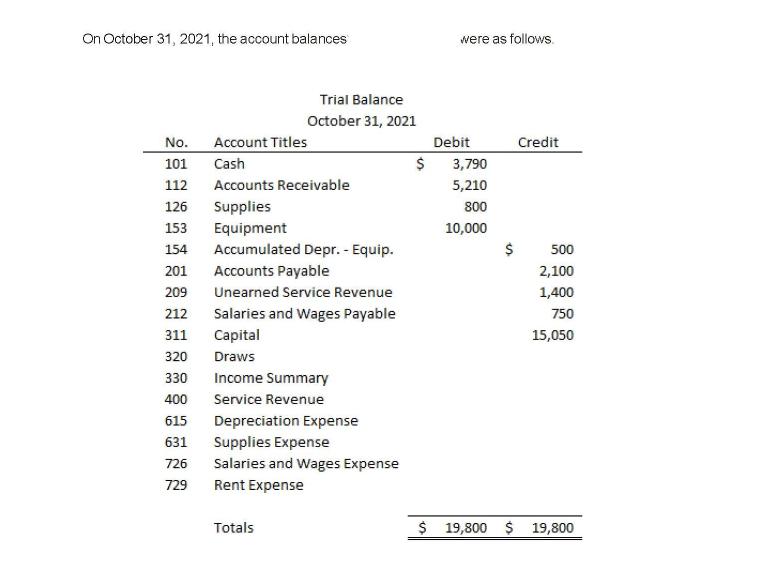

On October 31, 2021, the account balances Account Titles Cash Accounts Receivable Trial Balance October 31, 2021 No. 101 112 126 Supplies 153 154

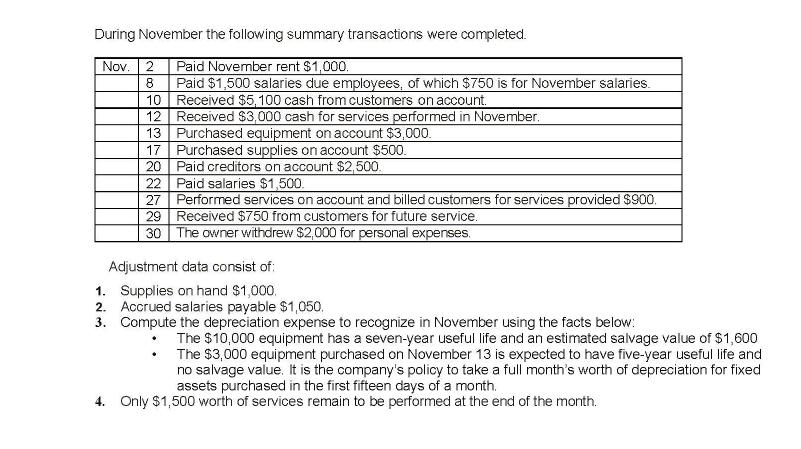

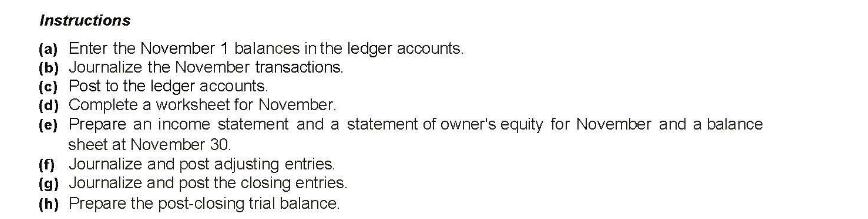

On October 31, 2021, the account balances Account Titles Cash Accounts Receivable Trial Balance October 31, 2021 No. 101 112 126 Supplies 153 154 Accumulated Depr. - Equip. 201 209 212 311 320 330 400 615 631 726 729 Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Capital Draws Income Summary Service Revenue Depreciation Expense Supplies Expense Salaries and Wages Expense Rent Expense Totals $ were as follows. Debit 3,790 5,210 800 10,000 $ Credit 500 2,100 1,400 750 15,050 $ 19,800 $ 19,800 During November the following summary transactions were completed. Nov. 2 Paid November rent $1,000. 8 Paid $1,500 salaries due employees, of which $750 is for November salaries. Received $5,100 cash from customers on account. 10 12 Received $3,000 cash for services performed in November. 13 Purchased equipment on account $3,000. 17 Purchased supplies on account $500. 20 Paid creditors on account $2,500. 22 Paid salaries $1,500. 27 Performed services on account and billed customers for services provided $900. Received $750 from customers for future service. 30 The owner withdrew $2,000 for personal expenses. 29 Adjustment data consist of: 1. Supplies on hand $1,000. 2. Accrued salaries payable $1,050. 3. Compute the depreciation expense to recognize in November using the facts below: The $10,000 equipment has a seven-year useful life and an estimated salvage value of $1,600 The $3,000 equipment purchased on November 13 is expected to have five-year useful life and no salvage value. It is the company's policy to take a full month's worth of depreciation for fixed assets purchased in the first fifteen days of a month. 4. Only $1,500 worth of services remain to be performed at the end of the month. Instructions (a) Enter the November 1 balances in the ledger accounts. (b) Journalize the November transactions. (c) Post to the ledger accounts. (d) Complete a worksheet for November. (e) Prepare an income statement and a statement of owner's equity for November and a balance sheet at November 30. (f) Journalize and post adjusting entries. (g) Journalize and post the closing entries. (h) Prepare the post-closing trial balance.

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Enter the November 1 balances in the ledger accounts Heres the ledger with the November 1 balances Account Title Debit Credit Cash 3790 Accounts Receivable 5210 Supplies 800 Equipment 10000 Accumula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started