Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 6, 2021, Ronan Corp. sold land to Bane Co., its wholly owned subsidiary. The land cost $72,400 and was sold to Bane for

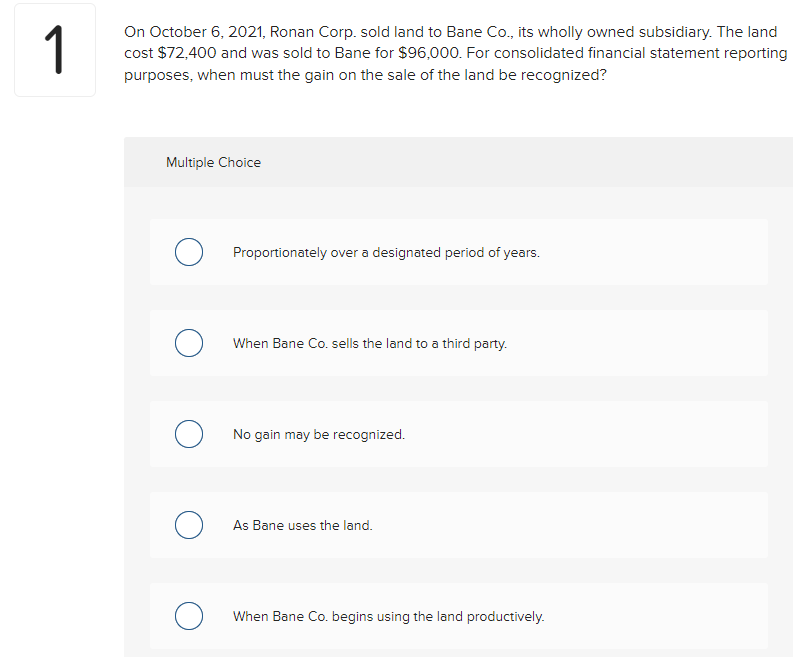

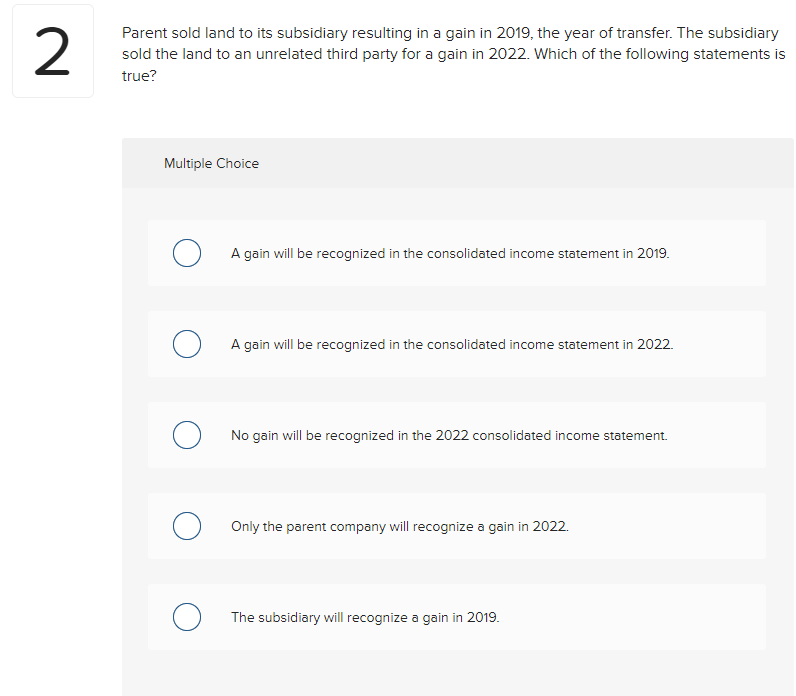

On October 6, 2021, Ronan Corp. sold land to Bane Co., its wholly owned subsidiary. The land cost $72,400 and was sold to Bane for $96,000. For consolidated financial statement reporting purposes, when must the gain on the sale of the land be recognized? Multiple Choice Proportionately over a designated period of years. When Bane Co. sells the land to a third party. No gain may be recognized. As Bane uses the land. When Bane Co. begins using the land productively. Parent sold land to its subsidiary resulting in a gain in 2019 , the year of transfer. The subsidiary sold the land to an unrelated third party for a gain in 2022. Which of the following statements is true? Multiple Choice A gain will be recognized in the consolidated income statement in 2019 . A gain will be recognized in the consolidated income statement in 2022 . No gain will be recognized in the 2022 consolidated income statement. Only the parent company will recognize a gain in 2022 . The subsidiary will recognize a gain in 2019

On October 6, 2021, Ronan Corp. sold land to Bane Co., its wholly owned subsidiary. The land cost $72,400 and was sold to Bane for $96,000. For consolidated financial statement reporting purposes, when must the gain on the sale of the land be recognized? Multiple Choice Proportionately over a designated period of years. When Bane Co. sells the land to a third party. No gain may be recognized. As Bane uses the land. When Bane Co. begins using the land productively. Parent sold land to its subsidiary resulting in a gain in 2019 , the year of transfer. The subsidiary sold the land to an unrelated third party for a gain in 2022. Which of the following statements is true? Multiple Choice A gain will be recognized in the consolidated income statement in 2019 . A gain will be recognized in the consolidated income statement in 2022 . No gain will be recognized in the 2022 consolidated income statement. Only the parent company will recognize a gain in 2022 . The subsidiary will recognize a gain in 2019 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started