Answered step by step

Verified Expert Solution

Question

1 Approved Answer

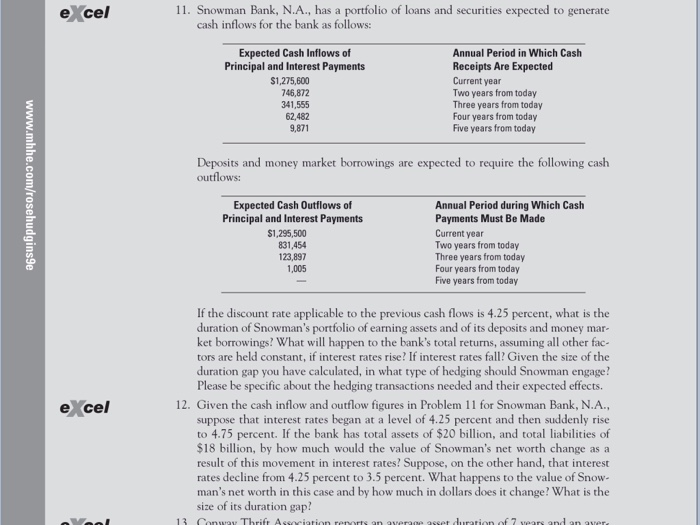

On p. 250 in the textbook, Problem 11-12, Snowman Bank, N.A. has a portfolio of loans and securities that is expected to generate cash inflows

On p. 250 in the textbook, Problem 11-12, Snowman Bank, N.A. has a portfolio of loans and securities that is expected to generate cash inflows for the bank. Include a spreadsheet to show your calculations. In addition, answer the following questions in your paper:

What is the duration of Snowmans portfolio of earned assets, and of its deposits and money market borrowings?

What will happen to the banks total returns, assuming all other factors are held constant, if interest rates rise? If interest rate fall?

Given the size of the duration gap you have calculated, in what type of hedging should Snowman engage?

If the bank has total assets of $20 billion and total liabilities of $18 billion, by how much would the value of Snowmans net worth change as a result of this movement in interest rates?

Suppose, on the other hand, that interest rates decline from 4.25% to 3.5%. What happens to the value of Snowmans net worth in this case, and by how much in dollars does it change?

What is the size of its duration gap?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started