Question

On Page 2 is information related to Sunny Corp., a sales corporation, at December 31, 20X2 (unless otherwise noted). All accounts/items are before tax

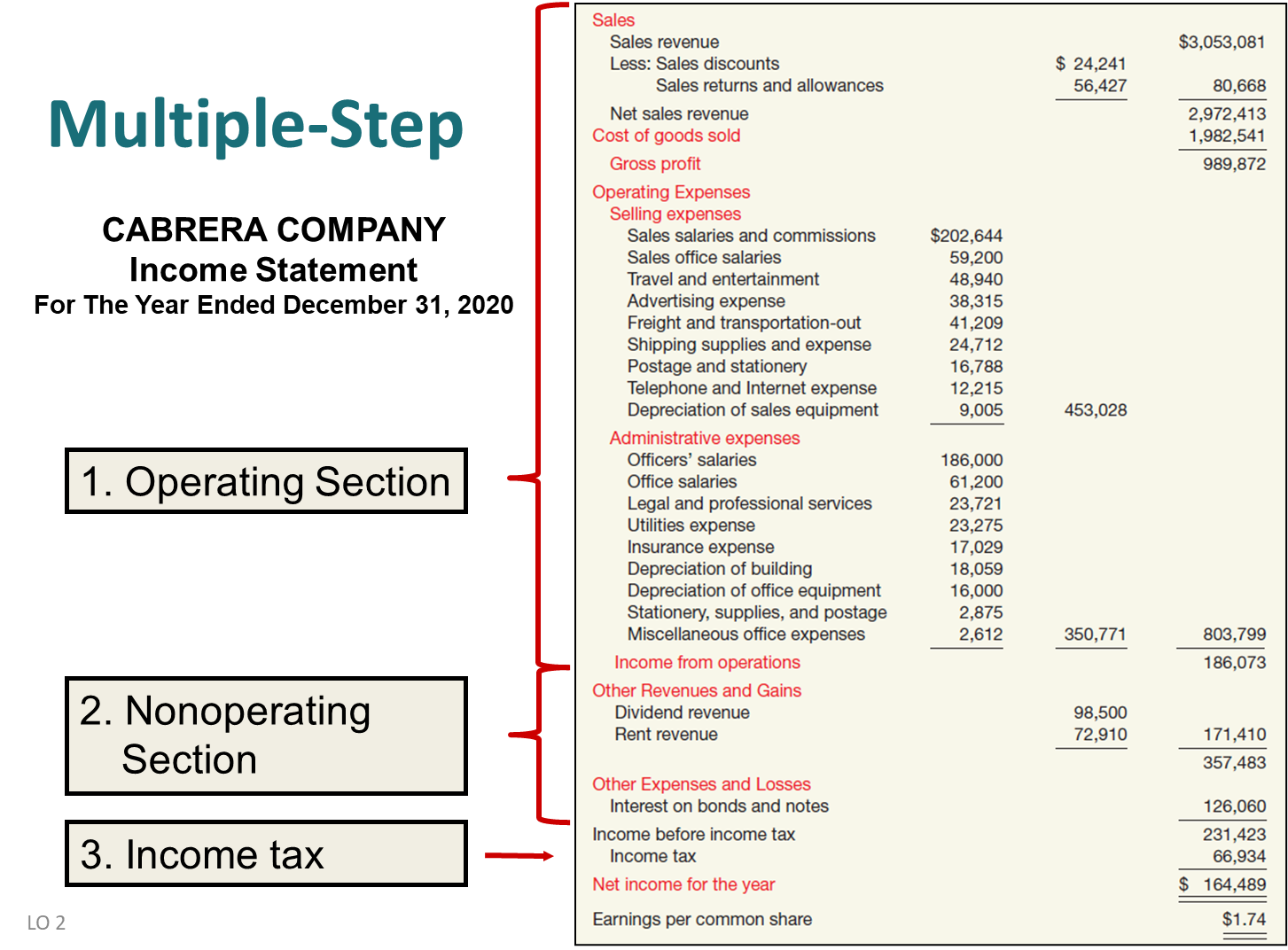

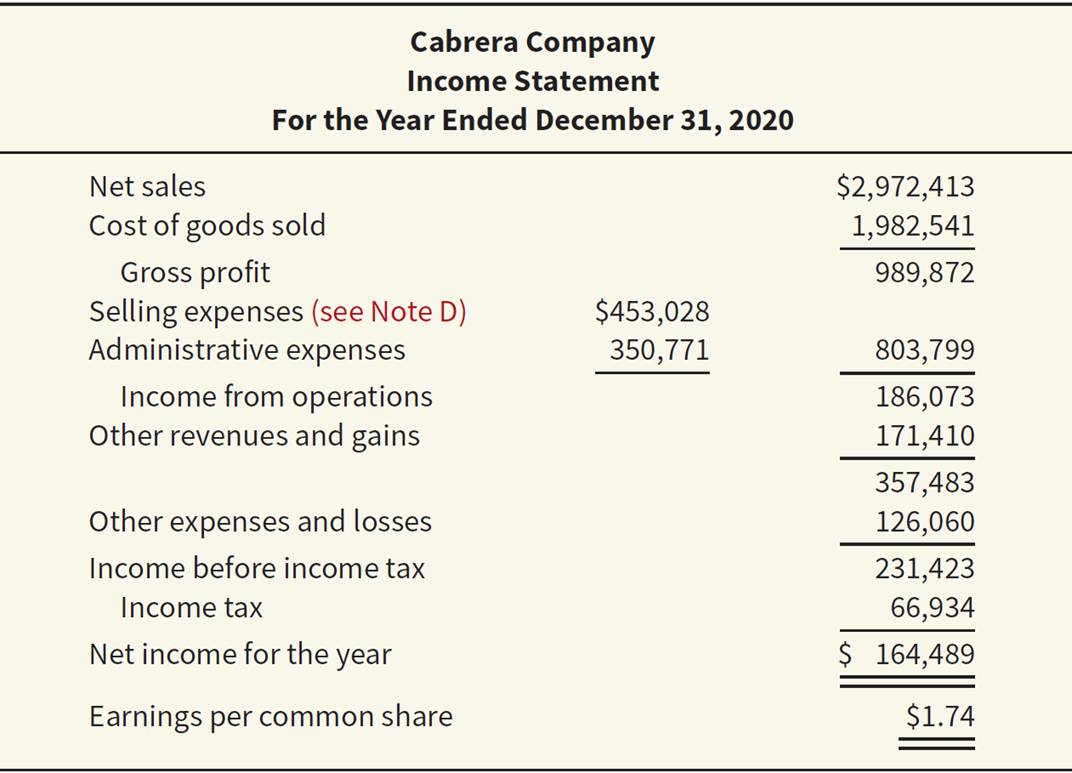

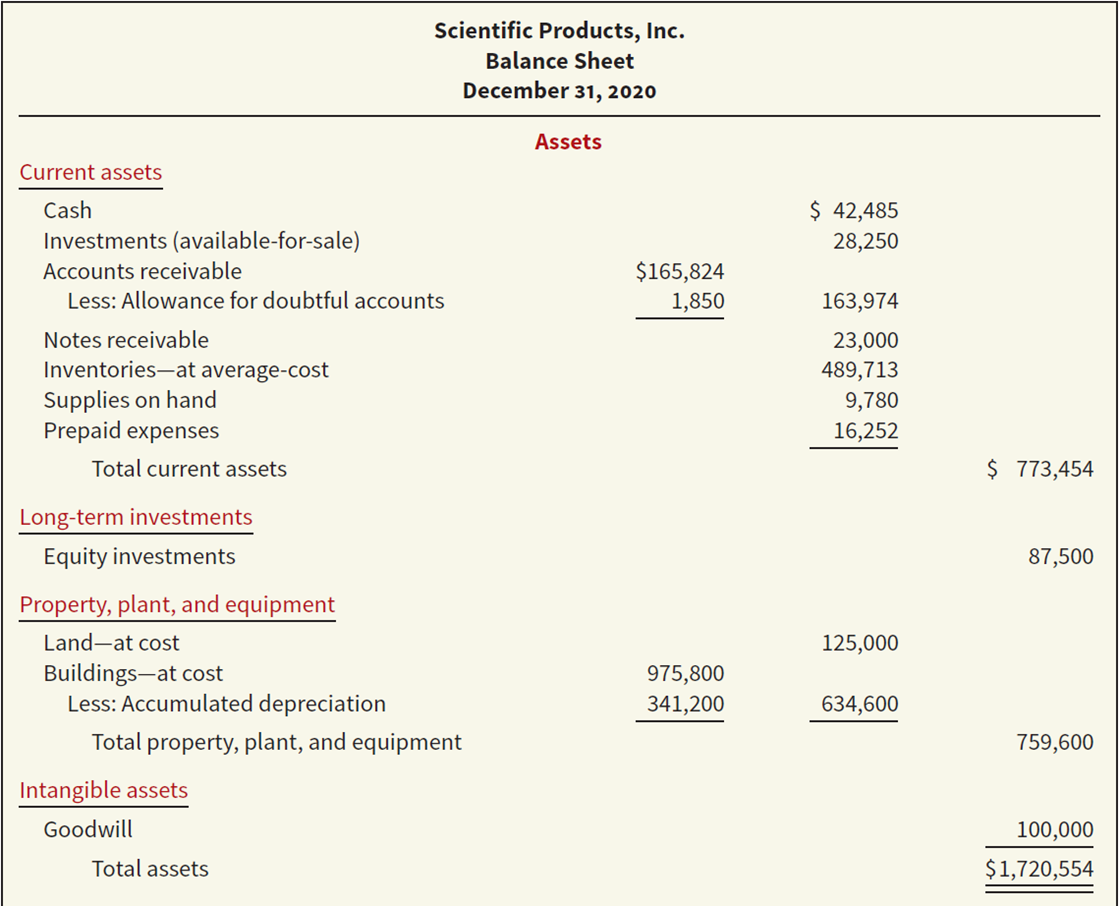

On Page 2 is information related to Sunny Corp., a sales corporation, at December 31, 20X2 (unless otherwise noted). All accounts/items are "before tax." Hint: **use two chart of accounts spreadsheets as guidance for the format of the financial statements and for the classifications of accounts/items.***

Directions: Part 1: On Page 2, write the appropriate financial statement section code for each of the 44 total accounts/itemsin the blanks. Each financial statement section code is listed below and each code is used at least once.

Part 2: On Page 3, using accounts/items from Page 2 creat a condensed multiple-step income statement for Sunny Corp. for the year ended December 31, 20X2, according to GAAP format and terminology. Round all earnings per share figures to the nearest cent. Assume 32,000 preferred stock shares and 26,000 common stock shares are outstanding for the all of 20X2and a 25% income tax rate for both 20X1 and 20X2. Note that not all lines may be needed.

Part 3: On Page 4, using the accounts/items from Page 2 and the income statement on Page 3 creat a retained earnings statement for Sunny Corp. for the year ended December 31, 20X2, according to GAAP format and terminology. Note that not all lines may be needed.

Part 4: On Page 5, using the accounts/items from Page 2 and the retained earnings statement on Page 4 creat a classified balance sheet for Sunny Corp. at December 31, 20X2, according to GAAP format and terminology. Assume the company's operating cycle is one year. Please prepare the balance sheet in a "condensed" format except for the current assets, property plant and equipment, and stockholders' equity sections that need to be filled out completely. Note that not all lines may be needed.

Part 5: On Page 7, please read the directions for preparing the cash flows statement for a different company. Page (1)

| Section Code | Account | Amount |

| Dividends-common stock | $ 6,300 | |

| Oil deposit | 26,500 | |

| Sales commissions expense | 2,300 | |

| Additional paid-in capital-common stock | 13,100 | |

| Retained earnings (beginning balance at January 1, 20X2) | 27,275 | |

| Loss on sale of investments | 21,700 | |

| Cash surrender value of life insurance (long-term) | 40,400 | |

| Payroll tax payable | 13,400 | |

| Bonds payable (matures July 20X7) | 57,000 | |

| Accounts receivable | 36,700 | |

| Deferred income tax asset | 12,900 | |

| Cost of goods sold | 336,000 | |

| Advertising expense | 4,200 | |

| Equity investments (to be held until 20X5) | 13,800 | |

| Common stock ($2 par value, 26,000 shares outstanding) | 52,000 | |

| Office salaries expense | 30,600 | |

| Treasury stock | 25,500 | |

| Interest revenue | 7,100 | |

| Cash | 34,200 | |

| Debt investments (matures March 20X3) | 41,300 | |

| Sales revenue | 816,700 | |

| Utilities expense | 3,700 | |

| Correction for understated revenues in 20X1 | 14,400 | |

| Accounts payable | 9,800 | |

| Trademarks | 27,200 | |

| Bad debt expense | 900 | |

| Accumulated depreciation-buildings | 86,300 | |

| Gain on disposal of discontinued operations | 43,600 | |

| Notes payable (due in 10 months) | 18,100 | |

| Shipping expense | 25,600 | |

| Supplies | 20,000 | |

| Pension fund | 27,900 | |

| Product warranties (amounts expected for 20X3) | 3,300 | |

| Dividends-preferred stock | 13,500 | |

| Allowance for doubtful accounts | 2,400 | |

| Land (held for sale) | 47,400 | |

| Buildings | 274,500 | |

| Inventory | 50,100 | |

| Interest expense | 4,600 | |

| Depreciation expense | 21,200 | |

| Preferred stock ($3 par value, 32,000 shares outstanding) | 96,000 | |

| Premium on bonds payable (matures July 20X7) | 3,900 | |

| Sales discounts | 17,900 | |

| Dividends payable | 5,800 | |

| Page (2) | ||

Sunny Corp

Income Statement

For the year ended Dec. 31, 20X2. Page3

| Sunny Corp. | ||

| Retained Earnings Statement | ||

| For the year ended Dec. 31, 20X2 | ||

| Page4 |

| Sunny Corp. | ||

| Balance Sheet | ||

| Dec. 31, 20X2 | Page 5 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started