Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* ON PAPER WORKING OUT The second product Suzie represents is an annuity. The customers of this product are typically retirees that use their retirement

* ON PAPER WORKING OUT

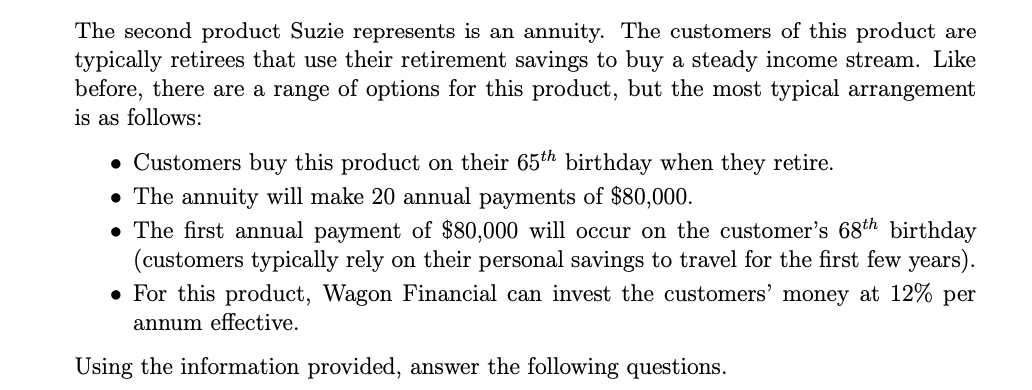

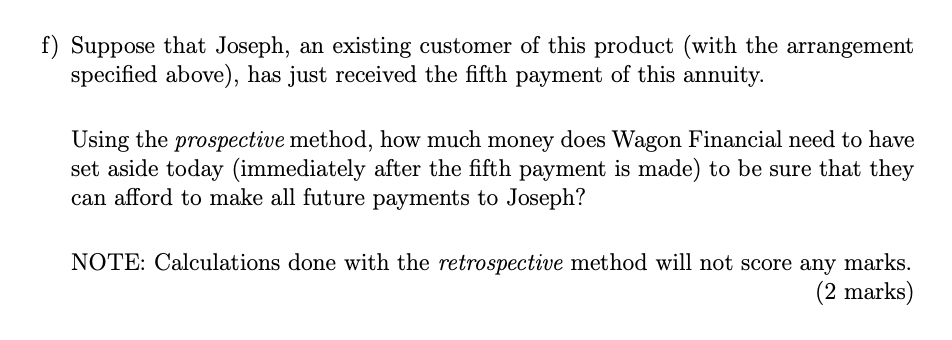

The second product Suzie represents is an annuity. The customers of this product are typically retirees that use their retirement savings to buy a steady income stream. Like before, there are a range of options for this product, but the most typical arrangement is as follows: - Customers buy this product on their 65th birthday when they retire. - The annuity will make 20 annual payments of $80,000. - The first annual payment of $80,000 will occur on the customer's 68th birthday (customers typically rely on their personal savings to travel for the first few years). - For this product, Wagon Financial can invest the customers' money at 12% per annum effective. Using the information provided, answer the following questions. f) Suppose that Joseph, an existing customer of this product (with the arrangement specified above), has just received the fifth payment of this annuity. Using the prospective method, how much money does Wagon Financial need to have set aside today (immediately after the fifth payment is made) to be sure that they can afford to make all future payments to Joseph? NOTE: Calculations done with the retrospective method will not score any marks. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started