Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Part A, what would the journal entries be for #4 and #11? I also don't understand part B. What would the journal entries be

On Part A, what would the journal entries be for #4 and #11? I also don't understand part B.

What would the journal entries be for #4 and #11?

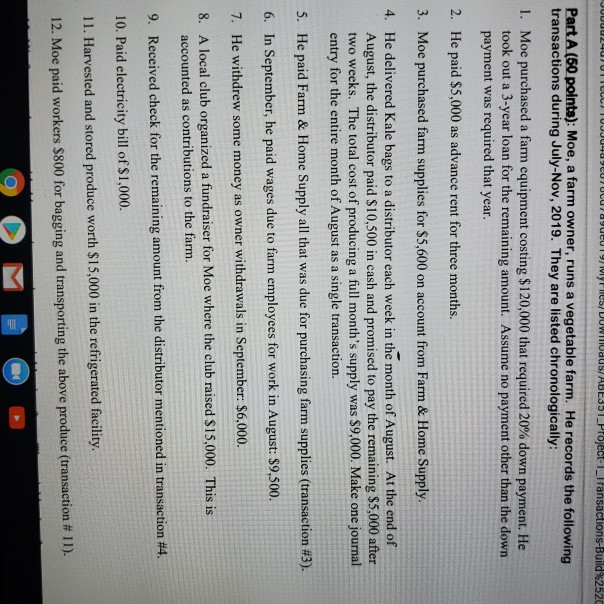

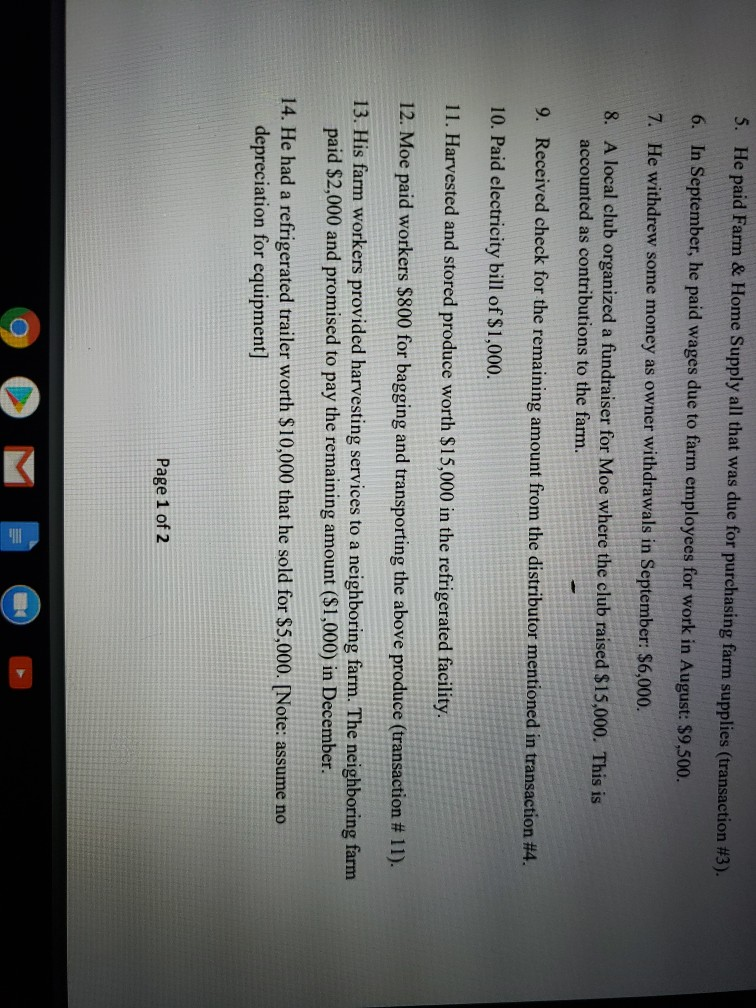

UUUUUUU LITUJJU4U9UUCUYUCU19 VYPICS/DUWUDUS/ABE351_Project- I _Transactions-Build%2520 Part A (50 points): Moe, a farm owner, runs a vegetable farm. He records the following transactions during July-Nov, 2019. They are listed chronologically: 1. Moe purchased a farm equipment costing $120,000 that required 20% down payment. He took out a 3-year loan for the remaining amount. Assume no payment other than the down payment was required that year. 2. He paid $5,000 as advance rent for three months. 3. Moe purchased farm supplies for $5,600 on account from Farm & Home Supply. 4. He delivered Kale bags to a distributor each week in the month of August. At the end of August, the distributor paid $10,500 in cash and promised to pay the remaining $5,000 after two weeks. The total cost of producing a full month's supply was $9,000. Make one journal entry for the entire month of August as a single transaction. 5. He paid Farm & Home Supply all that was due for purchasing farm supplies (transaction #3). 6. In September, he paid wages due to farm employees for work in August: $9,500. 7. He withdrew some money as owner withdrawals in September: $6,000. 8. A local club organized a fundraiser for Moe where the club raised $15,000. This is accounted as contributions to the farm. 9. Received check for the remaining amount from the distributor mentioned in transaction #4. 10. Paid electricity bill of $1,000. 11. Harvested and stored produce worth $15,000 in the refrigerated facility. 12. Moe paid workers $800 for bagging and transporting the above produce (transaction #11). O 5. He paid Farm & Home Supply all that was due for purchasing farm supplies (transaction #3). 6. In September, he paid wages due to farm employees for work in August: $9,500. 7. He withdrew some money as owner withdrawals in September: $6,000. 8. A local club organized a fundraiser for Moe where the club raised $15,000. This is accounted as contributions to the farm. 9. Received check for the remaining amount from the distributor mentioned in transaction #4. 10. Paid electricity bill of $1,000. 11. Harvested and stored produce worth $15,000 in the refrigerated facility. 12. Moe paid workers $800 for bagging and transporting the above produce (transaction # 11). 13. His farm workers provided harvesting services to a neighboring farm. The neighboring farm paid $2,000 and promised to pay the remaining amount ($1,000) in December. 14. He had a refrigerated trailer worth $10,000 that he sold for $5,000. (Note: assume no depreciation for equipment] Page 1 of 2 ABE 351: Financial Management in Agriculture (Fall 2020) (Project 01) Name . Do the following: Record all transactions in the journal-entry format. You need to show date, amount, accounts and write a short description like memo in a check. [Points = 30] For each transaction, verify that: - [Pts = 10] (i) The accounting identity holds; and . Sum of debits = Sum of credits . Write the account balances for each account. For example, Cash account balance = $X. (Pts = 10) NOTE: you can create own accounts (or account names) but please keep the standard account names as they are. For example, Cash, Accounts Receivable, Accounts Payable, etc. should follow the standard definitions. Part B (50 points): Build Balance Sheet and Income statement. 1) List each item in the Income Statement and the respective amounts. [Pts = 15) 2) What is the operating income or the income from operations? [Pts = 5] 3) List each item in the Balance Sheet and the respective amounts. [Pts = 25) Accounts should be classified under appropriate categories (current and non-current) reflecting a standard format shown in Chapter 02. 4) What is the ending net worth of the farm business? [Pts = 5]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started