Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on part two, most of the capitals are wrong. Required information QS 12-9 Liquidation of partnership LO P5 The following information applies to the questions

on part two, most of the capitals are wrong.

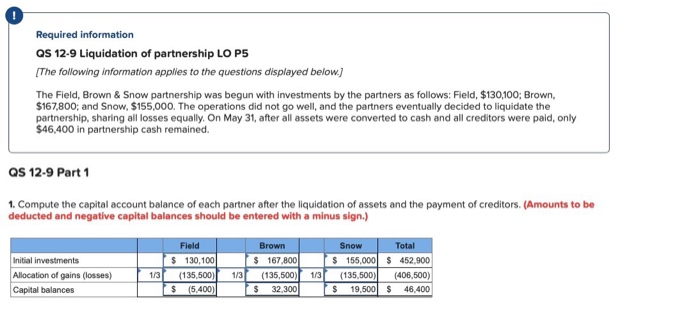

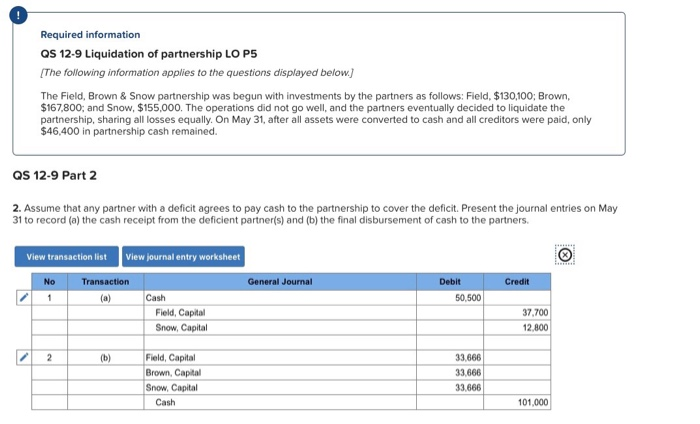

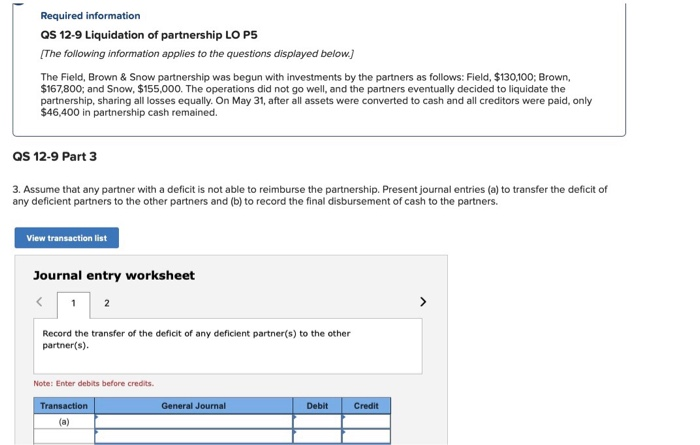

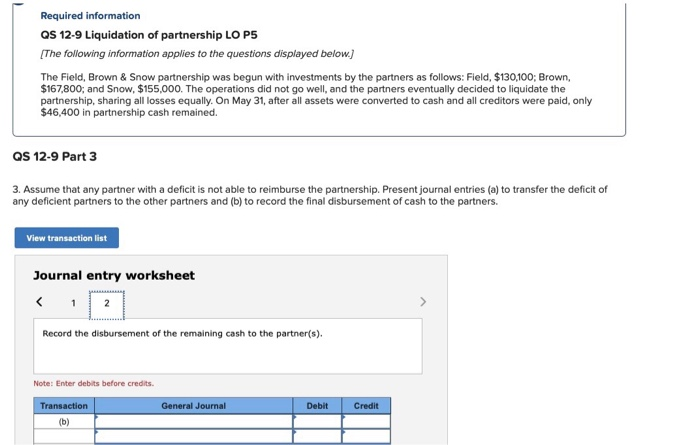

Required information QS 12-9 Liquidation of partnership LO P5 The following information applies to the questions displayed below The Field, Brown & Snow partnership was begun with investments by the partners as follows: Field, $130,100; Brown, $167,800; and Snow, $155,000. The operations did not go well, and the partners eventually decided to liquidate the partnership, sharing all losses equally. On May 31, after all assets were converted to cash and all creditors were paid, only $46,400 in partnership cash remained. QS 12-9 Part 1 1. Compute the capital account balance of each partner after the liquidation of assets and the payment of creditors. (Amounts to be deducted and negative capital balances should be entered with a minus sign.) Field Brown Snow Initial investments Allocation of gains (losses) Capital balances $ 130,100 S 167,800 S 155,000 452,900 35,500)(406,500) S 19,500 46,400 $ (5,400) $ 32,300 Required information QS 12-9 Liquidation of partnership LO P5 The following information applies to the questions displayed below. The Field, Brown & Snow partnership was begun with investments by the partners as follows: Field, $130,100; Brown, $167,800; and Snow, $155,000. The operations did not go well, and the partners eventually decided to liquidate the partnership, sharing all losses equally. On May 31, after all assets were converted to cash and all creditors were paid, only $46,400 in partnership cash remained. QS 12-9 Part 2 2. Assume that any partner with a deficit agrees to pay cash to the partnership to cover the deficit. Present the journal entries on May 31 to record (a) the cash receipt from the deficient partner(s) and (b) the final disbursement of cash to the partners. View transaction list View journal entry worksheet General Journal Debit Credit Cash 50,500 Field, Captal 37,700 Snow, Capital 12,800 Field, Capital Brown, Capital Snow, Capital 33,666 33,666 3.666 Cash 101,000 Required information QS 12-9 Liquidation of partnership LO P5 The following information applies to the questions displayed below. The Field, Brown & Snow partnership was begun with investments by the partners as follows: Field, $130,100; Brown, $167,800; and Snow, $155,000. The operations did not go well, and the partners eventually decided to liquidate the partnership, sharing all losses equally. On May 31, after all assets were converted to cash and all creditors were paid, only $46,400 in partnership cash remained. QS 12-9 Part 3 3. Assume that any partner with a deficit is not able to reimburse the partnership. Present journal entries (a) to transfer the deficit of any deficient partners to the other partners and (b) to record the final disbursement of cash to the partners. View transaction list Journal entry worksheet Record the transfer of the deficit of any deficient partner(s) to the other partner(s) Note: Enter debits before credits. ansaction General Journal Debit Credit Required information QS 12-9 Liquidation of partnership LO P5 The following information applies to the questions displayed below. The Field, Brown & Snow partnership was begun with investments by the partners as follows: Field, $130,100; Brown, $167,800; and Snow, $155,000. The operations did not go well, and the partners eventually decided to liquidate the partnership, sharing all losses equally. On May 31, after all assets were converted to cash and all creditors were paid, only $46,400 in partnership cash remained. QS 12-9 Part 3 3. Assume that any partner with a deficit is not able to reimburse the partnership. Present journal entries (a) to transfer the deficit of any deficient partners to the other partners and (b) to record the final disbursement of cash to the partners. View transaction list Journal entry worksheet Record the disbursement of the remaining cash to the partner(s). Note: Enter debits before credits. ansaction General Journal Debit Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started