On Schedule K-1

Need to know what the following would be:

20 - Other Information

14. - Self Employment Earnings (loss)

| 13 | Other deductions 2000 | | |

| 20 | Other information |

| | |

| | | | W2 wages 100,000 |

| 14 | Self-employment earnings (loss) | |

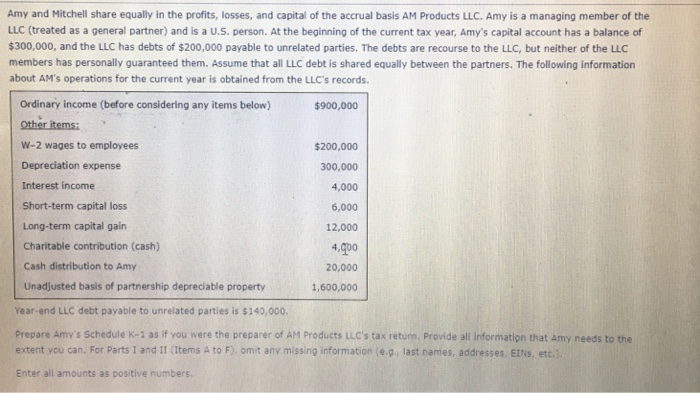

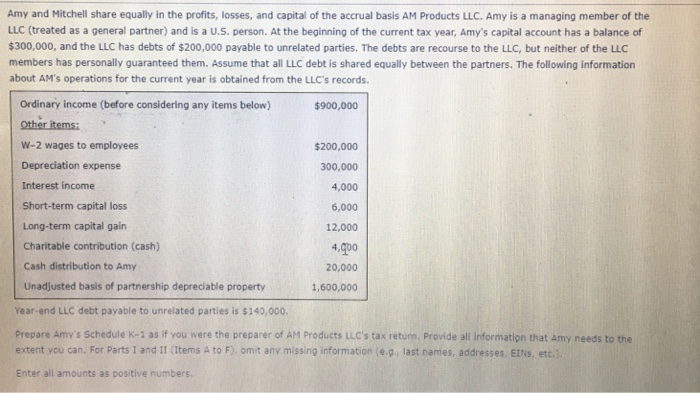

Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products LLC. Amy is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $300,000, and the LLC has debts of $200,000 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLC members has personally guaranteed them. Assume that all LLC debt is shared equally between the partners. The following information about AM's operations for the current year is obtained from the LLC's records. $900,000 Ordinary income (before considering any items below) Other items: W-2 wages to employees Depreciation expense Interest income Short-term capital loss Long-term capital gain Charitable contribution (cash) Cash distribution to Amy Unadjusted basis of partnership depreciable property Year-end LLC debt payable to unrelated parties is $140,000 $200,000 300,000 4,000 6,000 12,000 4.000 20,000 1,600,000 Prepare Amy's Schedule K-1 as if you were the preparer of AM Products LLC's tax return. Provide all information that Amy needs to the extent you can. For Parts 1 and It Items A to F). omit any missing information (e. last names, addresses, EINS, etc. Enter all amounts as positive numbers. Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products LLC. Amy is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $300,000, and the LLC has debts of $200,000 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLC members has personally guaranteed them. Assume that all LLC debt is shared equally between the partners. The following information about AM's operations for the current year is obtained from the LLC's records. $900,000 Ordinary income (before considering any items below) Other items: W-2 wages to employees Depreciation expense Interest income Short-term capital loss Long-term capital gain Charitable contribution (cash) Cash distribution to Amy Unadjusted basis of partnership depreciable property Year-end LLC debt payable to unrelated parties is $140,000 $200,000 300,000 4,000 6,000 12,000 4.000 20,000 1,600,000 Prepare Amy's Schedule K-1 as if you were the preparer of AM Products LLC's tax return. Provide all information that Amy needs to the extent you can. For Parts 1 and It Items A to F). omit any missing information (e. last names, addresses, EINS, etc. Enter all amounts as positive numbers