Answered step by step

Verified Expert Solution

Question

1 Approved Answer

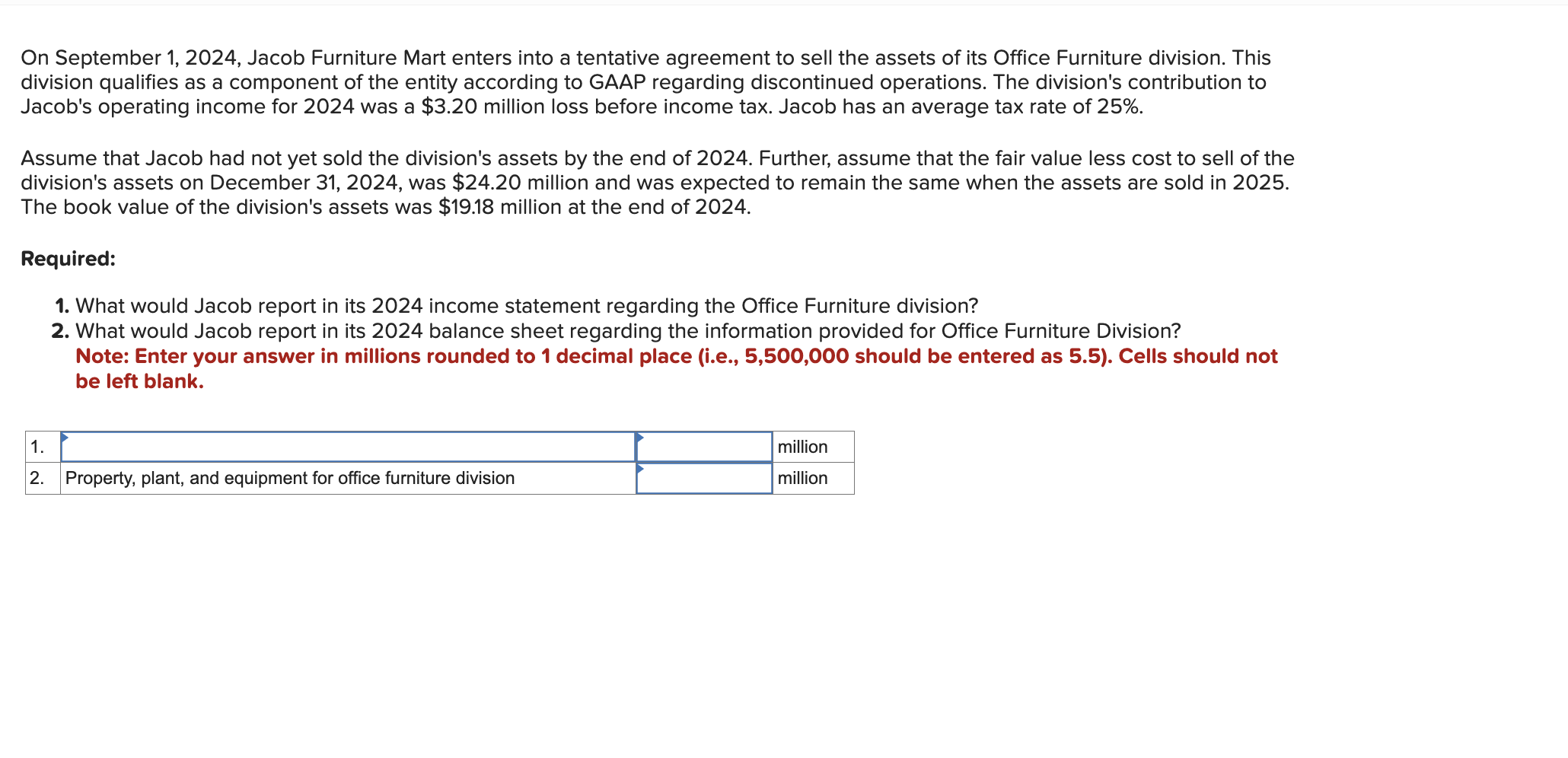

On September 1 , 2 0 2 4 , Jacob Furniture Mart enters into a tentative agreement to sell the assets of its Office Furniture

On September Jacob Furniture Mart enters into a tentative agreement to sell the assets of its Office Furniture division. This

division qualifies as a component of the entity according to GAAP regarding discontinued operations. The division's contribution to

Jacob's operating income for was a $ million loss before income tax. Jacob has an average tax rate of

Assume that Jacob had not yet sold the division's assets by the end of Further, assume that the fair value less cost to sell of the

division's assets on December was $ million and was expected to remain the same when the assets are sold in

The book value of the division's assets was $ million at the end of

Required:

What would Jacob report in its income statement regarding the Office Furniture division?

What would Jacob report in its balance sheet regarding the information provided for Office Furniture Division?

Note: Enter your answer in millions rounded to decimal place ie should be entered as Cells should not

be left blank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started