Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 1, 2019, Dental Equipment Corporation sold equipment priced at 350,000 in exchange for a six-month note receivable with an annual interest rate of

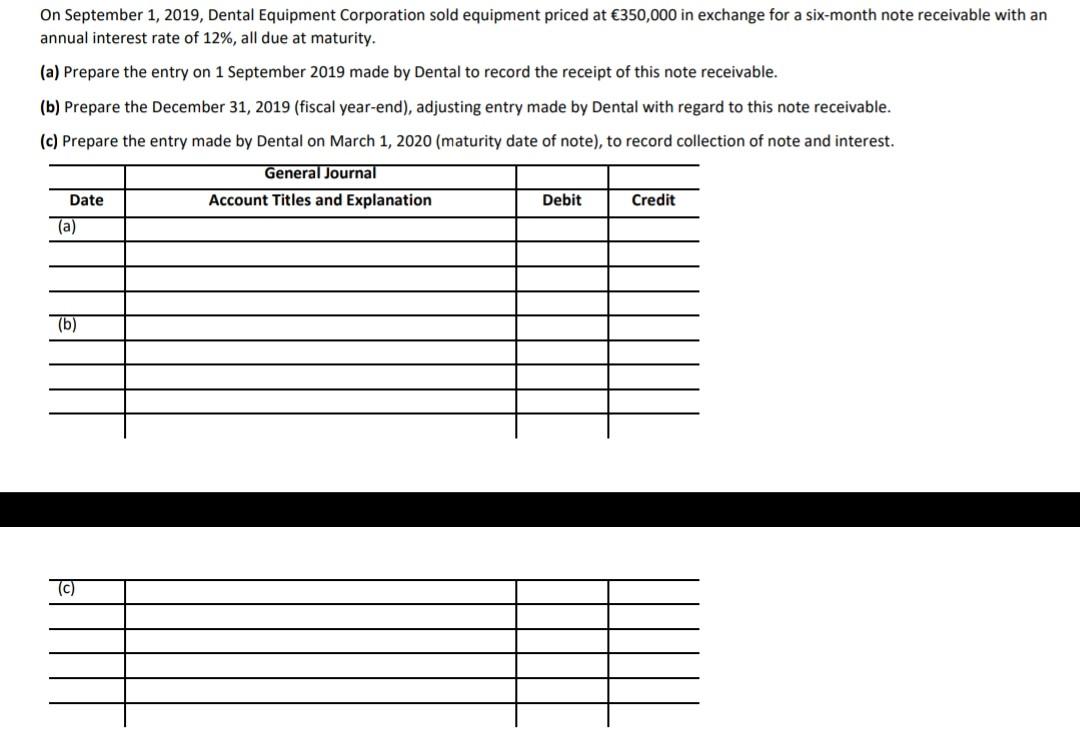

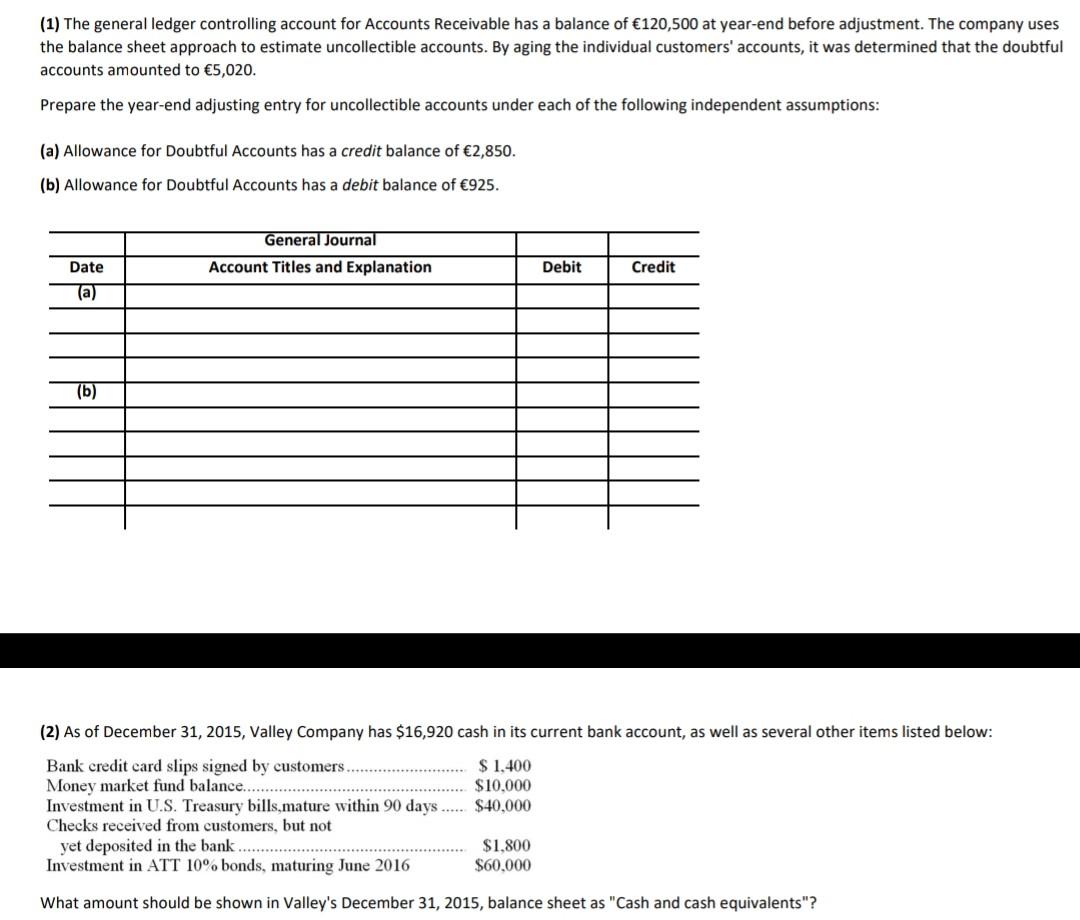

On September 1, 2019, Dental Equipment Corporation sold equipment priced at 350,000 in exchange for a six-month note receivable with an annual interest rate of 12%, all due at maturity. (a) Prepare the entry on 1 September 2019 made by Dental to record the receipt of this note receivable. (b) Prepare the December 31, 2019 (fiscal year-end), adjusting entry made by Dental with regard to this note receivable. (c) Prepare the entry made by Dental on March 1, 2020 (maturity date of note), to record collection of note and interest. General Journal Date Account Titles and Explanation Debit Credit (a) (b) TC) (1) The general ledger controlling account for Accounts Receivable has a balance of 120,500 at year-end before adjustment. The company uses the balance sheet approach to estimate uncollectible accounts. By aging the individual customers' accounts, it was determined that the doubtful accounts amounted to 5,020. Prepare the year-end adjusting entry for uncollectible accounts under each of the following independent assumptions: (a) Allowance for Doubtful Accounts has a credit balance of 2,850. (b) Allowance for Doubtful Accounts has a debit balance of 925. General Journal Account Titles and Explanation Date Debit Credit a) (6) (2) As of December 31, 2015, Valley Company has $16,920 cash in its current bank account, as well as several other items listed below: Bank credit card slips signed by customers $ 1.400 Money market fund balance....... $10.000 Investment in U.S. Treasury bills,mature within 90 days ..... $40,000 Checks received from customers, but not yet deposited in the bank ..... $1,800 Investment in ATT 10% bonds, maturing June 2016 $60.000 What amount should be shown in Valley's December 31, 2015, balance sheet as "Cash and cash equivalents

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started