Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 1, 2021, one of AXIE COMPAY's delivery vans was destroyed in an accident. The carrying value of the truck was P125,000. On September

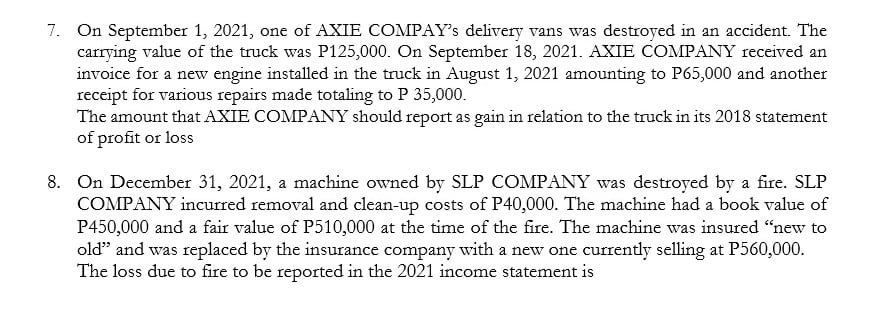

- On September 1, 2021, one of AXIE COMPAY's delivery vans was destroyed in an accident. The carrying value of the truck was P125,000. On September 18, 2021. AXIE COMPANY received an invoice for a new engine installed in the truck in August 1, 2021 amounting to P65,000 and another receipt for various repairs made totaling to P 35,000.

The amount that AXIE COMPANY should report as gain in relation to the truck in its 2018 statement of profit or loss

2. On December 31, 2021, a machine owned by SLP COMPANY was destroyed by a fire. SLP COMPANY incurred removal and clean-up costs of P40,000. The machine had a book value of P450,000 and a fair value of P510,000 at the time of the fire. The machine was insured "new to old" and was replaced by the insurance company with a new one currently selling at P560,000.

The loss due to fire to be reported in the 2021 income statement is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started