Question

On September 1, 20X0, the Citibank was searching for arbitrage opportunities in the FX and money markets between USD and JPY (Yen). One FX

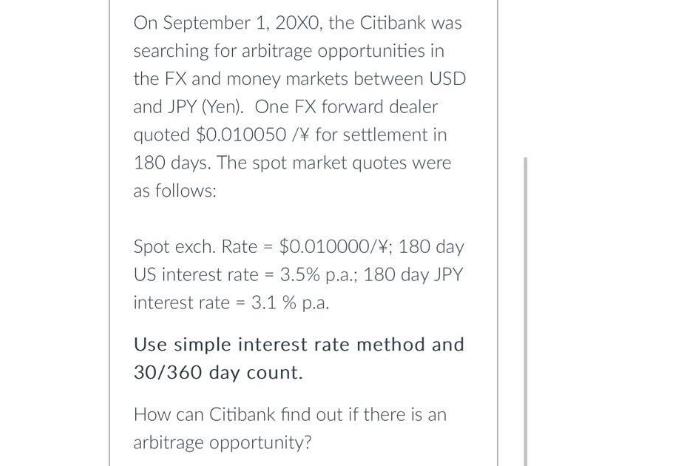

On September 1, 20X0, the Citibank was searching for arbitrage opportunities in the FX and money markets between USD and JPY (Yen). One FX forward dealer quoted $0.010050 / for settlement in 180 days. The spot market quotes were as follows: Spot exch. Rate = $0.010000/; 180 day US interest rate = 3.5% p.a.; 180 day JPY interest rate = 3.1 % p.a. Use simple interest rate method and 30/360 day count. How can Citibank find out if there is an arbitrage opportunity?

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets start with say 1 million and follow the steps for both strategies Strategy 1 Investing in USD a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Spreadsheet Modeling And Decision Analysis A Practical Introduction To Management Science

Authors: Cliff T. Ragsdale

5th Edition

324656645, 324656637, 9780324656640, 978-0324656633

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App