Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 1, the beginning of its fiscal year, Blossom Ltd. had an inventory of 124 calculators at a cost of $20 each. The company

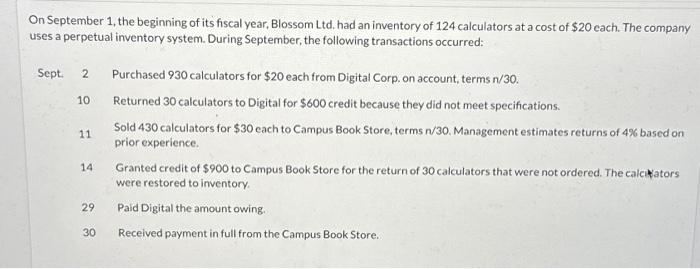

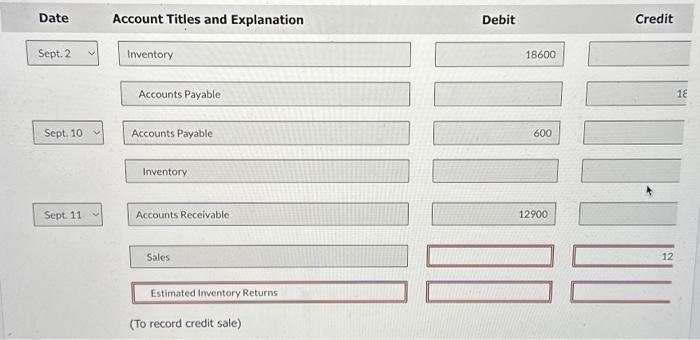

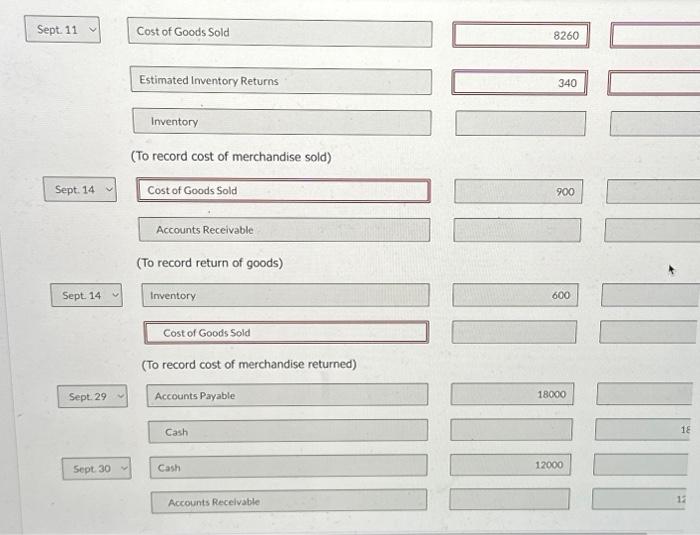

On September 1, the beginning of its fiscal year, Blossom Ltd. had an inventory of 124 calculators at a cost of $20 each. The company uses a perpetual inventory system. During September, the following transactions occurred: Sept. 2 10 11 14 29 30 Purchased 930 calculators for $20 each from Digital Corp. on account, terms n/30. Returned 30 calculators to Digital for $600 credit because they did not meet specifications. Sold 430 calculators for $30 each to Campus Book Store, terms n/30. Management estimates returns of 4% based on prior experience. Granted credit of $900 to Campus Book Store for the return of 30 calculators that were not ordered. The calciators were restored to inventory. Paid Digital the amount owing. Received payment in full from the Campus Book Store.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started